Travis Texas Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift The Travis Texas Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift is a document that plays a significant role in recognizing and confirming the receipt of a pledged gift by charitable or educational institutions. It serves as an official acknowledgment of the commitment made by a donor to contribute towards a cause or organization. This acknowledgment provides legal validity to the pledged gift and establishes a formal confirmation from the institution that the gift has been received. It serves as a crucial document for both the donor and the institution, documenting the terms of the pledge and ensuring transparency in the handling of funds. Keywords: 1. Travis Texas: This refers to the specific location where the acknowledgment is being executed, indicating it follows the rules and regulations of Travis County, Texas. 2. Acknowledgment: Denotes the act of recognizing and confirming the receipt of a pledged gift. 3. Charitable Institution: Refers to organizations that are established for promoting charitable causes and have been granted tax-exempt status by the IRS. 4. Educational Institution: Indicates organizations primarily focused on providing education and promoting knowledge. 5. Receipt: The document serves as an official receipt signifying the reception of the pledged gift. 6. Pledged Gift: Indicates a commitment made by a donor to contribute towards a charitable or educational institution over a specific period or in installments. Different Types of Travis Texas Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift: 1. Cash Pledge Acknowledgment: This type of acknowledgment is used when a donor pledges a specified amount of cash to the institution. It details the terms and conditions of the pledge and confirms the receipt of the pledged amount. 2. In-kind Pledge Acknowledgment: This acknowledgment comes into play when a donor commits to contributing non-cash items such as property, assets, or services to the institution. It outlines the agreed-upon terms, confirms the receipt of the pledged item, and includes a description of the item or service. 3. Multi-Year Pledge Agreement: In situations where a donor commits to providing a pledged gift over multiple years, this type of acknowledgment is utilized. It includes the terms, conditions, and amounts of the annual contributions, assuring the donor's commitment and confirming the receipt of each installment over the agreed-upon period. 4. Named Gift Acknowledgment: When donors pledge a significant amount to an institution, they may have the opportunity to name a building, wing, scholarship, or program in their honor. This acknowledgment recognizes the pledged gift, specifies the name associated with it, and confirms the institution's commitment to honoring the naming request. The Travis Texas Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift is a vital legal document that upholds the transparency and credibility of philanthropic commitments. It ensures the accuracy of recorded donations, strengthens the relationship between donors and institutions, and provides donors with the necessary documentation for tax deductions.

Travis Texas Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift

Description

How to fill out Travis Texas Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift?

Laws and regulations in every sphere differ throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Travis Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used multiple times: once you pick a sample, it remains available in your profile for future use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Travis Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Travis Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift:

