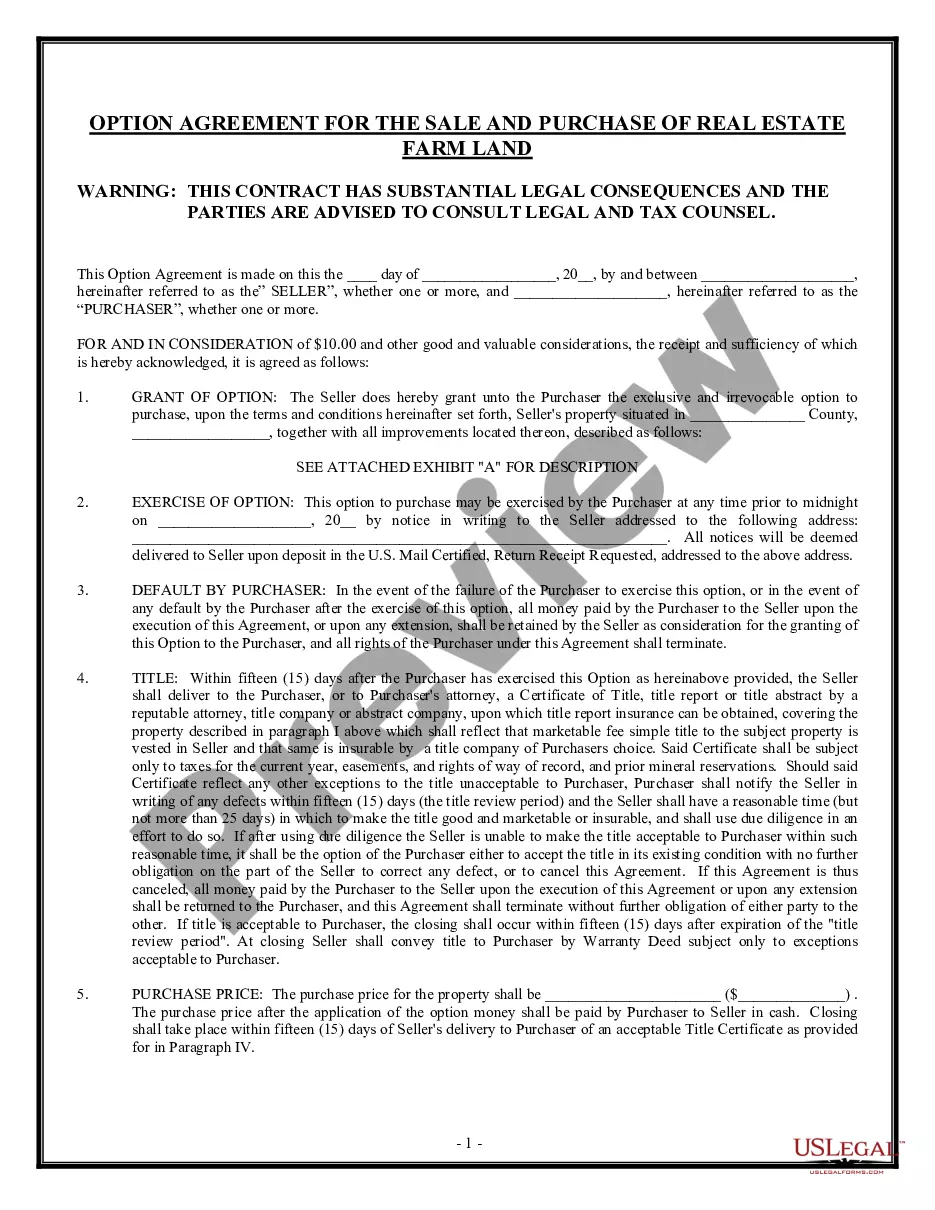

Hillsborough Florida Option For the Sale and Purchase of Real Estate - Farm Land

Description

How to fill out Hillsborough Florida Option For The Sale And Purchase Of Real Estate - Farm Land?

If you need to get a trustworthy legal document supplier to get the Hillsborough Option For the Sale and Purchase of Real Estate - Farm Land, look no further than US Legal Forms. Whether you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed form.

- You can select from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, variety of learning resources, and dedicated support make it simple to locate and complete different paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

You can simply type to search or browse Hillsborough Option For the Sale and Purchase of Real Estate - Farm Land, either by a keyword or by the state/county the form is created for. After finding the required form, you can log in and download it or save it in the My Forms tab.

