Fairfax Virginia Unrestricted Charitable Contribution of Cash refers to a type of monetary donation made by individuals, organizations, or businesses to charitable entities located in Fairfax, Virginia, with no specific limitations or restrictions on the usage of the contributed funds. Such contributions aim to provide financial assistance to nonprofit organizations that work towards various causes and initiatives within the Fairfax community. Fairfax, Virginia, being a vibrant and diverse area, nurtures a wide range of charitable organizations dedicated to areas like education, healthcare, community development, environmental conservation, social welfare, arts and culture, and more. These organizations rely heavily on the generosity of individuals, corporations, and foundations, who contribute unrestricted cash donations to sustain their operations, fund programs, and contribute towards the betterment of the Fairfax community. By making unrestricted charitable contributions of cash, donors empower the nonprofits to allocate funds as they see fit, within the boundaries of their missions and charitable objectives. This type of donation allows charities to have the flexibility to address immediate needs, invest in long-term sustainability, or develop new initiatives that advance their causes effectively. Unrestricted charitable contributions of cash in Fairfax, Virginia, are vital for supporting the variety of nonprofit organizations operating in the area. Donors can choose to contribute to different types of charities based on their personal interests and values. These may include: 1. Education-focused nonprofits: Organizations dedicated to providing quality educational opportunities, scholarships, and support services to students, teachers, and schools in the Fairfax County area. 2. Healthcare and Medical organizations: Nonprofits that focus on improving healthcare access, promoting wellness, and providing medical services and resources to underserved populations within Fairfax. 3. Community development nonprofits: Organizations aiming to improve local communities by addressing issues like affordable housing, poverty, job training, and economic development in Fairfax. 4. Environmental conservation organizations: Nonprofits dedicated to preserving and protecting the natural resources, green spaces, and wildlife in Fairfax, promoting sustainable practices, and educating the community about environmental issues. 5. Social welfare organizations: Nonprofits committed to addressing social challenges such as hunger, homelessness, domestic violence, substance abuse, mental health, and fostering inclusivity and equality within Fairfax. 6. Arts and culture nonprofits: Organizations focused on promoting and enriching the arts, culture, and heritage in Fairfax, providing artistic opportunities, exhibitions, performances, and cultural events. The act of making an unrestricted charitable contribution of cash in Fairfax, Virginia, allows philanthropic individuals and entities to make a meaningful impact on the community, leaving a lasting legacy of positive change. By supporting these organizations, individuals and businesses contribute to the overall well-being and advancement of Fairfax, making it an even more vibrant and inclusive place to live, work, and thrive.

Fairfax Virginia Unrestricted Charitable Contribution of Cash

Description

How to fill out Fairfax Virginia Unrestricted Charitable Contribution Of Cash?

