A Houston Texas Loan Assumption Agreement is a legal contract that allows a buyer to take over an existing loan from a seller of real estate property located in Houston, Texas. This agreement is commonly used in real estate transactions to transfer the responsibility of loan repayment from the original borrower to the new buyer. By assuming the loan, the buyer agrees to become the new borrower and assume all the terms and conditions, interest rates, and payment terms associated with the existing loan. Houston, Texas Loan Assumption Agreements are essential in real estate transactions as they provide a smooth transition for both the buyer and seller. These agreements eliminate the need for the buyer to apply for a new loan, saving time and resources. The seller benefits from avoiding prepayment penalties associated with paying off the loan early. There are different types of Houston, Texas Loan Assumption Agreements, including: 1. FHA Loan Assumption Agreement: This type of agreement is specific to loans insured by the Federal Housing Administration (FHA). It allows buyers to assume FHA-insured loans under certain conditions, such as meeting creditworthiness requirements and providing proof of income stability. 2. VA Loan Assumption Agreement: This agreement is designed for loans guaranteed by the Department of Veterans Affairs (VA). It enables eligible buyers to assume VA-guaranteed loans without the need for extensive credit checks. However, the buyer must meet specific service and credit eligibility criteria. 3. Conventional Loan Assumption Agreement: This type of agreement covers loans that are not insured or guaranteed by any government entity. Conventional loan assumption agreements typically involve more stringent credit checks and financial evaluations by the lender. 4. Private Loan Assumption Agreement: In some cases, sellers may offer private financing for the property they are selling. Private loan assumption agreements specify the terms and conditions, interest rates, and payment terms agreed upon between the buyer and the seller. It is important to carefully review and understand the terms and conditions of a Houston, Texas Loan Assumption Agreement before signing. Seeking legal advice from a qualified real estate attorney is highly recommended ensuring all parties involved are protected and understand their obligations under the agreement.

Houston Texas Loan Assumption Agreement

Description

How to fill out Houston Texas Loan Assumption Agreement?

Preparing legal paperwork can be difficult. Besides, if you decide to ask a legal professional to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Houston Loan Assumption Agreement, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario collected all in one place. Consequently, if you need the current version of the Houston Loan Assumption Agreement, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Houston Loan Assumption Agreement:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your Houston Loan Assumption Agreement and download it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

To qualify for an assumable mortgage, lenders will check a buyer's credit score and debt-to-income ratio (DTI) to meet loan requirements. Additional information such as employment history, income information, and asset verification for a down payment may be needed to process the loan.

An assumable mortgage allows a home buyer to not only move into the seller's former house but to step into the seller's loan, too. Having an assumable loan might give a seller a marketing edge, particularly if mortgage rates have risen since the seller got the loan.

It's also misguided to think a refinance will take the same amount of time as assuming a loan. A refinance typically takes about 30 days, but a loan assumption can take anywhere from three to six months, depending on the lender.

Assumable refers to when one party takes over the obligation of another. In terms of an assumable mortgage, the buyer assumes the existing mortgage of the seller. When the mortgage is assumed, the seller is often no longer responsible for the debt.

Although a due-on-sale risk may exist if title to property is transferred without lender consent (which remains small so long as the note is kept current), the vast majority of assumptions occur unofficially, that is, without consent from the lender.

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability.

