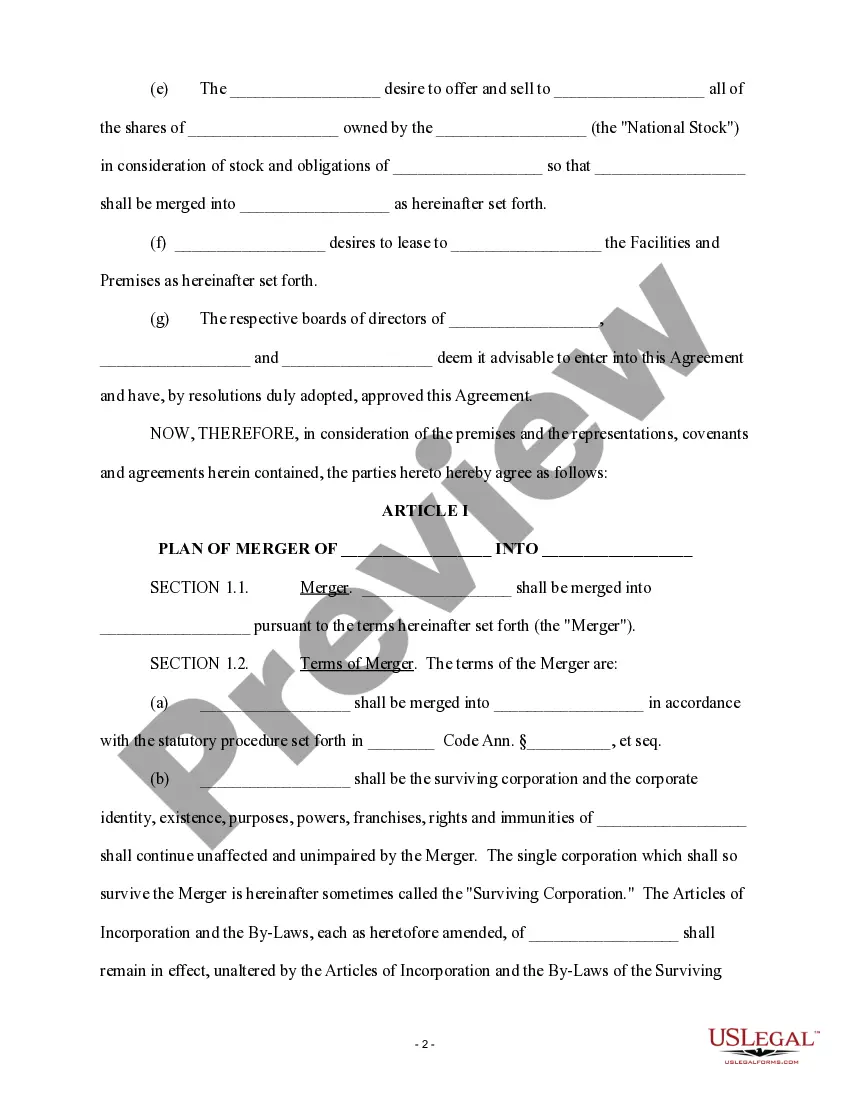

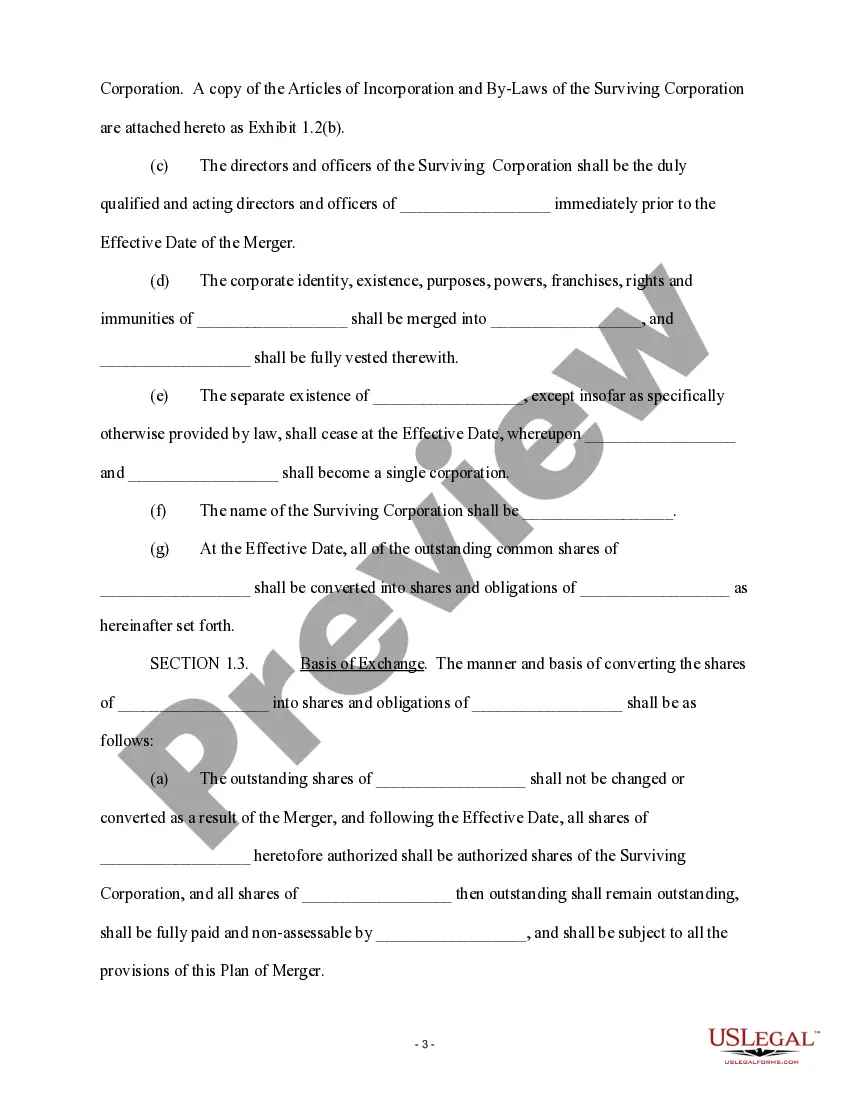

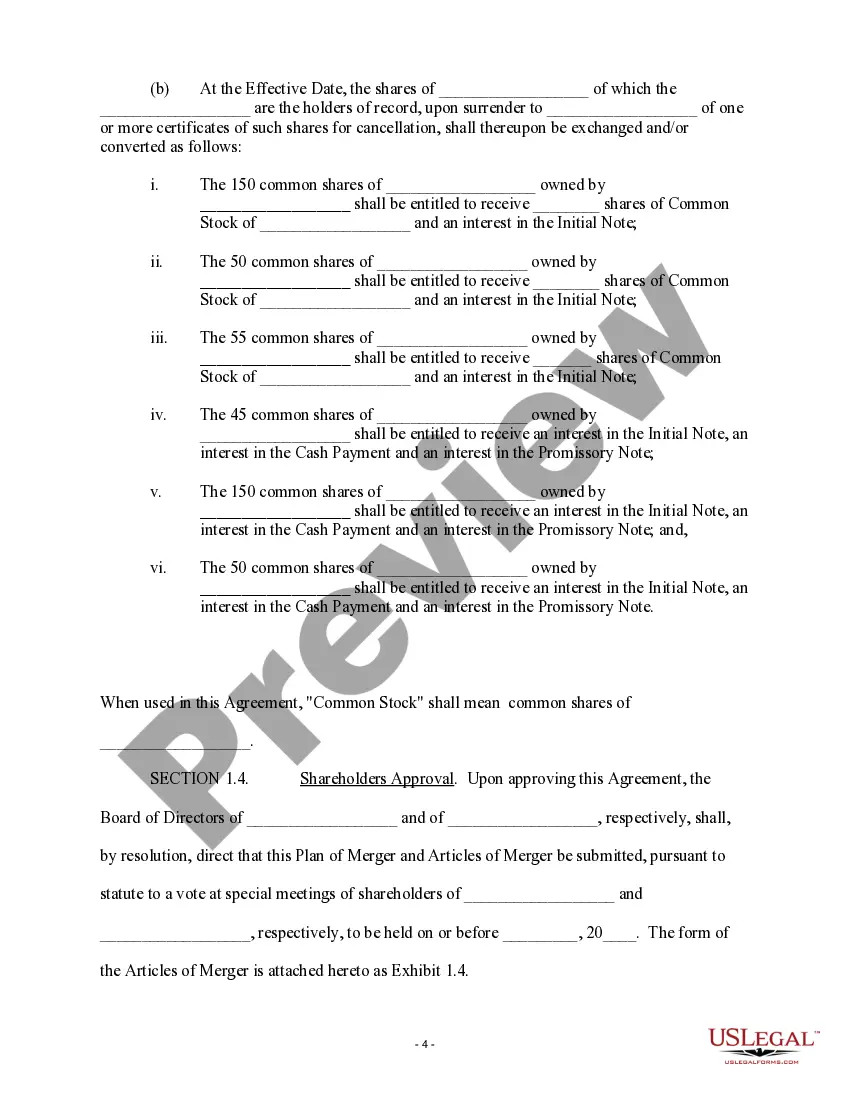

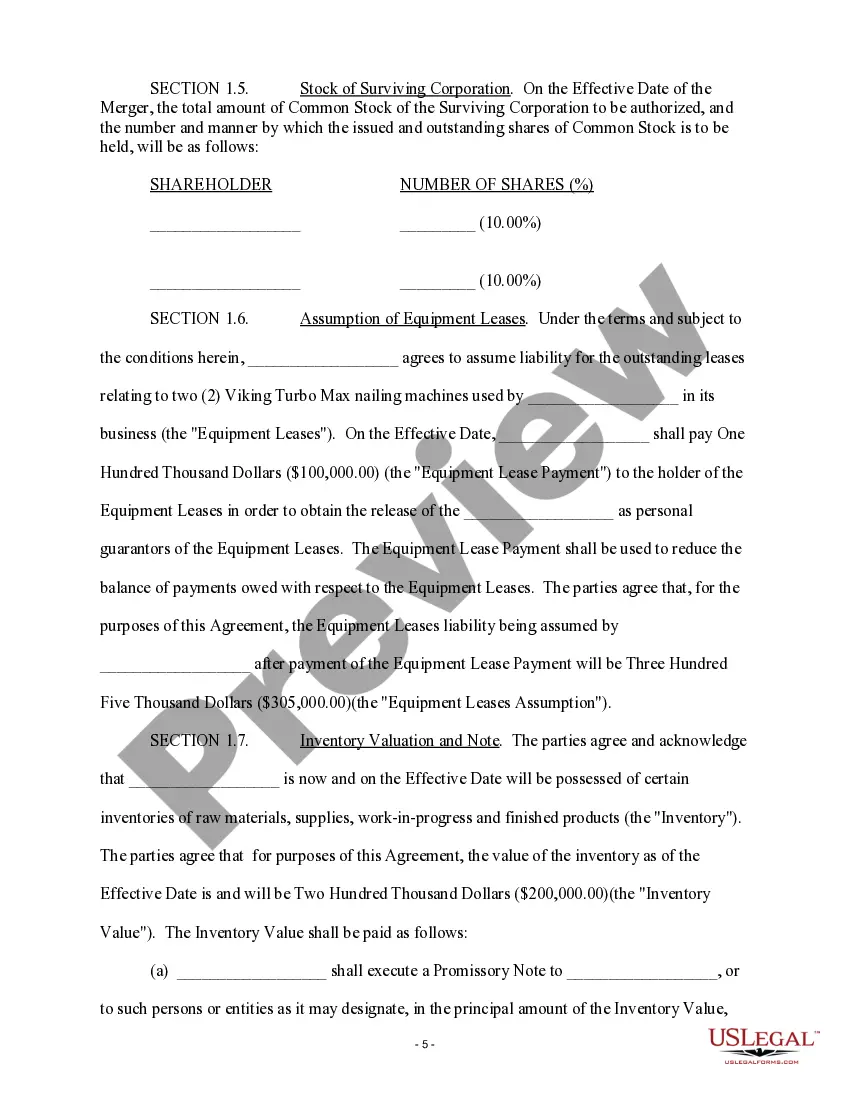

The Harris Texas Merger Agreement is a legal document that outlines the terms and conditions of a merger between two companies in the state of Texas, specifically in Harris County. This agreement governs the merger process, including the rights, obligations, and protections of the parties involved. Harris Texas Merger Agreement is a broad term that encompasses different types of merger agreements based on the structure and terms of the merger. Some common types of Harris Texas Merger Agreements include: 1. Stock Merger Agreement: This type of agreement involves the merger of two companies, where the acquiring company offers its own stock as consideration for the target company's shares. The agreement outlines the exchange ratio, conversion of shares, and other relevant provisions related to the stock merger. 2. Asset Purchase Agreement: In this type of merger agreement, the acquiring company purchases the assets of the target company, rather than acquiring its stock. The agreement outlines the specific assets being acquired, the purchase price, any liabilities being assumed, and other terms and conditions of the asset purchase. 