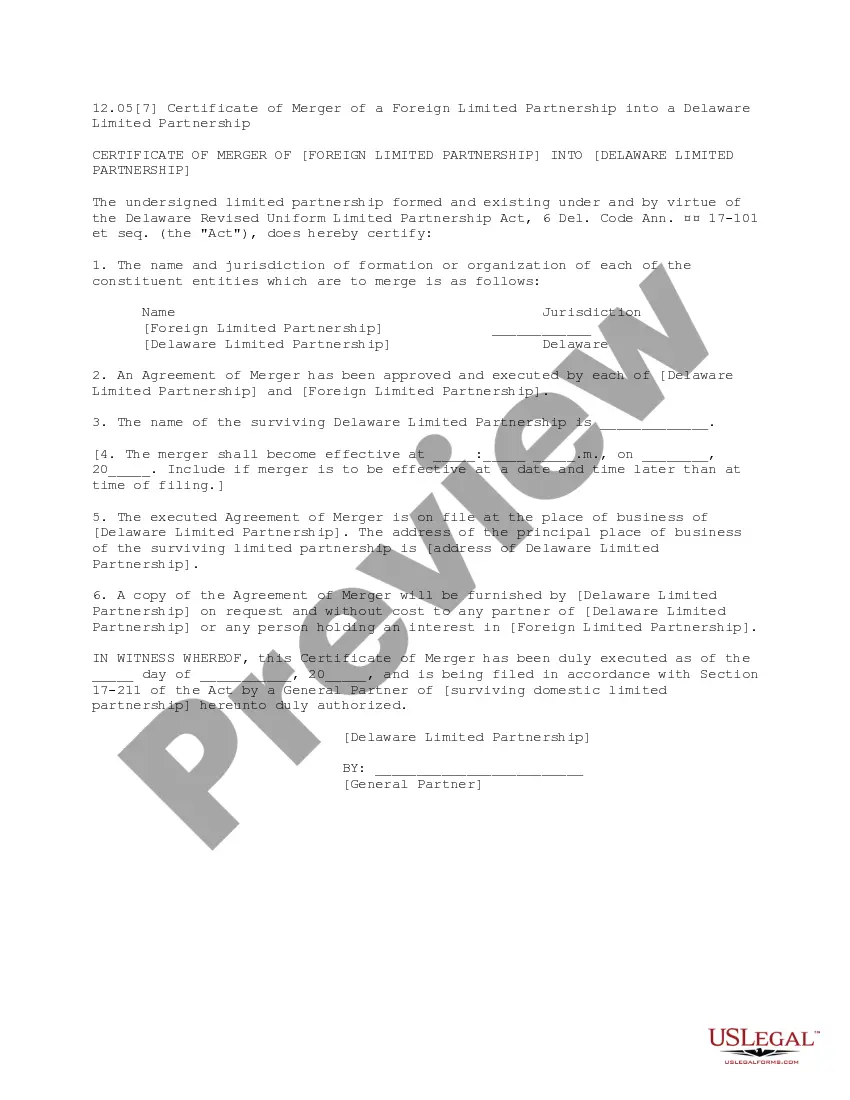

Dallas Texas Loan Assumption Agreement is a legally binding contract that allows a third party to take over an existing loan on a property located in Dallas, Texas. This agreement is commonly used in real estate transactions when a buyer wishes to assume the seller's mortgage loan instead of obtaining a new loan. A Loan Assumption Agreement is a beneficial option for both buyers and sellers involved in a property transaction. For buyers, it allows them to acquire the property without the hassles of applying for a new loan and going through the often time-consuming underwriting process. It can be particularly useful when interest rates are high or when the buyer's creditworthiness may hinder obtaining a favorable loan. For sellers, a Loan Assumption Agreement provides an opportunity to transfer the existing loan to a creditworthy buyer, thereby avoiding the costs associated with paying off the loan or prepayment penalties. It can make the property more attractive to potential buyers and expedite the closing process. The Dallas Texas Loan Assumption Agreement typically includes essential information such as the names and addresses of the buyer, seller, and lender. It outlines the terms and conditions of the loan assumption, including the outstanding loan balance, interest rate, repayment terms, and any additional fees or charges. The agreement also clarifies the responsibilities and obligations of the buyer concerning the loan payments and maintenance of the property. It's important to note that there can be variations of the Loan Assumption Agreement based on the type of loan being assumed. Some common types include: 1. Conventional Loan Assumption Agreement: This agreement applies when the buyer assumes a conventional mortgage loan from the seller. Conventional loans are not insured or guaranteed by the government, and the buyer must meet the lender's eligibility criteria to assume the loan. 2. FHA Loan Assumption Agreement: This type of agreement is specific to loans insured by the Federal Housing Administration (FHA). The buyer must meet the FHA's qualification guidelines, and the lender must approve the assumption. 3. VA Loan Assumption Agreement: VA loans are guaranteed by the United States Department of Veterans Affairs. If the seller has a VA loan, the buyer may be able to assume it by meeting the VA's eligibility requirements and obtaining the lender's approval. 4. USDA Loan Assumption Agreement: USDA loans provided by the United States Department of Agriculture Rural Development program can also be assumed by eligible buyers. The buyer must qualify under the USDA's guidelines, and the lender's consent is necessary. In summary, a Dallas Texas Loan Assumption Agreement is a contractual arrangement that facilitates the transfer of an existing loan from a seller to a buyer. It streamlines the buying process and offers advantages to both parties involved. Understanding the specific type of loan being assumed, such as conventional, FHA, VA, or USDA, is crucial for determining the eligibility and requirements of the agreement.