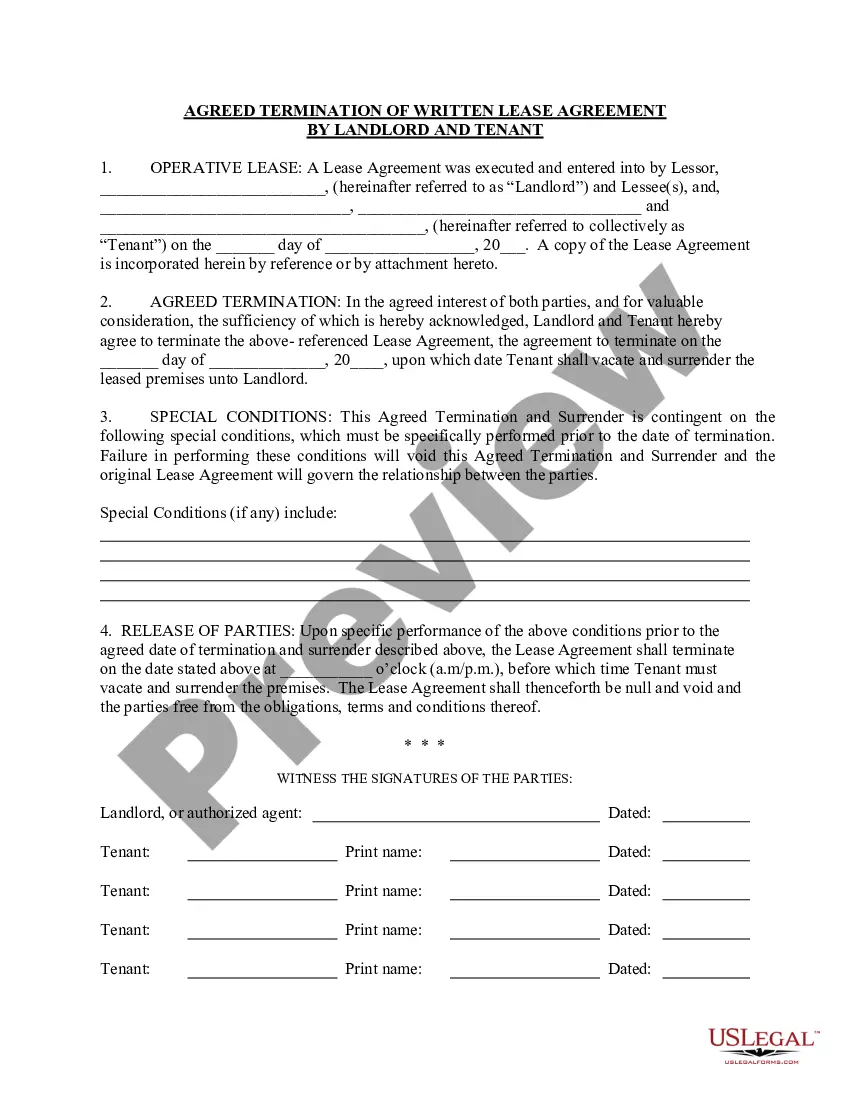

When a buyer assumes a loan it is with the lender's knowledge and approval. An assumption agreement is prepared by the existing lender of record and signed by the buyer as part of the escrow process.

Advantages. If the assumable interest rate is lower than current market rates, the buyer saves money straight away. There are also fewer closing costs associated with assuming a mortgage. This can save money for the seller as well as the buyer.

What is mortgage assumption? Mortgage assumption is the process of one borrower taking over, or assuming, another borrower's existing home loan. When you're assuming a loan, the outstanding balance, mortgage interest rate, repayment period and other terms attached to that loan often don't change.

What is a mortgage assumption agreement? It's actually pretty self-explanatory. A person who assumes a mortgage takes over a payment from the previous homeowner. Basically, the agreement shifts the financial responsibility of the loan to a different borrower.

More info

If so, here is when the inspection will be in progress. If you need to transfer ownership before the inspection, visit your local New York State Department of Motor Vehicles in person. This allows the DMV to complete any licensing and title issues on your behalf. Transferring Finance Transfers and Sales, Sales and Exchanges in New York State, also known as M-Finance, is our name for all forms of finance transfers and sales. The New York City-LIRR Transfer Station may be used by first time customers to make an M-Finance purchase. The first step to begin planning your vehicle transfer depends on your vehicle make and model and any restrictions on ownership. Transfer Price To qualify for your vehicle transfer, you must provide a prearranged payment. This usually takes the form of a down payment, a loan principal, taxes and insurance, and a monthly payment. Our customers are able to purchase vehicles based on prearranged payment plans.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.