3. Share Exchange Agreement: This agreement involves the exchange of shares between the acquiring company and the target company's shareholders. The terms of the share exchange, such as the exchange ratio and the treatment of minority shareholders, are detailed in the agreement. 4. Merger of Equals Agreement: When two companies of relatively equal size merge, they may enter into a merger of equals agreement. This agreement outlines the governance structure, management team, and other key provisions for the merged entity. 5. Joint Venture Agreement: In certain cases, rather than a complete merger, two companies may form a joint venture to pursue a specific business opportunity. The joint venture agreement establishes the terms of this partnership, including ownership structure, profit-sharing, and management rights. The Harris Texas Merger Agreement is typically a comprehensive document that covers various aspects of the merger, including the purpose of the merger, the consideration to be paid, the treatment of employees and customers, the protection of intellectual property, governance structure, and any PRE or post-closing conditions. In summary, the Harris Texas Merger Agreement is a legal contract that governs the merger process between two companies in Harris County, Texas. It ensures that all parties involved are protected and that the terms of the merger are clearly outlined. The specific type of merger agreement within the Harris Texas Merger Agreement category depends on the structure and terms of the merger transaction.

Harris Texas Merger Agreement

Description

How to fill out Harris Texas Merger Agreement?

How much time does it usually take you to create a legal document? Given that every state has its laws and regulations for every life sphere, locating a Harris Merger Agreement meeting all local requirements can be exhausting, and ordering it from a professional attorney is often costly. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, grouped by states and areas of use. Aside from the Harris Merger Agreement, here you can get any specific document to run your business or individual affairs, complying with your regional requirements. Professionals verify all samples for their validity, so you can be sure to prepare your paperwork properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can pick the file in your profile at any moment later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Harris Merger Agreement:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Harris Merger Agreement.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!