Montgomery Maryland Oil, Gas, and Mineral Lease is a legally binding contract that grants rights to individuals or companies to extract and develop oil, gas, or mineral resources from specified land in Montgomery County, Maryland. It outlines the terms and conditions under which the lessee can explore, drill, and extract these valuable natural resources. The oil and gas industry in Montgomery Maryland has gained significant attention due to its potential for economic growth and job creation. With an increasing focus on diversification and energy independence, the lease offers a unique opportunity for interested parties to explore and exploit the region's underground resources. Montgomery Maryland offers several types of oil, gas, and mineral leases, each with its own set of characteristics and terms. Some of these include: 1. Standard Lease: This type of lease is commonly adopted and provides comprehensive guidelines for exploration, drilling, production, and payment obligations for the lessee. 2. Royalty Lease: In a royalty lease, the lessor is entitled to receive a specific percentage of the revenue generated from the sale of extracted oil, gas, or minerals. These terms are negotiated between the parties involved and are often influenced by market conditions and the potential value of the resources. 3. Production Sharing Agreement (PSA): Under a PSA, the lessor and lessee agree to share the extracted resources in pre-determined proportions. This type of lease is common when there is collaboration between multiple parties in a larger-scale extraction project. 4. Farm out Agreement: A farm out agreement allows one party, known as the armor, to grant the right to explore and develop its oil, gas, or mineral interest to another party, known as the farmer. The farmer usually incurs the exploration and development costs in exchange for an agreed-upon percentage of the production revenue. It is essential to note that the specific terms and conditions of the Montgomery Maryland Oil, Gas, and Mineral Lease may vary depending on factors such as the size and type of the resource, market demand, and prevailing industry regulations. Both parties must thoroughly review and negotiate the lease to ensure their respective rights and responsibilities are adequately protected. In conclusion, the Montgomery Maryland Oil, Gas, and Mineral Lease provides the framework for responsible exploration, extraction, and development of valuable underground resources in Montgomery County. Various types of leases exist, allowing interested parties to choose the agreement that best aligns with their objectives and priorities while adhering to legal and environmental requirements.

