A Wake North Carolina Loan Assumption Agreement is a legal document that allows a borrower to transfer their existing mortgage to a new borrower, who takes over the responsibility of making payments to the lender. This agreement is commonly used when a property is sold or transferred to a new owner, and the new owner agrees to assume the remaining mortgage obligations. The Wake North Carolina Loan Assumption Agreement includes various details outlining the terms and conditions of the assumption, ensuring that both parties involved are protected. It specifies the names and contact information of the original borrower (also known as the "assignor") and the new borrower (also known as the "assignee"). Additionally, it provides the details of the original mortgage, such as the loan amount, interest rate, and repayment schedule. The agreement also stipulates the responsibilities and liabilities of the assignee. This includes the commitment to make timely mortgage payments, maintain insurance coverage on the property, and adhere to any other terms outlined in the original mortgage agreement. The assignee also agrees to indemnify and hold harmless the assignor from any liability related to the assumption of the loan. It is important to note that not all mortgages are assumable, and the terms for assuming a loan may vary based on the lender and the specific mortgage contract. In Wake North Carolina, there may be different types of Loan Assumption Agreements available, such as conventional loan assumption agreements, FHA loan assumption agreements, VA loan assumption agreements, or USDA loan assumption agreements. Each type may have its own set of requirements, restrictions, and procedures for assumption. To ensure a smooth loan assumption process, it is crucial for both parties to thoroughly review the agreement, consult with their respective legal advisors, and comply with all relevant laws and regulations in Wake North Carolina. This includes obtaining the lender's approval for the assumption, paying any necessary fees, and completing all required paperwork accurately and on time. In summary, a Wake North Carolina Loan Assumption Agreement is a legal document that facilitates the transfer of a mortgage from one borrower to another. It protects the rights and obligations of both parties involved and should be executed with careful consideration and adherence to applicable laws and regulations.

Wake North Carolina Loan Assumption Agreement

Description

How to fill out Wake North Carolina Loan Assumption Agreement?

If you need to get a reliable legal form provider to get the Wake Loan Assumption Agreement, consider US Legal Forms. No matter if you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can browse from more than 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of supporting resources, and dedicated support make it simple to find and complete different documents.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

You can simply type to search or browse Wake Loan Assumption Agreement, either by a keyword or by the state/county the form is created for. After locating required template, you can log in and download it or retain it in the My Forms tab.

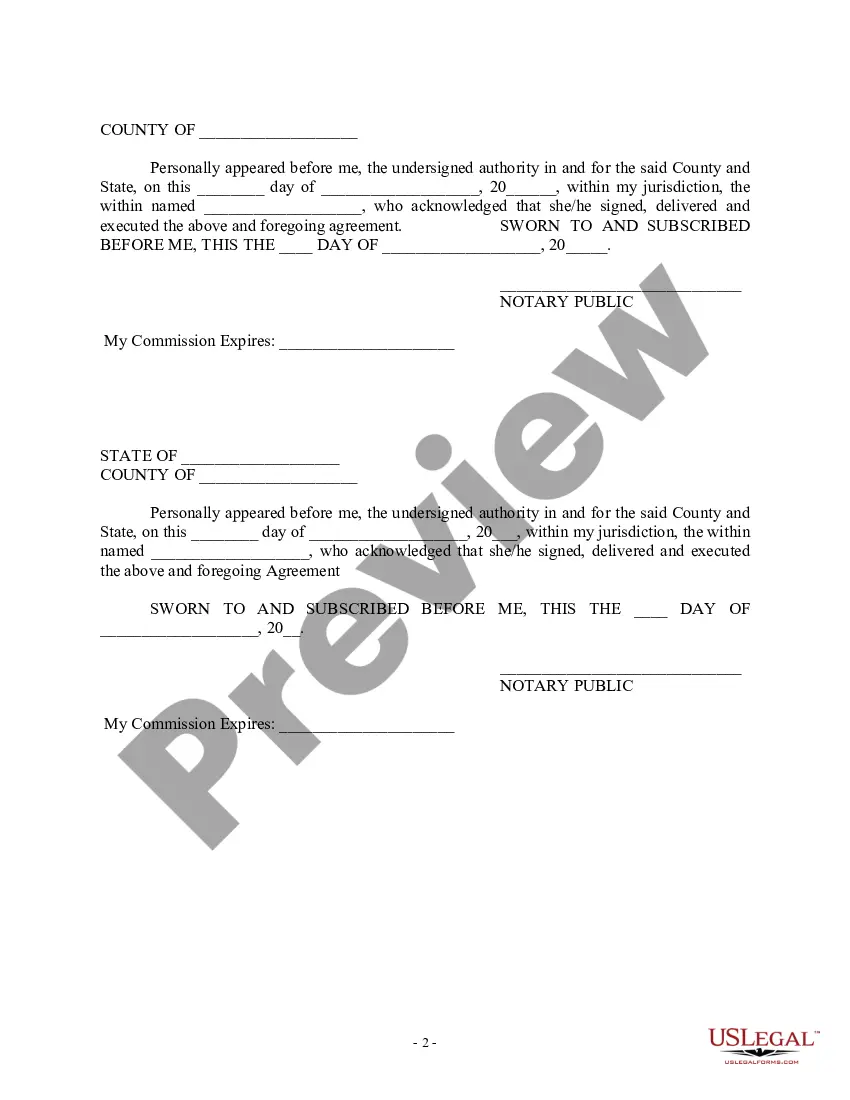

Don't have an account? It's simple to get started! Simply find the Wake Loan Assumption Agreement template and take a look at the form's preview and description (if available). If you're confident about the template’s terminology, go ahead and hit Buy now. Create an account and select a subscription option. The template will be immediately available for download once the payment is completed. Now you can complete the form.

Taking care of your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes this experience less pricey and more affordable. Set up your first business, organize your advance care planning, draft a real estate agreement, or complete the Wake Loan Assumption Agreement - all from the comfort of your home.

Join US Legal Forms now!