Columbus Ohio Construction Cost Estimate 1

Description

Form popularity

FAQ

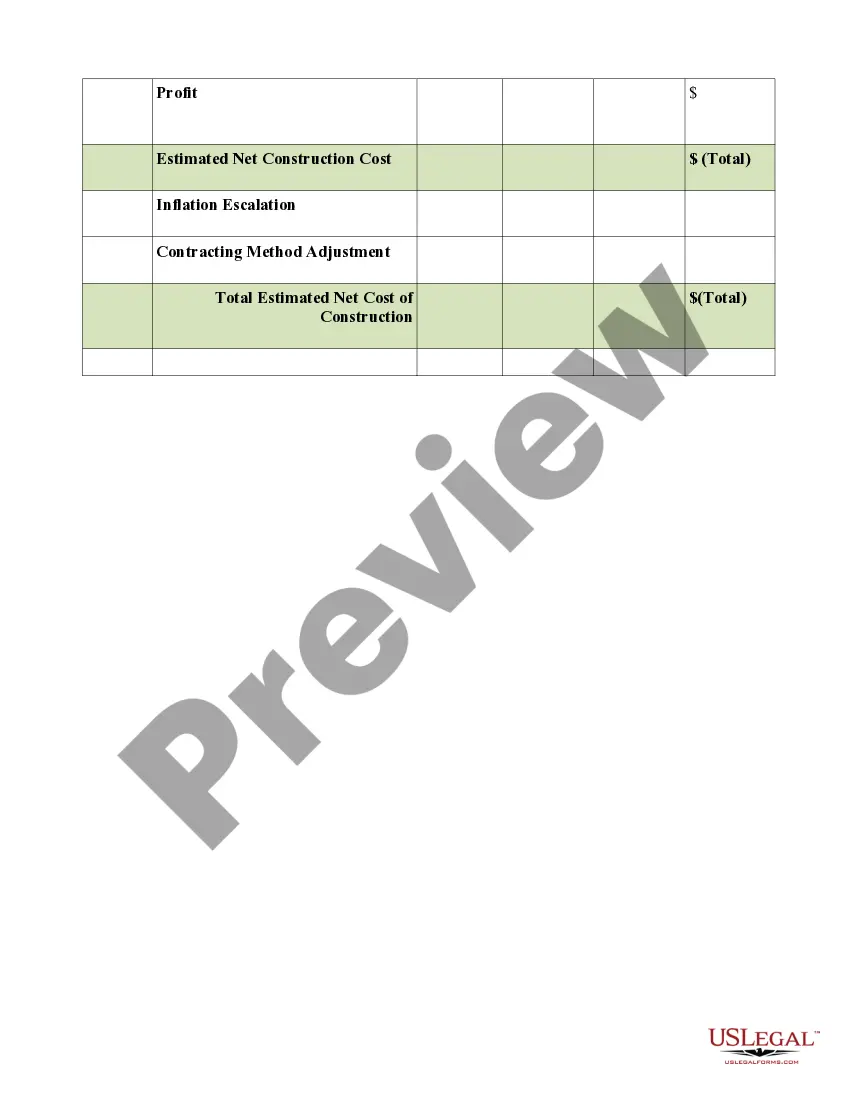

To estimate construction costs accurately, you can start by calculating the square footage of your project. Then, multiply this figure by the average cost per square foot in Columbus, Ohio. Don't forget to include additional expenses, such as permits, materials, and labor. By using a detailed Columbus Ohio Construction Cost Estimate, you can achieve a reliable budget for your construction project.

To write a construction estimate, start by gathering detailed project information, including materials, labor costs, and timelines. Next, create a detailed list that breaks down each component, ensuring that all costs are accounted for. This process will help you provide an accurate Columbus Ohio Construction Cost Estimate, which is crucial for client transparency and project success. Consider using platforms like uslegalforms to streamline your estimate creation and improve your overall accuracy.

The four main types of estimation include rough order of magnitude, budget estimate, definitive estimate, and control estimate. Each type serves a different purpose, ranging from initial feasibility assessments to precise budget planning. Understanding these categories enhances your ability to develop a reliable Columbus Ohio Construction Cost Estimate. Utilizing tools like USLegalForms can assist you in creating accurate estimates tailored to your specific project needs.

A Class 1 estimate provides the most precise cost prediction for a construction project. Typically created at the end of the design phase, this estimate involves detailed information about materials, labor, and overhead costs. By focusing on specific project details, it helps stakeholders prepare an accurate Columbus Ohio Construction Cost Estimate. This level of detail ensures that there are fewer surprises during project execution.

Ing to Ohio Instructions for Form IT 1040, ?Every Ohio resident and part year resident is subject to the Ohio Income tax.? Every full-year resident, part year resident and full year nonresident must file an Ohio tax return if they have income from Ohio sources.

Local income tax is usually based on where a taxpayer lives, but in some cases, taxpayers also owe local income tax based on where they perform work (for example, if they commute). You may have withholding obligations based on where your company does business or based on where your employees perform work.

Columbus residents pay a total of 2.5% in taxes on all income earned, regardless of whether it was earned in Columbus or another city.

In Ohio, you have an income tax obligation to both your employment city and your resident city. Your employer is required by law to withhold your work place city tax and if you have "fully withheld", you have no filing requirement with your work place city.

Municipalities may generally impose tax on on wages, salaries, and other compensation earned by residents and by nonresidents who work in the municipality. The tax also applies to the net profits of business attributable to activities in the municipality, and to the net profits from rental activities.

1. WHO SHOULD FILE THIS RETURN: a) All Ohio City residents 18 years of age and over, (except high school students) are required to regis- ter and report income with the Ohio City Tax Office. b) High School Students 18 years of age and under, working part time, do not have to register with the Ohio City Tax Office.