The Alameda California Restricted Endowment to Religious Institution refers to a specific fund or financial arrangement established in Alameda, California, that is dedicated solely to supporting religious institutions in the area. This endowment is aimed at providing financial assistance, resources, and stability to religious organizations, enabling them to carry out their mission and serve their communities effectively. Religious institutions play a vital role in the well-being and spiritual development of individuals and communities. The Alameda California Restricted Endowment recognizes the importance of these institutions and seeks to provide ongoing support to ensure their sustainability and growth. This restricted endowment has been created to adhere to specific guidelines and limitations. It ensures that the funds are utilized exclusively for religious purposes, such as maintenance of religious buildings, improvements, repairs, or even expansion projects. Its primary objective is to assist religious organizations in achieving their goals and enhancing their ability to meet the needs of their congregations and the wider community. The Alameda California Restricted Endowment to Religious Institution is an excellent avenue for benefactors and donors to channel their contributions towards religious causes that align with their values and beliefs. By contributing to this endowment, donors can rest assured that their contributions will have a lasting impact on supporting and nurturing religious institutions within the Alameda area. While there may not be different types of Alameda California Restricted Endowment to Religious Institutions per se, there can be variations in terms of specific religious organizations or denominations benefiting from it. For instance, certain endowments may be designated exclusively for Catholic institutions, while others can be more broadly accessible to various religious affiliations, including Protestant, Jewish, or Muslim institutions. This ensures that the endowment caters to the diverse religious fabric of the Alameda community. In conclusion, the Alameda California Restricted Endowment to Religious Institution is a crucial financial resource that aims to provide sustained support to religious organizations in Alameda. Through its careful allocation of funds, it enables religious institutions to further their mission, enhance their services, and positively impact the lives of their congregation members and the wider community. By offering a means for individuals and organizations to contribute to this endowment, it fosters the continued growth and vitality of religious institutions in preserving and cultivating faith traditions in Alameda, California.

