King Washington Oil, Gas, and Mineral Lease is a legal agreement between a landowner (lessor) and an oil and gas company (lessee) that grants the lessee the right to explore, extract, and produce oil, gas, and minerals from the lessor's property. This lease allows the lessee to access and exploit the natural resources present in the land for a specified period. The King Washington Oil, Gas, and Mineral Lease typically includes comprehensive terms and conditions that outline the rights and responsibilities of both parties. It specifies the duration of the lease, which typically ranges from a few years to several decades. The lessee is required to comply with local, state, and federal laws and regulations concerning oil, gas, and mineral extraction. There are different types of King Washington Oil, Gas, and Mineral Leases, tailored to specific requirements and objectives: 1. Exploration Lease: This type of lease grants the lessee the right to explore the property to determine the presence and potential of oil, gas, and mineral reserves. It does not allow for extraction or production. 2. Development Lease: After exploration, if oil, gas, or mineral reserves are discovered, a development lease is established. It enables the lessee to extract and produce the resources found. 3. Royalty Lease: In a royalty lease, the lessor receives a percentage of the profits generated from the production and sale of the extracted resources. The royalty percentage is negotiated and specified in the lease agreement. 4. Bonus Lease: A bonus lease involves a signing bonus, which is a lump sum payment made to the lessor upon signing the lease agreement. This compensation serves as an upfront payment for granting the lessee access to the property. 5. No-Drill Lease: A no-drill lease restricts the lessee from drilling for oil, gas, and minerals on the property. However, the lessor may still allow surface-level activities that do not involve extraction activities. When entering into a King Washington Oil, Gas, and Mineral Lease, it is crucial for both parties to thoroughly review and negotiate the terms to ensure a fair and beneficial agreement. Professional advice from legal, financial, and environmental experts is often sought to protect the interests of all involved parties.