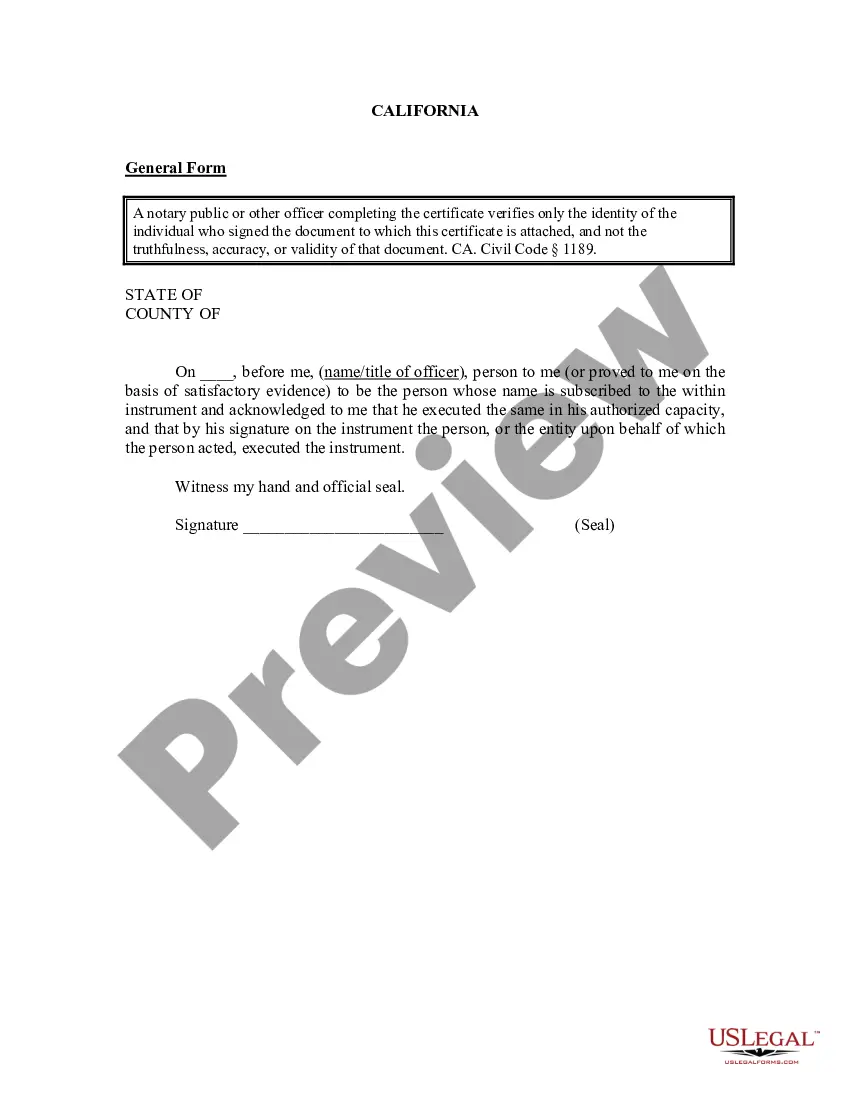

How much time does it normally take you to create a legal document? Since every state has its laws and regulations for every life situation, locating a Fairfax Unrestricted Charitable Contribution of Cash suiting all local requirements can be stressful, and ordering it from a professional attorney is often costly. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, collected by states and areas of use. Aside from the Fairfax Unrestricted Charitable Contribution of Cash, here you can get any specific form to run your business or individual deeds, complying with your county requirements. Professionals check all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can pick the document in your profile anytime later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your Fairfax Unrestricted Charitable Contribution of Cash:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Fairfax Unrestricted Charitable Contribution of Cash.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Usually, individual itemizers are allowed to deduct up to 60% of their adjusted gross incomes (AGI) for cash donations to qualified charities. However, in 2021, they generally can deduct cash contributions equal to 100% of their AGI.

There are annual limits on the deductible donation. In generally your donation deduction will be limited to 50% of your adjusted gross income (AGI) ?unless you only give cash, in which case the limit increases to 60% of AGI. Whereas, the limit on donating appreciated assets to a qualified charities is 30% of your AGI.

Can you make charitable tax deductions without itemizing them in 2022? Unfortunately, as of April 2022, the answer is no. In the 2021 tax year, the IRS temporarily allowed individuals to deduct $300 per person (those married filing jointly can deduct up to $600) without itemizing other deductions.

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporation may deduct qualified contributions of up to 25 percent of its taxable income.

Any contribution?of cash or non-cash assets?received by December 31 is eligible for a 2022 tax deduction.

Annual income tax deduction limits for gifts to public charities, including donor-advised funds, are 30% of adjusted gross income (AGI) for contributions of non-cash assets, if held more than one year, and 60% of AGI for contributions of cash.

Unfortunately, as of April 2022, the answer is no. In the 2021 tax year, the IRS temporarily allowed individuals to deduct $300 per person (those married filing jointly can deduct up to $600) without itemizing other deductions. But that change does not apply to the 2022 tax year.

However, for 2021, individuals who do not itemize their deductions may deduct up to $300 ($600 for married individuals filing joint returns) from gross income for their qualified cash charitable contributions to public charities, private operating foundations, and federal, state, and local governments.

Requirement: A donor cannot claim a tax deduction for any contribution of cash, a check or other monetary gift unless the donor maintains a record of the contribution in the form of either a bank record (such as a cancelled check) or a written communication from the charity (such as a receipt or letter) showing the