Dallas Texas Loan Assumption Agreement

Description

How to fill out Dallas Texas Loan Assumption Agreement?

Do you need to quickly create a legally-binding Dallas Loan Assumption Agreement or maybe any other form to handle your personal or business affairs? You can go with two options: contact a professional to write a legal paper for you or create it entirely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you get neatly written legal papers without paying unreasonable fees for legal services.

US Legal Forms provides a rich collection of over 85,000 state-specific form templates, including Dallas Loan Assumption Agreement and form packages. We provide documents for an array of life circumstances: from divorce paperwork to real estate document templates. We've been out there for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the needed document without extra hassles.

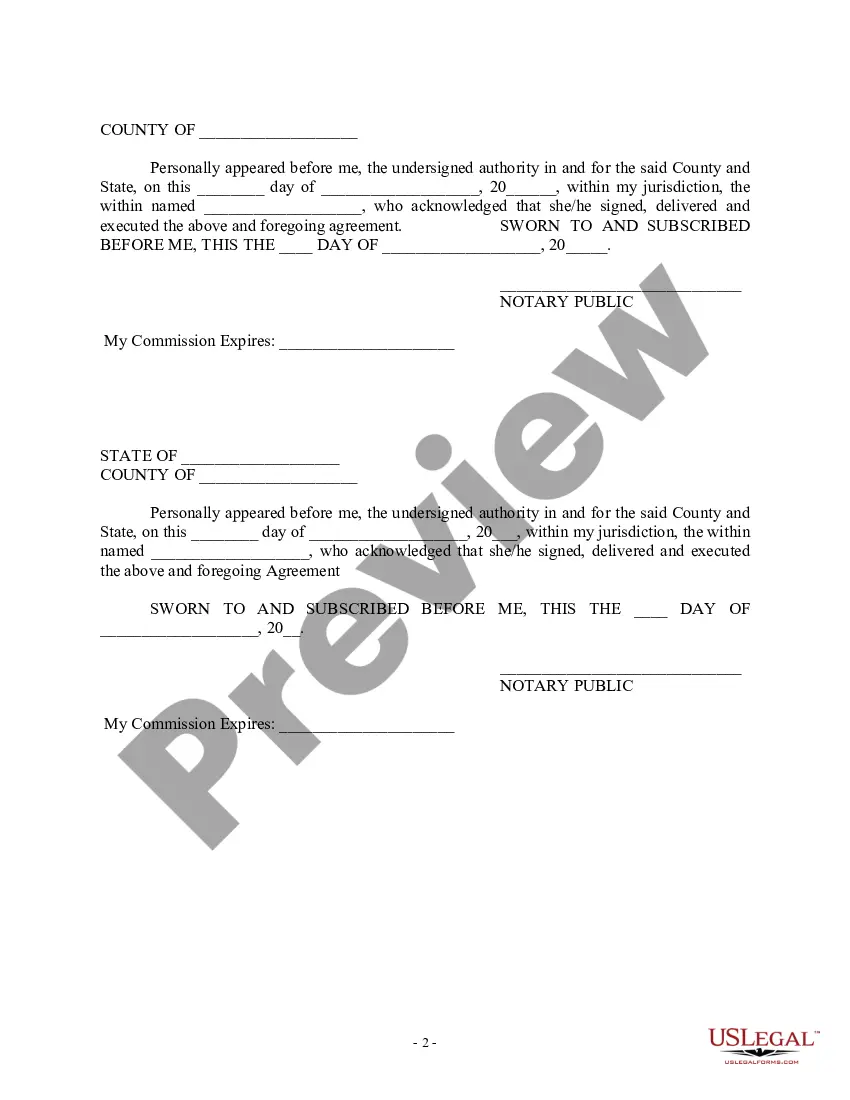

- First and foremost, carefully verify if the Dallas Loan Assumption Agreement is tailored to your state's or county's laws.

- In case the form has a desciption, make sure to verify what it's intended for.

- Start the search again if the template isn’t what you were looking for by utilizing the search box in the header.

- Select the plan that best suits your needs and move forward to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Dallas Loan Assumption Agreement template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. In addition, the paperwork we offer are reviewed by law professionals, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Although a due-on-sale risk may exist if title to property is transferred without lender consent (which remains small so long as the note is kept current), the vast majority of assumptions occur unofficially, that is, without consent from the lender.