Alameda California Restricted Endowment to Religious Institution

Description

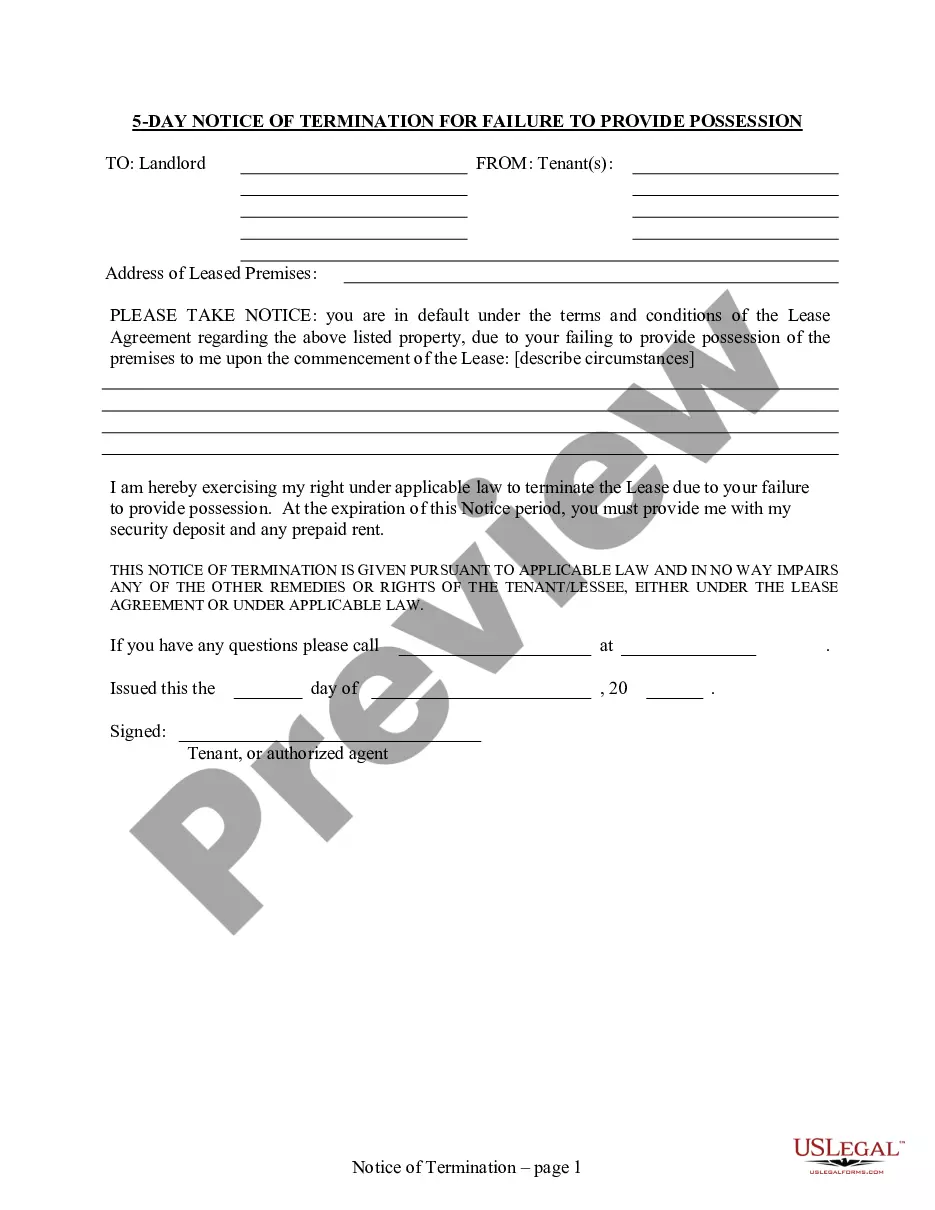

How to fill out Alameda California Restricted Endowment To Religious Institution?

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to draft some of them from the ground up, including Alameda Restricted Endowment to Religious Institution, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to choose from in various categories ranging from living wills to real estate paperwork to divorce documents. All forms are organized based on their valid state, making the searching experience less frustrating. You can also find detailed materials and guides on the website to make any activities related to paperwork execution straightforward.

Here's how to locate and download Alameda Restricted Endowment to Religious Institution.

- Take a look at the document's preview and outline (if provided) to get a basic information on what you’ll get after getting the form.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can affect the legality of some records.

- Examine the similar document templates or start the search over to locate the correct file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the option, then a suitable payment gateway, and purchase Alameda Restricted Endowment to Religious Institution.

- Select to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Alameda Restricted Endowment to Religious Institution, log in to your account, and download it. Needless to say, our website can’t replace a legal professional completely. If you have to deal with an extremely challenging case, we recommend using the services of a lawyer to examine your document before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Become one of them today and purchase your state-specific paperwork with ease!

Form popularity

FAQ

Only donors can establish binding restrictions.The only endowment or purpose restrictions that are legally binding are those that are imposed by donors in a gift instrument.

For endowment funds, the donor states that the gift is to be held permanently as an endowment; for quasi-endowment funds, gifts are elected to be added to the fund, which means a future board could vote to remove part or all of the principal for spending.

UPMIFA makes it clear that the term endowment fund does not include funds that the charity designates as endowment (these are quasi-endowment funds).

An Designated Agency Endowed Fund allows you to support your non-profit organization, school or religious institution in perpetuity. Individuals or the nonprofit itself may establish this fund. This is an endowed fundyou are creating a permanent charitable legacy. It endures forever.

Quasi-endowments are established using either donor or institutional funds, typically excess operating support and revenue or unrestricted bequests. An organization's board may earmark a portion of its unrestricted net assets as a quasi-endowment to be invested to provide income for a long but unspecified period.

If the endowment has a permanent endowment classification, the nonprofit records the initial funds in a permanently restricted revenue account. For example, to record the initial gift of a permanent endowment, the nonprofit debits the investment account and credits the permanently restricted assets revenue account.

endowment is created when the Board imposes a restriction on the organization's own general operating funds; this is not considered a permanent restriction because the board can remove the restriction at any time. Quasiendowment spending restrictions can simply be removed by board action.

Based on the Financial Accounting Standards Board (FASB), the three distinct types of endowments are:Term Endowment. A term endowment, unlike most other endowments, is not perpetual.True Endowment. When a donor provides funds to the endowment, it is specified that they are to be kept perpetually.Quasi-Endowment.

Endowments are usually permanently restricted funds. In most cases, their principal cannot be spent, and only a specified percent of the interest they earn can be spent per year. Furthermore, there are restrictions on how the interest can be spent.

Based on the Financial Accounting Standards Board (FASB), the three distinct types of endowments are:Term Endowment. A term endowment, unlike most other endowments, is not perpetual.True Endowment. When a donor provides funds to the endowment, it is specified that they are to be kept perpetually.Quasi-Endowment.