Allegheny Pennsylvania Merger Agreement is a legal contract that outlines the terms and conditions of a merger between two companies in Allegheny, Pennsylvania. This agreement is vital in ensuring a smooth transition and consolidation of business operations, assets, and liabilities. The Allegheny Pennsylvania Merger Agreement typically includes several key provisions and components. Firstly, it outlines the identification and classification of the merging entities, specifying the parent or acquiring company and the subsidiary or target company. It also describes the purpose and objectives of the merger, which may include expanding market presence, achieving cost synergies, or diversifying product offerings. Moreover, this agreement specifies the consideration given to the shareholders of the target company, such as cash, stock, or a combination of both. It details the exchange ratio, offering a clear understanding of the value attributed to the target company's shares. The agreement also guides the handling of any outstanding stock options, employee benefits, or pension plans held by the target company's employees. The Allegheny Pennsylvania Merger Agreement includes information on the corporate governance structure of the merged entity. It outlines the composition of the board of directors, executive appointments, and any changes in the voting rights and ownership structure. This section may also cover any restrictions or limitations, such as non-compete clauses or confidentiality agreements, to protect the interests of the merged entity. Additionally, the agreement addresses legal and regulatory compliance matters, including requisite approvals from government authorities, industry regulators, or shareholders. It highlights any required filings, waiting periods, or antitrust regulations that need to be adhered to during the merger process. In terms of different types of Allegheny Pennsylvania Merger Agreements, there can be variations based on the transaction specifics and parties involved. Some common types are: 1. Stock-for-Stock Merger Agreement: This type of agreement involves the exchange of shares between the acquiring and target companies, with the consideration entirely in the form of stock. 2. Cash Merger Agreement: In this type, the target company's shareholders receive cash as consideration for their shares. 3. Asset Merger Agreement: This agreement entails the acquisition of specific assets of the target company rather than a complete merger of both entities. Typically, the acquiring company assumes only selected assets and liabilities. 4. Reverse Merger Agreement: This agreement occurs when a private company acquires a public company, allowing the private company to become publicly traded without undergoing the traditional initial public offering (IPO) process. In conclusion, the Allegheny Pennsylvania Merger Agreement is a comprehensive legal document that sets out the terms, conditions, and considerations of a merger between companies in Allegheny, Pennsylvania. It encompasses various provisions to ensure a smooth transition and compliance with applicable laws and regulations.

Allegheny Pennsylvania Merger Agreement

Description

How to fill out Allegheny Pennsylvania Merger Agreement?

Preparing legal documentation can be cumbersome. In addition, if you decide to ask an attorney to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Allegheny Merger Agreement, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario collected all in one place. Consequently, if you need the current version of the Allegheny Merger Agreement, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Allegheny Merger Agreement:

- Glance through the page and verify there is a sample for your region.

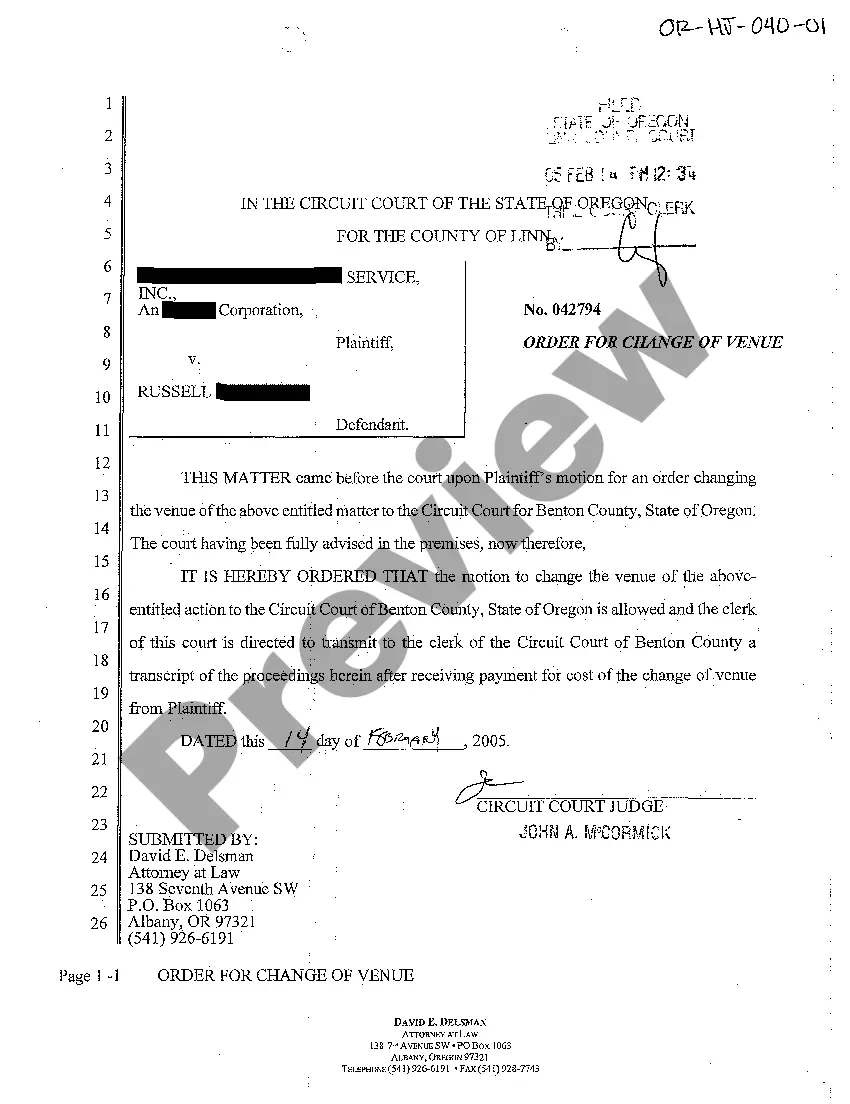

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Allegheny Merger Agreement and save it.

When finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!