Cook Illinois Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift is a legal document used by charitable or educational institutions to confirm and acknowledge the receipt of a pledged gift from Cook County, Illinois. This document is crucial for maintaining transparency and ensuring that both the donor and the institution are in agreement regarding the intended gift. The Cook Illinois Acknowledgment includes detailed information about the pledged gift, such as the nature of the gift, its value, and any specific conditions or restrictions that may apply. This document serves as an official record and provides documentation for tax purposes, as donors may be eligible for tax deductions or other benefits depending on the nature and value of their gift. Types of Cook Illinois Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift: 1. Cash Gift Acknowledgment: This type of acknowledgment is for pledged cash donations made by individuals or organizations based in Cook County, Illinois. It includes the amount of the pledged gift, the date it was pledged, and any special arrangements, such as installment payments or matching gift programs. 2. In-Kind Gift Acknowledgment: In cases where a donor pledges a non-monetary gift, such as equipment, property, or artwork, an In-Kind Gift Acknowledgment is used. This document describes the nature and estimated value of the pledged item, and any additional terms or conditions related to the gift. 3. Stock or Securities Gift Acknowledgment: When an individual or organization pledges a gift of stocks, bonds, or other securities, a Stock or Securities Gift Acknowledgment is utilized. This document provides the details of the pledged assets, including their market value, date of transfer, and any instructions regarding their liquidation or use. 4. Named Endowment Gift Acknowledgment: For donors who pledge a named endowment gift, which establishes a perpetual fund for a specific purpose within the charitable or educational institution, a Named Endowment Gift Acknowledgment is prepared. This document outlines the donor's intent, the purpose of the endowment, any naming rights associated with the gift, and the terms of the endowment agreement. In all cases, the Cook Illinois Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift serves as an official and legally binding agreement between the donor and the institution. It ensures that both parties are in agreement regarding the pledged gift and helps to establish a strong foundation for fulfilling the charitable or educational mission of the institution while upholding the donor's philanthropic intentions.

Cook Illinois Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift

Description

How to fill out Cook Illinois Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift?

Preparing legal documentation can be difficult. Besides, if you decide to ask an attorney to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the Cook Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case collected all in one place. Consequently, if you need the current version of the Cook Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Cook Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift:

- Glance through the page and verify there is a sample for your area.

