A Lima Arizona Liability Waiver for Property Owner is a legal document that aims to protect property owners from potential legal claims and liabilities that may arise from the use of their property by others. This waiver is typically used when property owners allow individuals or organizations to access or utilize their premises for various purposes, such as recreational activities, events, or rentals. Keywords: Lima Arizona, liability waiver, property owner, legal document, protect, legal claims, liabilities, use of property, premises, recreational activities, events, rentals. There are various types of Lima Arizona Liability Waivers for Property Owners, each designed to address specific situations and potential risks. Some common types include: 1. Recreation Liability Waiver: This type of waiver is used when property owners allow individuals or groups to engage in recreational activities on their property, such as hiking, camping, or water sports. 2. Event Liability Waiver: Event organizers often require property owners to sign this waiver to protect themselves from liability in case accidents, injuries, or property damage occur during the event, such as a wedding, concert, or festival. 3. Rental Liability Waiver: Property owners who rent out their premises, whether it's a residential property or a commercial space, may use this waiver to exempt themselves from liability for any damages or injuries caused by the tenant or their guests. 4. Agricultural Liability Waiver: Farmers or property owners engaged in agricultural activities may utilize this waiver to mitigate potential risks associated with farming operations, such as accidents involving machinery, livestock, or pesticides. 5. Trespasser Liability Waiver: In certain circumstances, property owners may allow individuals to access their property for specific purposes, such as hunting or hiking. A trespasser liability waiver helps protect property owners from legal claims if these individuals are injured or cause damage while on the property. Remember, it is crucial to consult with legal professionals to ensure that the specific liability waiver used adheres to the laws and regulations of Arizona and accurately reflects the intended purpose and scope of the property owner's liability protection.

Pima Arizona Liability Waiver for Propery Owner

Description

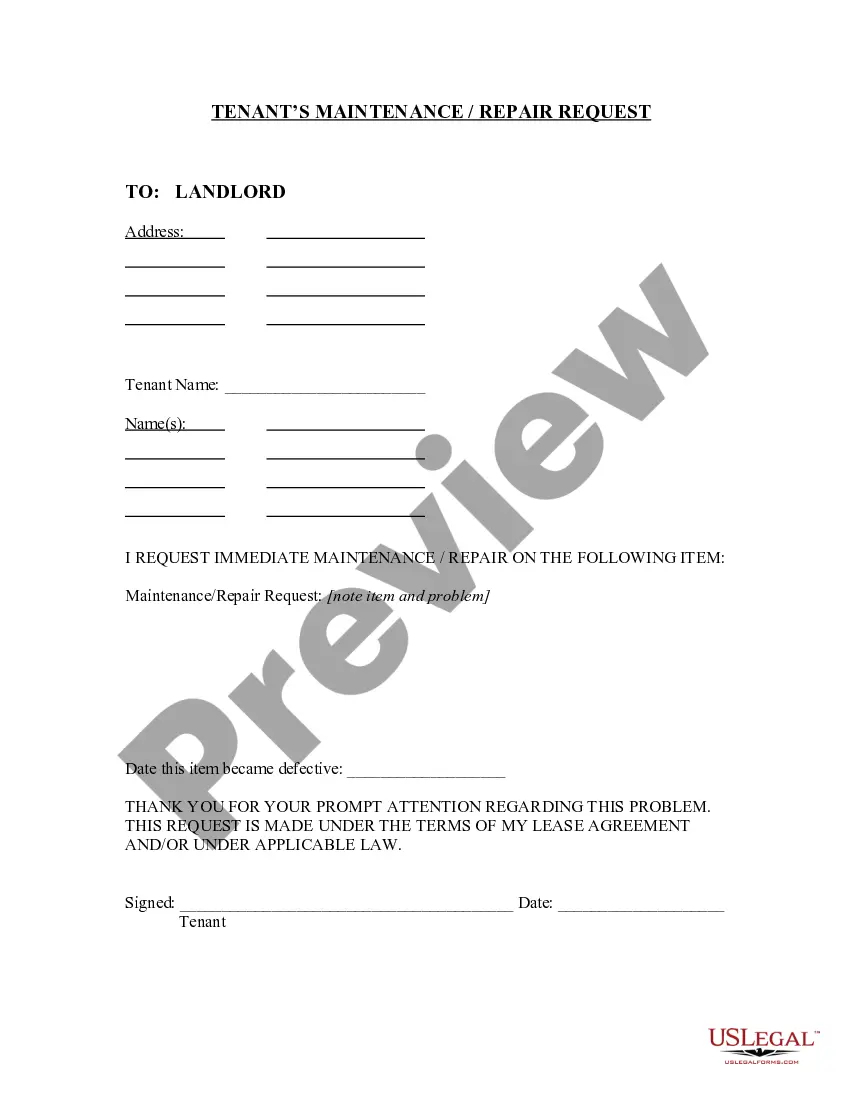

How to fill out Pima Arizona Liability Waiver For Propery Owner?

Laws and regulations in every area differ throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Pima Liability Waiver for Propery Owner, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for different life and business occasions. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Pima Liability Waiver for Propery Owner from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Pima Liability Waiver for Propery Owner:

- Take a look at the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the document when you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

The Pima County Assessor's Office is responsible for locating, listing, and valuing all of the properties under its jurisdiction that are to be listed on the assessment rolls. This includes both real and personal property.

The Assessor is not a taxing jurisdiction. The constitutional duty of the Assessor's Office is to locate, identify and value at full cash value all taxable property to be compiled in the annual tax roll.

However, certain changes, such as new constructions or additions, parcel splits or consolidations, or changes to a property's use trigger a reassessment of the LPV.

New development, rising housing prices and valuations contribute to that rising tax base. There were 5,104 new home permits in 2021, a nearly 18% increase over the previous tax year, according to the Pima County Assessor's office, which is responsible for assigning values to properties.

Real Estate Assessor ? a duly registered and licensed natural person who works in a local government unit and performs appraisal and assessment of real properties, including plants, equipment, and machineries, essentially for taxation purposes.

By statute, the County uses the value of your property on January 1 of the previous year when calculating your current year property taxes. The 2022 tax statement uses your property's value as of January 1, 2021, as determined by the County Assessor or the Arizona Department of Revenue. What is an exemption?

The average property tax rate across Pima County is 0.81%?when combined with the average home price, the median annual tax bill for county residents is $1,614.

What is the property tax rate in Pima County? The average property tax rate across Pima County is 0.81%?when combined with the average home price, the median annual tax bill for county residents is $1,614.

Property taxes are usually billed in two installments. The first half of property taxes are due on October 1 of the tax year and become delinquent after November 1 of that year. The second half of property taxes are due on the following March 1, and become delinquent after the following May 1.