King Washington Oil, Gas and Mineral Lease

Description

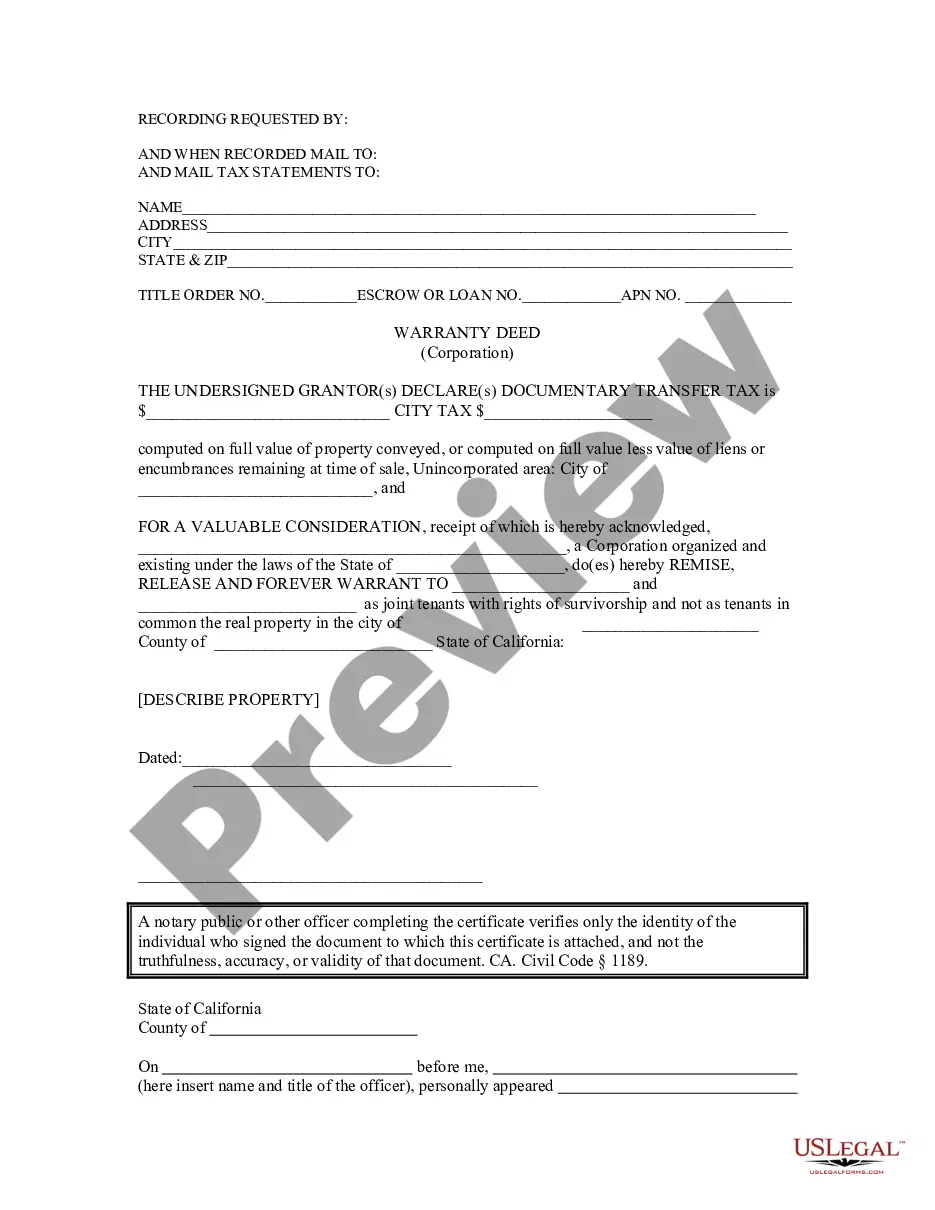

How to fill out King Washington Oil, Gas And Mineral Lease?

Whether you plan to open your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you need to prepare certain documentation meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business occurrence. All files are grouped by state and area of use, so picking a copy like King Oil, Gas and Mineral Lease is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few additional steps to obtain the King Oil, Gas and Mineral Lease. Follow the guide below:

- Make sure the sample fulfills your individual needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to get the file once you find the correct one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the King Oil, Gas and Mineral Lease in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

Mineral rights can be an excellent investment for you and it will become endlessly rewarding provided that it is done in a correct manner. It will be a supplemental source of income that enables you to earn a royalty lifelong by selling your mineral rights.

If you have a property that does not currently produce royalty income and you do not have an active lease, the value is nearly always under $1,000/acre. The average price per acre for mineral rights that are not leased is between $0 and $250/acre.

When it comes to mineral rights, the standard admonition has long been consistent and emphatic: Avoid selling them. After all, simply owning mineral rights costs you nothing. There are no liability risks, and in most cases, taxes are assessed only on properties that are actively producing oil or gas.

Average Oil Royalty Payment For Oil Or Gas Lease The federal government charges oil and gas companies a royalty on hydrocarbon resources extracted from public lands. The standard Federal royalty payment was 12.5%, or a 1/8th royalty.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

Investing your money earned from your mineral rights can be endlessly rewarding. When done correctly, the investment will often pay itself off and can provide you another source of income, be used to pay off a mortgage, or be used to start a college fund for your children or grandchildren.

Mineral Rights Purchase ProcessPlan. Develop a Plan. Develop an acquisition plan and preferred location to buy minerals.Browse. Browse Minerals for Sale.Research. Perform Due Diligence.Offer/Bid. Make an Offer or Place a Bid.Pay. Wire Funds.Transfer. Transfer Ownership.Manage. Manage Your New Minerals.

Mineral rights have sold for as high as $40,000 per acre, and usually, the average price can be between $250 and $9,000. If mineral rights buyers and sellers conduct proper due diligence, both parties can negotiate the best mining rights deal and avoid future legal quagmires.

For many years, almost all oil and gas leases reserved a 1/8th royalty. Today, the royalty fraction is negotiable, and is usually between 1/8th and 1/4th. Bonus. The bonus is the amount paid to the Lessor as consideration for his/her execution of the lease.