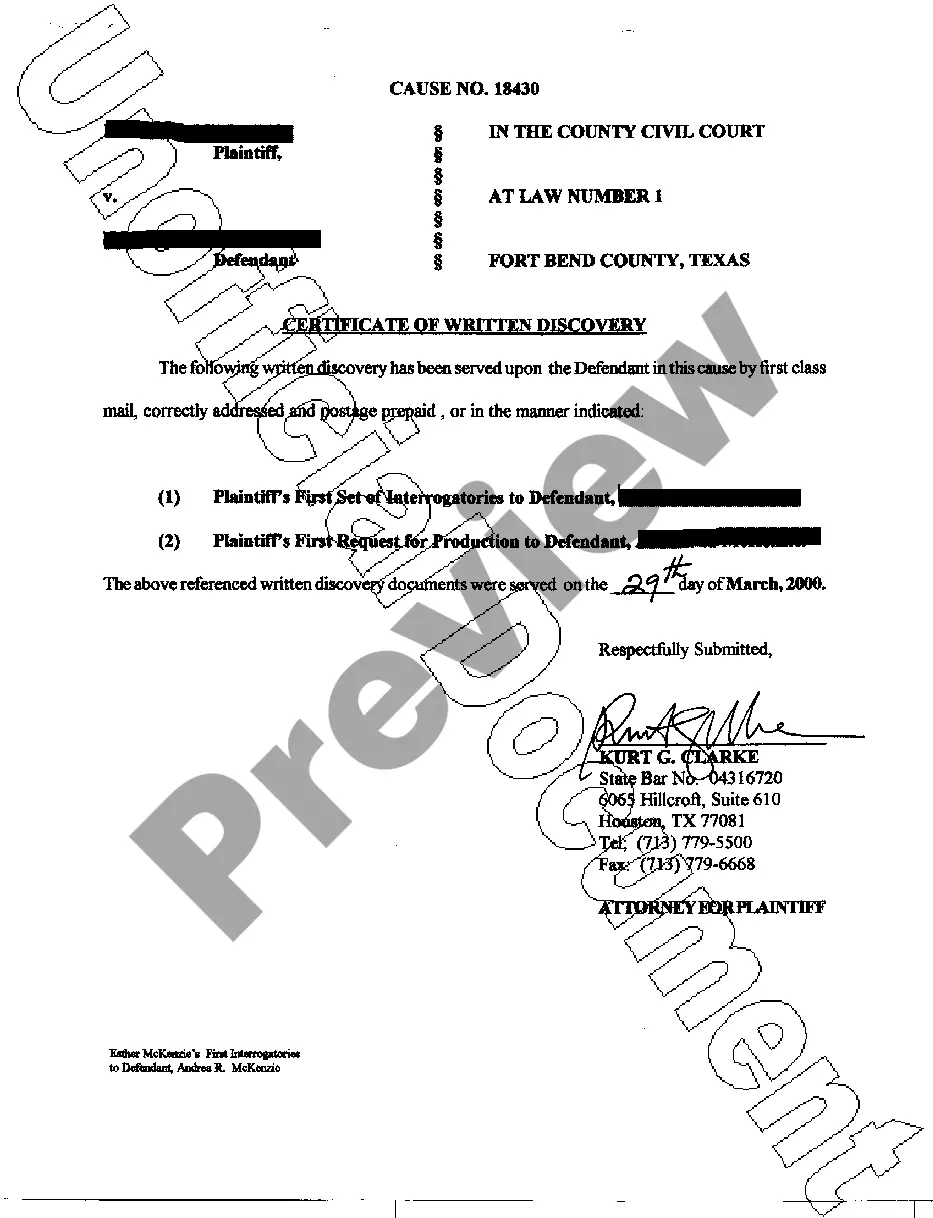

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your Cook Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift and save it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

How Do I Write Donation Receipts?The name of the donor.The name of your organization.Your organization's federal tax ID number, and a statement indication your organization is a registered 501(c)(3)The date of the donation.The amount given OR a description of items donated, if any.

Dear (Sir/Name/Uncle), We, at the (Foundation name), would like to express our gratitude for your generous gift of (Product/Item type and name) with (Support item type/money) and other accessories from (Institute/Supplier name) Association towards the noble cause of our organization. (Describe in your words).

I would like to express my special thanks of gratitude to my teacher (Name of the teacher) as well as our principal (Name of the principal)who gave me the golden opportunity to do this wonderful project on the topic (Write the topic name), which also helped me in doing a lot of Research and i came to know about so many

A cancelled check, credit card charge, payroll stub, thank you letter or other statement alone is not sufficient to secure a charitable contribution deduction.

How do you acknowledge a donation?The name of your donor.The full legal name of your organization.A declaration of your organization's tax-exempt status.Your organization's employer identification number.The date the gift was received.A description of the gift and the amount received.More items...

Here are the basic steps to create an acknowledgement receipt:Use a company letterhead.Give the receipt a title.Write the statement of acknowledgement.Create a place for signatures and the date of the transaction.Explain any next steps.Provide contact information for further questions.Be specific and detailed.Be formal.More items...?

Phrases to use while writing an AcknowledgementI'm extremely grateful to 2026I'd like to express my deepest thanks to2026This project would not have been possible without2026I cannot begin to express my thanks to20262026, who2026I would like to extend my deepest gratitude to2026I would like to pay my special regards to 2026More items...?

Please accept this letter as a contemporaneous written acknowledgement of the following: (1) no goods or services were provided in exchange for your QCD; (2) our organization is a qualified public charity and therefore we may receive your QCD; and (3) your QCD is a gift to us for general purposes or to a designated

To be contemporaneous the written acknowledgment must generally be obtained by the donor no later than the date the donor files the return for the year the contribution is made. The written acknowledgment must state whether the donee provides any goods or services in consideration for the contribution.

An acknowledgement letter is a letter of receipt sent by an individual or business to the other end to make them know that you have received the offer, complaint, product, or any demand which is provided by another party or individual whomsoever is involved in the transaction.