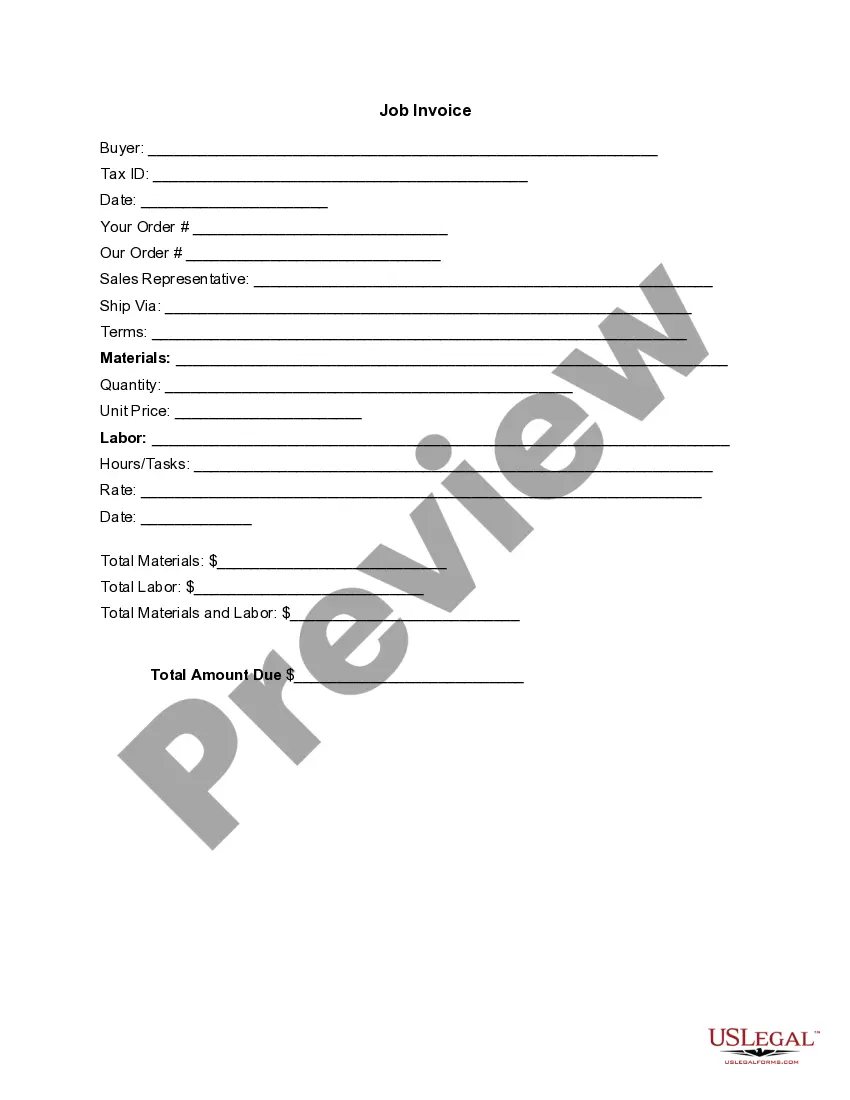

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability.

It's also misguided to think a refinance will take the same amount of time as assuming a loan. A refinance typically takes about 30 days, but a loan assumption can take anywhere from three to six months, depending on the lender.

To qualify for an assumable mortgage, lenders will check a buyer's credit score and debt-to-income ratio (DTI) to meet loan requirements. Additional information such as employment history, income information, and asset verification for a down payment may be needed to process the loan.

You can transfer a mortgage to another person if the terms of your mortgage say that it is assumable. If you have an assumable mortgage, the new borrower can pay a flat fee to take over the existing mortgage and become responsible for payment. But they'll still typically need to qualify for the loan with your lender.

What is a mortgage assumption agreement? It's actually pretty self-explanatory. A person who assumes a mortgage takes over a payment from the previous homeowner. Basically, the agreement shifts the financial responsibility of the loan to a different borrower.

An assumable mortgage allows a home buyer to not only move into the seller's former house but to step into the seller's loan, too. Having an assumable loan might give a seller a marketing edge, particularly if mortgage rates have risen since the seller got the loan.

Assumable refers to when one party takes over the obligation of another. In terms of an assumable mortgage, the buyer assumes the existing mortgage of the seller. When the mortgage is assumed, the seller is often no longer responsible for the debt.

Advantages. If the assumable interest rate is lower than current market rates, the buyer saves money straight away. There are also fewer closing costs associated with assuming a mortgage. This can save money for the seller as well as the buyer.

Interesting Questions

More info

Read my FAQ about my reassignment and release agreement. This will serve as a document that will be signed by both sides including, the Buyer and Seller, which would then be forwarded to the Bank. The SBA Loan Information form will be attached. Click to Continue Questions About Repairs, Repairs & Relocation FAQs If your home is under construction, and you are in need of repair work done, then take your time to get it right. When your house is finished and ready to be occupied, your lender must have done all its own repairs, and therefore cannot require you to complete repairs until completion of the loan. Once you do move in, and you learn that work was done differently than you were told; you may have a few questions to ask. Read Flag star Bank's Repairs FAQs below. Your lender may require you complete an assessment after you move in and prior to your loan being posted. Repairs include such things as kitchen counters, appliances, carpet, and other household items.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.