Suffolk New York Office Space Lease Agreement is a legally binding contract between a property owner or landlord and a tenant who wishes to lease office space in Suffolk County, New York. This agreement outlines the terms and conditions that both parties must follow throughout the lease term. The Suffolk New York Office Space Lease Agreement typically includes various provisions such as the duration of the lease, rental payment terms, security deposit, maintenance responsibilities, on-site amenities, and any additional clauses specific to the property or parties involved. It is important for both the landlord and tenant to review and understand the terms prior to signing the agreement to avoid any potential disputes or legal issues. There are different types of Suffolk New York Office Space Lease Agreements, depending on the specific needs and preferences of the parties involved. Some common variations include: 1. Full-Service Lease Agreement: This type of agreement typically includes all costs associated with the office space, including utilities, maintenance, cleaning services, and property taxes. The tenant pays a higher rental rate to cover these additional expenses. 2. Gross Lease Agreement: Under a gross lease agreement, the tenant pays a fixed rental amount, and the landlord covers most of the operating expenses. However, utilities and other service charges might still be the tenant's responsibility. 3. Modified Gross Lease Agreement: This type of lease agreement is a combination of gross and net leases. The tenant pays a base rent, and the landlord may include certain operating expenses such as insurance or property maintenance costs. However, the tenant might still be responsible for utilities and other specific expenses. 4. Triple Net Lease Agreement: In a triple net lease agreement, the tenant is responsible for paying a base rent along with all operating expenses, including property taxes, insurance, maintenance, repairs, and utilities. This type of lease agreement places a higher financial burden on the tenant but offers more control over the premises. These are just a few examples of the various types of Suffolk New York Office Space Lease Agreements available. It is advisable for both landlords and tenants to consult with an attorney or real estate professional to ensure that all the terms and conditions of the lease are clearly understood and protect their respective interests.

Suffolk New York Office Space Lease Agreement

Description

How to fill out Suffolk New York Office Space Lease Agreement?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a lawyer to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Suffolk Office Space Lease Agreement, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case accumulated all in one place. Therefore, if you need the recent version of the Suffolk Office Space Lease Agreement, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Suffolk Office Space Lease Agreement:

- Glance through the page and verify there is a sample for your region.

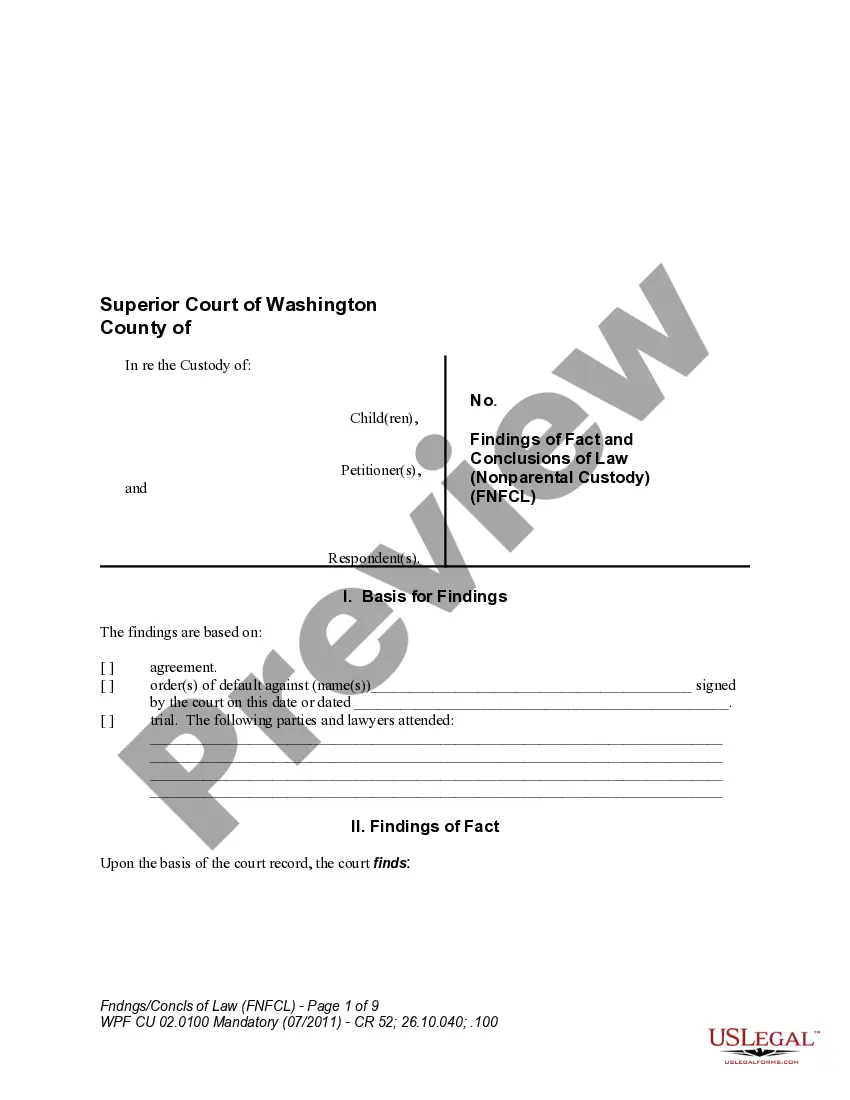

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the file format for your Suffolk Office Space Lease Agreement and download it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!