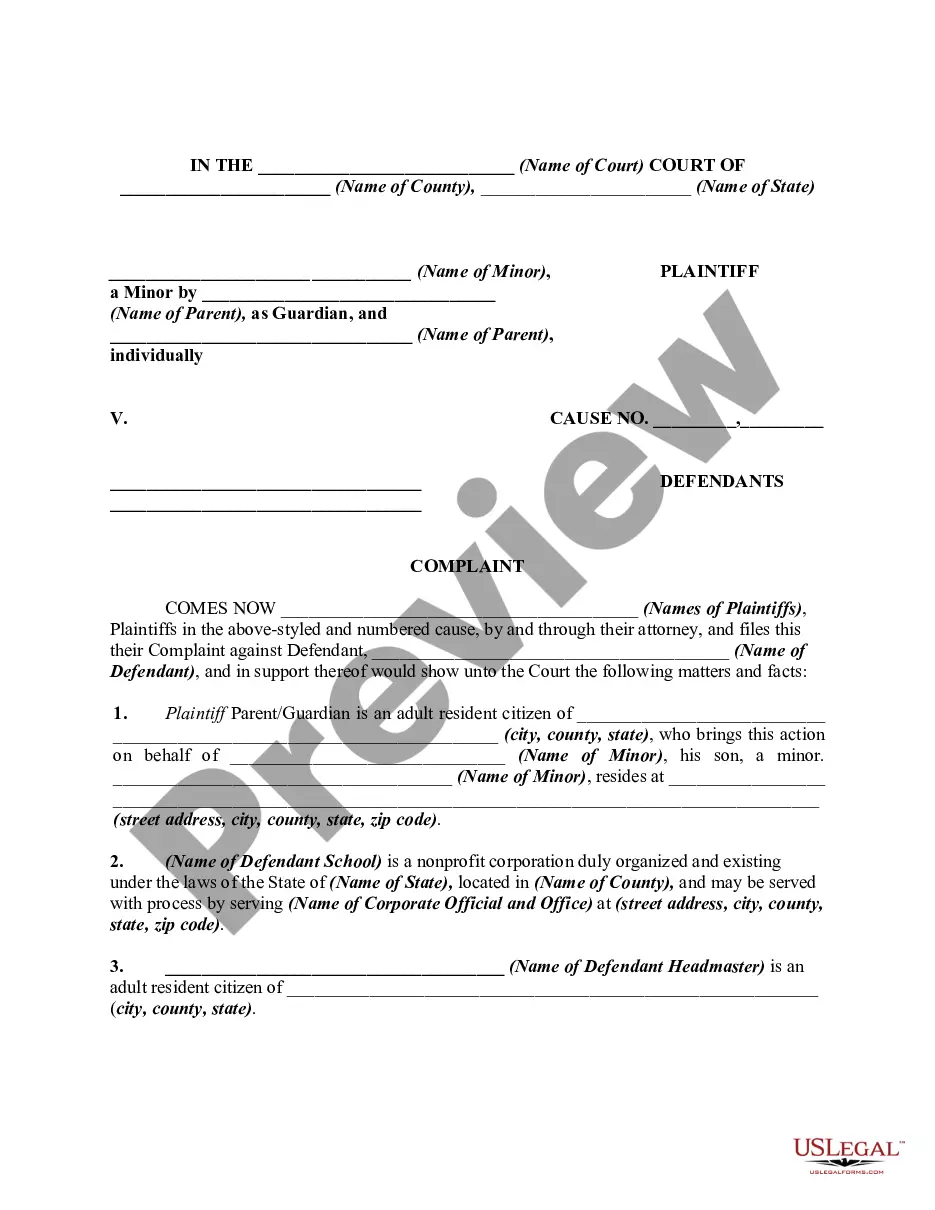

Don't have an account? It's simple to get started! Simply locate the Hillsborough Option For the Sale and Purchase of Real Estate - Farm Land template and check the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Create an account and choose a subscription option. The template will be instantly available for download as soon as the payment is processed. Now you can complete the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes these tasks less expensive and more affordable. Create your first company, organize your advance care planning, create a real estate contract, or execute the Hillsborough Option For the Sale and Purchase of Real Estate - Farm Land - all from the comfort of your home.

Sign up for US Legal Forms now!

Form popularity

FAQ

Who Is Eligible for a Greenbelt Law Exemption in Florida?The length of time you have used the land for commercial agricultural purposes;The continuity of your commercial agricultural use;The purchase price paid for the land;The size of the land in relation to agricultural use;More items...?

DR-405, R. 01/18, Page 2 Description Age Year Taxpayer's Estimate Original Installed Disposed, sold, or traded and to whom? LEASED, LOANED, OR RENTED EQUIPMENT Complete if you hold equipment belonging to others. Equipment owned by you but rented, leased, or held by others.

Tangible Personal Property Tax is an ad valorem tax assessed against the furniture, fixtures and equipment located in businesses and rental property.

To obtain agricultural classification for greenbelt purposes, a landowner must apply for the classification with their local property appraiser's office. The Florida Department of Revenue's Form DR-482 is the standard application form for agricultural classification.

Tangible personal property (TPP) is all goods, property other than real estate, and other articles of value that the owner can physically possess and has intrinsic value. Inventory, household goods, and some vehicular items are excluded.200b200b

All businesses are required to file a Tangible Personal Property Tax Return (Form DR 405) annually by April 1st (Florida Statutes 193.062), unless the value of your tangible personal property last year was under $25,000 and you received notice from this office that your requirement to file has been waived.

WHO MUST FILE A RETURN? Any business owner or self-employed contractor owning tangible personal property on January 1st must file a return each year as required by Florida Statutes 193.052 and 193.062. Property owners that loan, lease or rent tangible property to others must also report such property.

Tangible Personal Property Tax is an ad valorem tax assessed against the furniture, fixtures and equipment located in businesses and rental property.

These guidelines are intended to provide assistance to those planning to make application for the exemption. Questions beyond the scope of the items listed below should be directed to our Agriculture Department at (386)-775-5228. 1. Must be at least twenty acres or used in conjunction with other properties.