Montgomery Maryland Oil, Gas and Mineral Lease

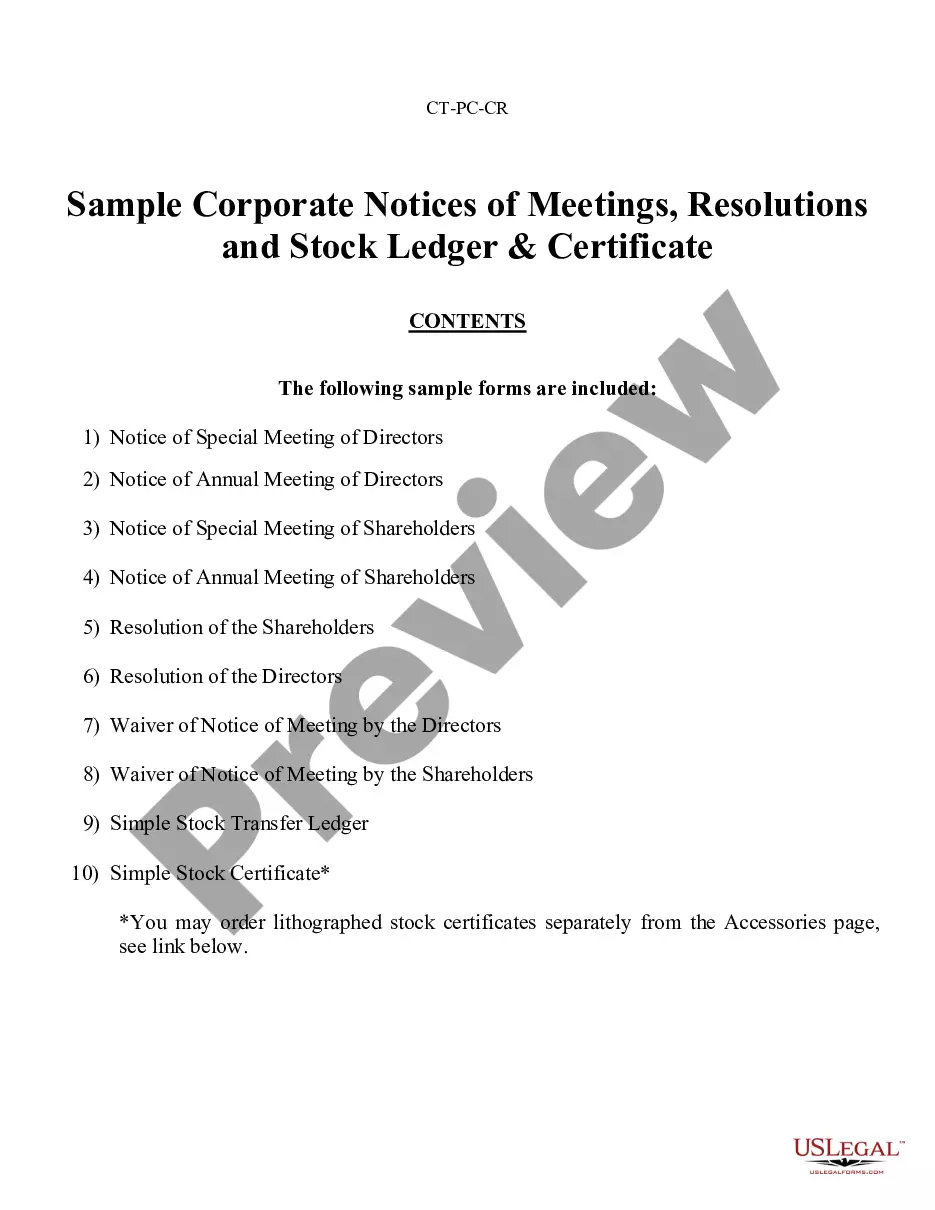

Description

How to fill out Montgomery Maryland Oil, Gas And Mineral Lease?

Preparing documents for the business or personal demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to create Montgomery Oil, Gas and Mineral Lease without professional help.

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid Montgomery Oil, Gas and Mineral Lease on your own, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal templates that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required form.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Montgomery Oil, Gas and Mineral Lease:

- Look through the page you've opened and check if it has the sample you require.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that fits your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any situation with just a couple of clicks!

Form popularity

FAQ

If you have a property that does not currently produce royalty income and you do not have an active lease, the value is nearly always under $1,000/acre. The average price per acre for mineral rights that are not leased is between $0 and $250/acre.

Where do you purchase mineral rights? There are multiple ways to buy minerals, the most common being at auction, from brokers, by negotiated sale, tax sales, and directly from mineral owners. The process of buying minerals varies depending on where you buy them.

Landowners commonly sever and sell their mineral rights, often to big oil and gas exploration companies. The most common way of claiming mineral rights today is by buying them at auction or through private sales .

As a general rule of thumb, the value for non-producing mineral rights will nearly always be less than $1,000/acre. In most cases, the mineral rights value in Texas for non-producing minerals will be $0 to $250, but producing minerals $25,000+ per acre is not unusual.

When you sign a mineral lease deal with an E&P, here are three things you want to make sure you have:Gross or Cost-Free Royalty Provision. The first thing landowners typically want to know with an Oil and Gas Lease is, What's my bonus amount?Surface protection & Pugh Clause.Length of lease.

The easiest way to buy mineral rights is through a reputable auction house. The quality and price of mineral rights sold at auctions vary widely. You will find rip-offs with a 60-year return on investments (ROIs) as well as high-quality assets at a reasonable market price.

Mineral rights have sold for as high as $40,000 per acre, and usually, the average price can be between $250 and $9,000.

A lease bonus is a one-time payment the mineral rights owner receives when the lease is signed. Royalty is a portion of the proceeds from the sale of production which is paid monthly to the mineral rights owner. The royalty is usually described in the lease as a fraction such as 1/8th, or 1/6th.

How do you determine if your property is already subject to a recorded oil and gas lease? A search of the public records at the county register of deeds office is necessary. For example, in Oceana County, the public records are available online, or you can go to their office.

The length of oil and gas lease agreements averages around 5 years. Typically, if a parcel is not drilled after a certain period time then the contract expires. Some leases, however, allow for extensions without the grantor's approval.