Philadelphia Pennsylvania Option to Purchase Stock — Short Form is a legal document that outlines the terms and conditions for purchasing stock in a company based in Philadelphia, Pennsylvania. This form is typically used when an individual or entity wishes to acquire shares in a company but does not want to enter into a lengthy and complex agreement. The Philadelphia Pennsylvania Option to Purchase Stock — Short Form allows the buyer, also known as the option holder, to secure the right to purchase a predetermined number of shares at a specified price within a specified timeframe. This option provides flexibility to the buyer without obligating them to purchase the stock. The main advantage of using the Philadelphia Pennsylvania Option to Purchase Stock — Short Form is that it simplifies the process of buying and selling stock. Unlike a traditional stock purchase agreement, which involves extensive negotiation and legal documentation, this short form option contract reduces the complexity and streamlines the transaction. There are several types of Philadelphia Pennsylvania Option to Purchase Stock — Short Form, including: 1. Individual Option: This type of option allows an individual investor to acquire stock in a Philadelphia-based company. It is commonly used by individual buyers who want to invest in a specific company without the need for a formal agreement. 2. Corporate Option: This variant is designed for corporations that wish to purchase stock in a Philadelphia-based company. It enables businesses to diversify their investment portfolio or acquire shares for strategic purposes. 3. Institutional Option: This type of option is tailored for institutional investors, such as pension funds or hedge funds. It allows them to acquire shares in Philadelphia companies in a simplified manner, in accordance with their investment strategies. 4. Employee Stock Option: This form of the option is specifically designed for employees of Philadelphia-based companies who are granted the right to purchase company stock at a predetermined price. It serves as an incentive for employees to contribute to the company's growth and success. In summary, the Philadelphia Pennsylvania Option to Purchase Stock — Short Form is a convenient and efficient way to acquire shares in a company located in Philadelphia. This legal agreement provides flexibility and simplicity in the stock acquisition process, making it suitable for individual investors, corporations, institutional investors, and employees.

