Montgomery Maryland Transfer of Property under the Uniform Transfers to Minors Act is a legal process that allows individuals in Montgomery County, Maryland, to transfer assets and property to minors while ensuring their protection and management until the minor reaches a certain age. This Act provides a mechanism for a smooth transfer of assets to minors, allowing donors to establish a custodial account for the benefit of the minor. One type of Montgomery Maryland Transfer of Property under the Uniform Transfers to Minors Act is known as the TMA (Uniform Transfers to Minors Act) account. This type of account allows donors to transfer a wide range of assets, such as cash, securities, real estate, and other types of property, to a minor beneficiary. The TMA account is managed by a custodian who oversees the assets until the minor reaches the age of majority, typically 18 or 21, depending on the state law. Another type of Montgomery Maryland Transfer of Property under the Uniform Transfers to Minors Act is a custodial trust. This trust is established by a donor to transfer assets to a minor beneficiary. The donor appoints a trustee who manages the trust assets and ensures their proper distribution to the minor beneficiary according to the terms of the trust agreement. The Montgomery Maryland Transfer of Property under the Uniform Transfers to Minors Act is a useful estate planning tool for parents and guardians looking to efficiently transfer property while ensuring its protection until the minor is capable of managing it independently. It allows for the avoidance of lengthy and costly probate processes that may arise from transferring assets to minors. By utilizing the Montgomery Maryland Transfer of Property under the Uniform Transfers to Minors Act, donors can benefit from tax advantages and flexibility in creating tailored plans for the minor's financial future. It is important to consult with a knowledgeable attorney who specializes in estate planning and Montgomery Maryland laws to ensure compliance with the specific requirements and provisions of the Act. In conclusion, the Montgomery Maryland Transfer of Property under the Uniform Transfers to Minors Act provides a structured and protective framework for transferring assets to minors, offering donors peace of mind in their estate planning endeavors.

Montgomery Maryland Transfer of Property under the Uniform Transfers to Minors Act

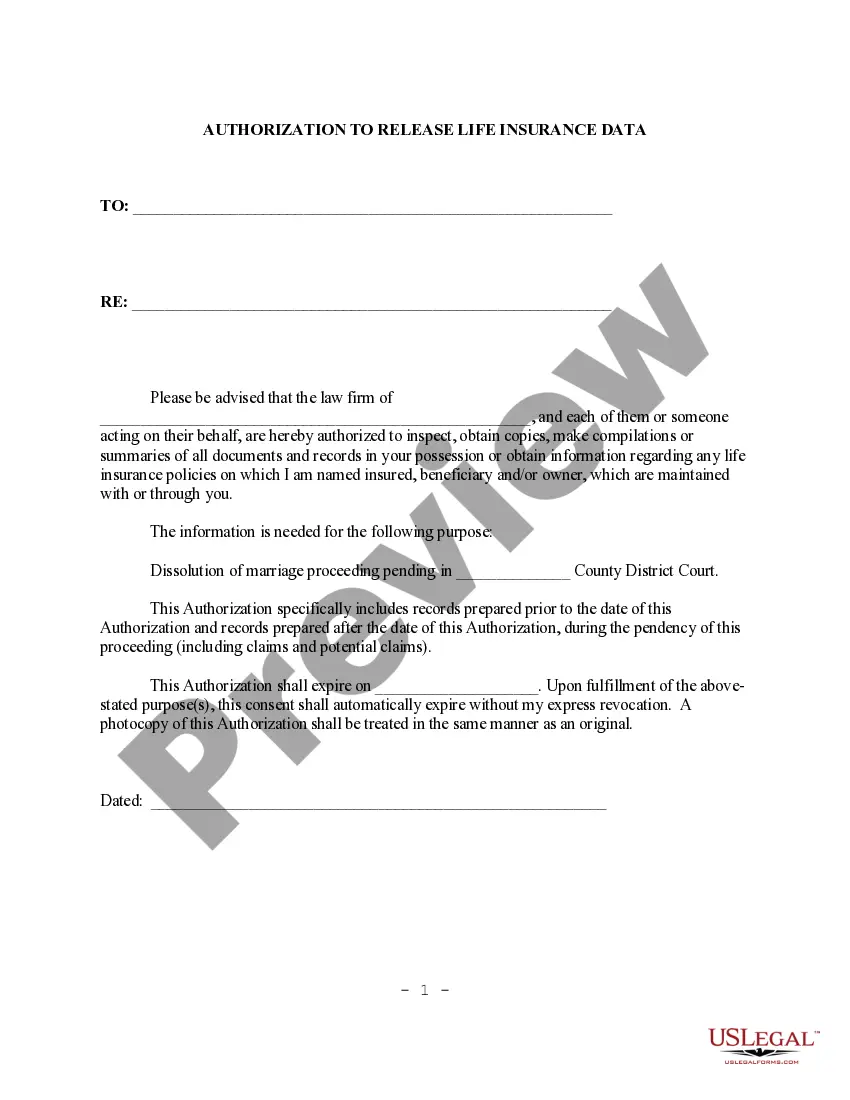

Description

How to fill out Montgomery Maryland Transfer Of Property Under The Uniform Transfers To Minors Act?

Laws and regulations in every area differ throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Montgomery Transfer of Property under the Uniform Transfers to Minors Act, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Montgomery Transfer of Property under the Uniform Transfers to Minors Act from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Montgomery Transfer of Property under the Uniform Transfers to Minors Act:

- Take a look at the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the document when you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!