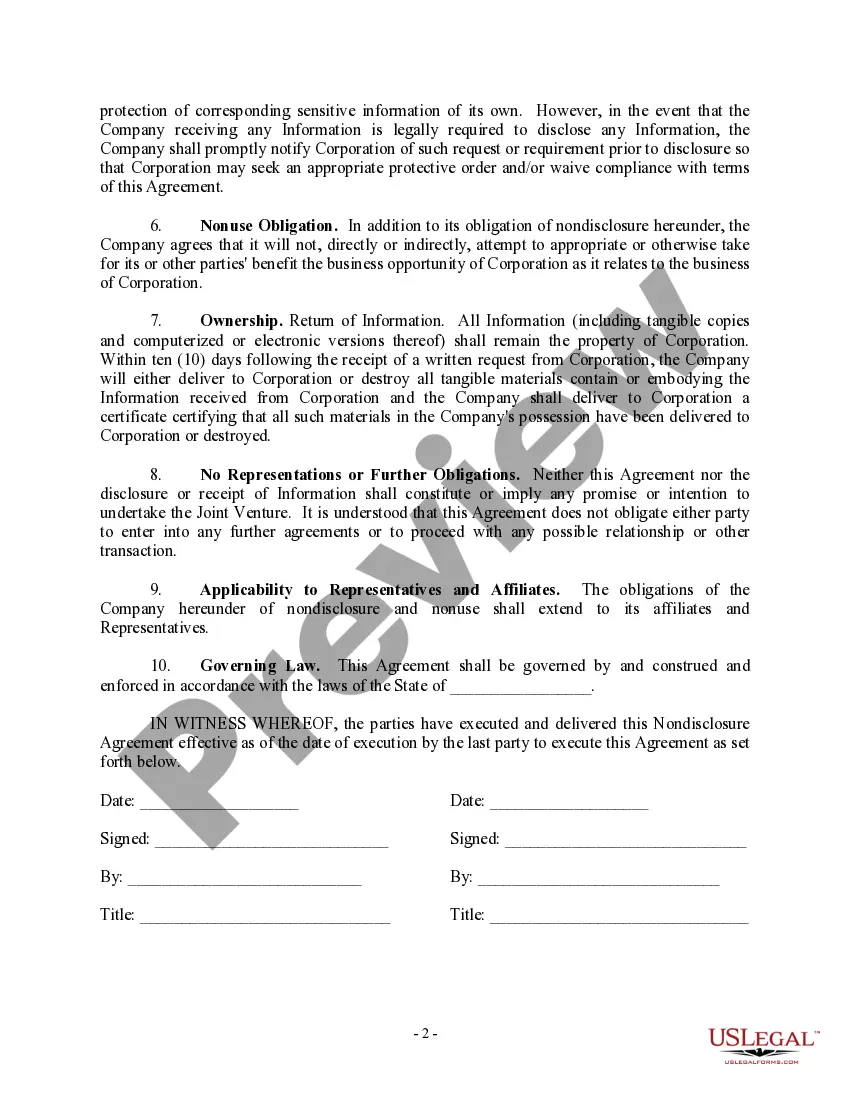

The Harris Texas Company Nondisclosure Agreement, specifically designed for company-to-company agreements, serves as a vital legal tool to protect sensitive information exchanged between businesses. This agreement ensures that confidential information remains confidential, preventing unauthorized dissemination and usage by either party involved. By signing this legally binding document, companies can establish a mutual understanding of their responsibilities, restrictions, and obligations regarding the protection of confidential information. Key Elements of the Harris Texas Company Nondisclosure Agreement — Company to Company: 1. Parties: This section defines the parties involved in the agreement, specifying the legal names and addresses of both the disclosing party and the receiving party. Having accurate identification is crucial for enforcing the terms of the agreement. 2. Definition of Confidential Information: This portion elaborates on what constitutes confidential information. It encompasses all non-public, proprietary, or sensitive information disclosed during the agreement, including trade secrets, financial data, customer information, marketing strategies, product designs, or any information explicitly labeled as confidential. 3. Exclusions: Here, the agreement enumerates certain elements that are not considered confidential information. This helps clarify the boundaries and scope of the agreement, ensuring that specific types of information, such as publicly available data or pre-existing knowledge, do not fall within the realm of confidentiality. 4. Obligations of the Receiving Party: This section outlines the responsibilities of the receiving party. It emphasizes the need to maintain confidentiality, exercise reasonable care in safeguarding the disclosed information, and restrict access to authorized personnel only. The agreement may specify strict measures like password protection or encryption to ensure the utmost security of confidential data. 5. Permitted Use: The agreement defines the authorized use of the confidential information. It strictly prohibits the receiving party from utilizing or exploiting the disclosed information for purposes beyond what is explicitly permitted in the agreement. The permitted use might be restricted to specifically stated business purposes or certain individuals within the receiving company. 6. Term and Termination: This section establishes the duration of the agreement's validity. It clarifies when the agreement becomes effective and the circumstances under which it may terminate. Parties typically set a specific term or link the agreement's lifespan to an event (e.g., termination of a business relationship). Additionally, it addresses what happens to the confidential information upon termination, requiring its return or destruction. 7. Remedies and Dispute Resolution: In case of a breach, this clause lays out the possible remedies, which may include injunctive relief, financial compensation, or specific performance. It also outlines the process for dispute resolution, such as negotiation, mediation, or arbitration, to ensure any conflicts are resolved efficiently and fairly. Types of Harris Texas Company Nondisclosure Agreement — Company to Company: 1. Standard Non-Disclosure Agreement: This is the most common type of company-to-company NDA, encompassing all the key elements mentioned above. It is applicable in various industries for protecting a wide range of confidential information. 2. NDA for Technology Companies: This specialized NDA focuses on safeguarding technological innovations, software codes, algorithms, proprietary technology, research and development discoveries, and other tech-related confidential information exchanged between companies. 3. NDA for Joint Ventures: When companies enter into joint ventures or partnerships, this NDA variant is utilized to protect shared confidential information, business plans, marketing strategies, and financial data to ensure cooperation while safeguarding each party's rights. 4. NDA for Supply Chain Contracts: Specifically tailored for companies engaged in supply chain management, this NDA safeguards the confidential information shared among manufacturers, suppliers, distributors, and retailers, ensuring the privacy of information related to pricing, inventory, logistics, or customer contracts.