Philadelphia Pennsylvania Option to Purchase Stock - Short Form

Description

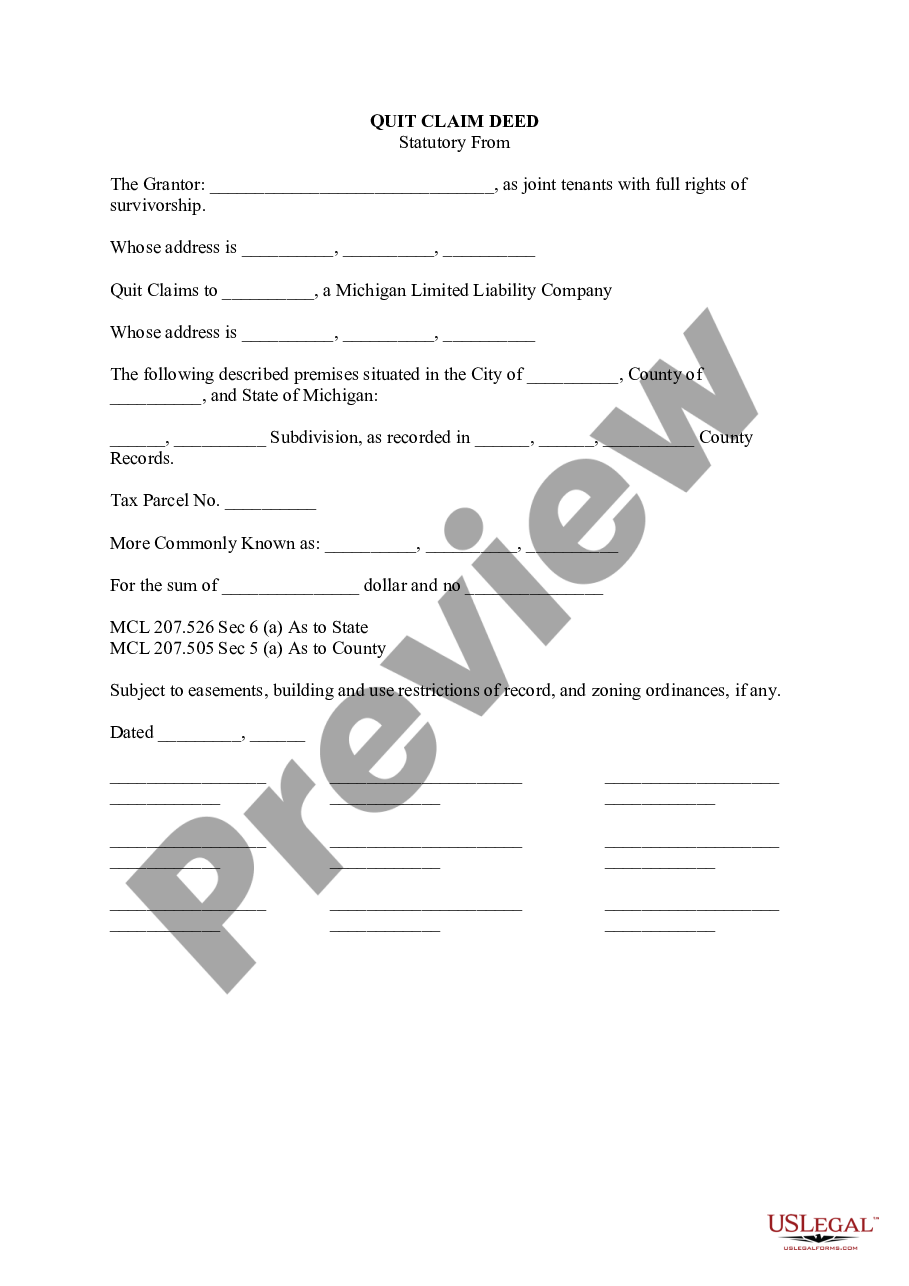

How to fill out Philadelphia Pennsylvania Option To Purchase Stock - Short Form?

Whether you intend to open your company, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you must prepare certain documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal templates for any individual or business occurrence. All files are grouped by state and area of use, so opting for a copy like Philadelphia Option to Purchase Stock - Short Form is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of additional steps to obtain the Philadelphia Option to Purchase Stock - Short Form. Follow the guidelines below:

- Make certain the sample fulfills your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to get the file once you find the correct one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Philadelphia Option to Purchase Stock - Short Form in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!

Form popularity

FAQ

What Is the CBOE Options Exchange? Founded in 1973, the CBOE Options Exchange is the world's largest options exchange with contracts focusing on individual equities, indexes, and interest rates.

With the short sale, the maximum possible profit of $78,000 would occur if the stock plummeted to zero. On the other hand, the maximum loss is potentially infinite if the stock only rises. With the put option, the maximum possible profit is $50,000 while the maximum loss is restricted to the price paid for the put.

Philadelphia Stock Exchange (PHLX), now known as NASDAQ OMX PHLX, is the oldest stock exchange in the United States. It is now owned by Nasdaq Inc. Founded in 1790, the exchange was originally named the Board of Brokers of Philadelphia, also referred to as the Philadelphia Board of Brokers.

Pre-market trading in the United States, in terms of stocks, usually runs between a.m. and a.m. Eastern Time and after-hours trading typically runs from p.m. to p.m. Eastern Time (EST). The U.S. stock exchanges are open from a.m. to p.m. EST.

However, after-hours price changes are more volatile than regular-hours prices, so they should not be relied on as an accurate reflection of where a stock will trade when the next regular session opens.

EDGX Exchange is a U.S. equities exchange operated by CBOE U.S. Equities. CBOE Global Markets acquired Bats Global Markets and now operates the BZX Exchange and BYX Exchange along with EDGX and EDGA. EDGX and CBOE members are registered broker-dealers across a broad range of financial services companies.

Bats Global Markets was previously known as Better Alternative Trading System (BATS) and was initially branded as an alternative trading platform, marketing itself to investors as a company that was more innovative than established exchanges.

"Buy the dips" is a common phrase investors and traders hear after an asset has declined in price in the short-term. After an asset's price drops from a higher level, some traders and investors view this as an advantageous time to buy or add to an existing position.

Cboe is currently one of the largest U.S. equities market operators on any given day. We operate four U.S. equities exchanges the BZX Exchange, BYX Exchange, EDGA Exchange, and EDGX Exchange.

Such trading tends to be limited in volume compared to regular trading hours when the exchange is open. Pre-market trading in the United States, in terms of stocks, usually runs between a.m. and a.m. Eastern Time and after-hours trading typically runs from p.m. to p.m. Eastern Time (EST).