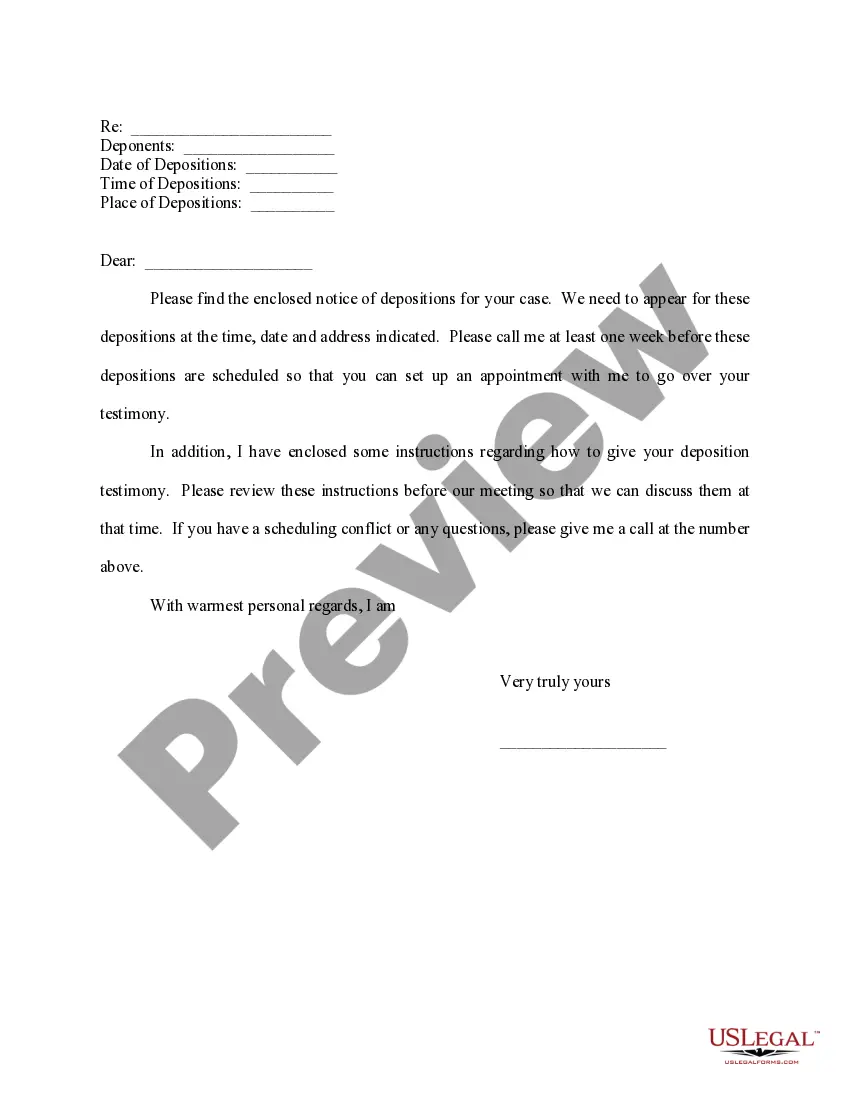

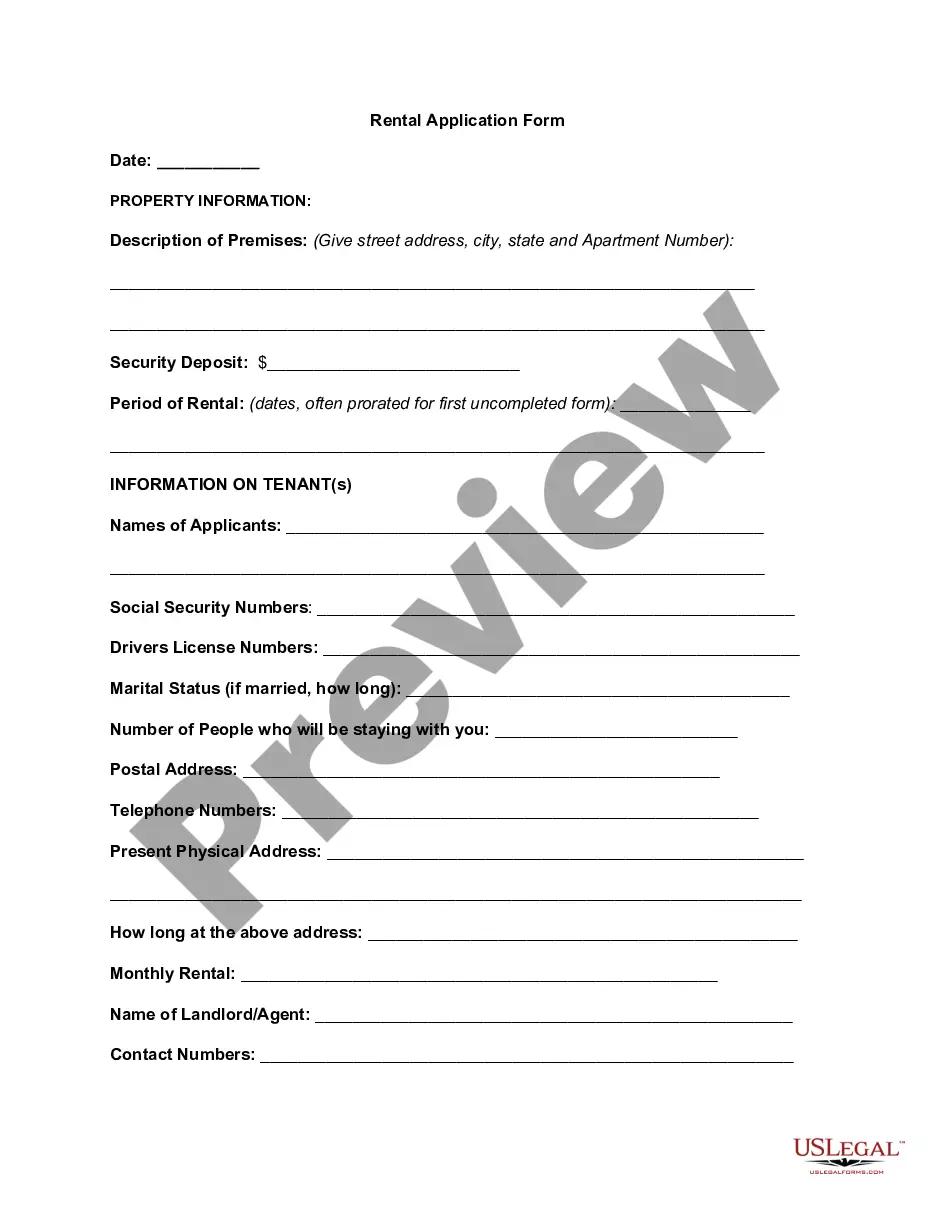

- Examine the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the document when you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!