Harris Texas Company Nondisclosure Agreement - Company to Company

Description

How to fill out Harris Texas Company Nondisclosure Agreement - Company To Company?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for professional help to create some of them from scratch, including Harris Company Nondisclosure Agreement - Company to Company, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different categories ranging from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching experience less frustrating. You can also find detailed resources and tutorials on the website to make any tasks related to paperwork completion simple.

Here's how you can purchase and download Harris Company Nondisclosure Agreement - Company to Company.

- Go over the document's preview and outline (if provided) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can affect the validity of some documents.

- Check the similar document templates or start the search over to locate the appropriate file.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a needed payment gateway, and buy Harris Company Nondisclosure Agreement - Company to Company.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Harris Company Nondisclosure Agreement - Company to Company, log in to your account, and download it. Of course, our platform can’t take the place of a lawyer completely. If you have to cope with an exceptionally difficult situation, we advise using the services of an attorney to examine your document before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of users. Become one of them today and get your state-specific paperwork with ease!

Form popularity

FAQ

The Key Elements of Non-Disclosure AgreementsIdentification of the parties.Definition of what is deemed to be confidential.The scope of the confidentiality obligation by the receiving party.The exclusions from confidential treatment.The term of the agreement.

disclosure agreement is a legally binding contract that establishes a confidential relationship. The party or parties signing the agreement agree that sensitive information they may obtain will not be made available to any others. An NDA may also be referred to as a confidentiality agreement.

NDAs, or non-disclosure agreements, are legally enforceable contracts that create a confidential relationship between a person who has sensitive information and a person who will gain access to that information.

A nondisclosure agreement is a written legal contract and is usually between an employer and an employee. The contract lays out binding terms and conditions that prohibit the employee from disclosing confidential and proprietary company information.

NDAs, or non-disclosure agreements, are legally enforceable contracts that create a confidential relationship between a person who has sensitive information and a person who will gain access to that information. A confidential relationship means one or both parties has a duty not to share that information.

How To Write a Non-Disclosure Agreement on Your Own. If you don't want to waste money on a lawyer, you could try to write an NDA yourself. Bear in mind that such an endeavor is super challenging as the contract includes many important clauses that shouldn't be overlooked: Disclosing and Receiving Parties.

Typically, a legal professional writing the NDA will complete these steps:Step 1 - Describe the scope. Which information is considered confidential?Step 2 - Detail party obligations.Step 3 - Note potential exclusions.Step 4 - Set the term.Step 5 - Spell out consequences.

How do I write a Non-Disclosure Agreement?Contact information for the parties involved.Details about the confidential information that needs protection.Permitted uses of the confidential information by the recipient.Time restrictions for keeping information confidential.Reason for disclosure.

Non-disclosure agreements bear many of the same qualities as a typical contract but, even when all essential elements are present to create legal obligations, some of them may still not be enforceable.

More info

The Investments and Debt of this fund will be applied to the amount of debt, when determined within 180 days of its issuance. The amount payable at maturity to you is determined as follows: · First 1.00 of Debt 0.00 Second 2.00 of Debt 0.00 Third 4.00 of Debt 0.00 Fourth 8.00 of Debt 0.00 Fifth and beyond 0.00 Any additional Debt will be applied to the amount of Debt which you are to collect from us, which amount shall be determined to be one and two thirds percent or not less than the annual rate plus accrued interest for each Debt Payment Date of 0.00, if not less than one. In no event shall you have any of the Debt or Interest to be a third party beneficiary on the Debt. Any Interest to be a third party beneficiary or otherwise paid to you as a result of the Debt or the interest to be payable thereon will be the sole responsibility of any holder of a secured party loan represented by a mortgage on the Property.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.