Contra Costa California Credit Cardholder's Report of Lost or Stolen Credit Card is a crucial document for residents or individuals residing in Contra Costa County, California, who have experienced the unfortunate occurrence of a lost or stolen credit card. This report is specifically designed to help credit cardholders promptly notify their financial institution about the incident, enabling swift actions to prevent any unauthorized transactions and minimize potential financial losses. When filing a Contra Costa California Credit Cardholder's Report of Lost or Stolen Credit Card, it is essential to provide specific details, such as the credit card issuer, cardholder's personal information, and the date, time, and location of the incident. Additionally, individuals may need to provide information on any fraudulent transactions they have noticed on their account. By filing this report, credit cardholders in Contra Costa County can take advantage of the credit card issuer's dedicated fraud prevention measures, such as card cancellation, reissuance, and monitoring for suspicious activity. This enables cardholders to protect themselves financially and mitigate any potential damage caused by unauthorized card usage. Moreover, it is crucial to understand that there may be different variations or types of Contra Costa California Credit Cardholder's Report of Lost or Stolen Credit Card, depending on the specific credit card issuer or financial institution. Some common variations may include the Bank of America Lost or Stolen Credit Card Report, Wells Fargo Credit Cardholder's Report of Lost or Stolen Credit Card, and Chase Loss or Theft Notification Form. When encountering a lost or stolen credit card situation in Contra Costa California, swift reporting is paramount. Cardholders should contact their respective credit card issuer's customer service immediately and follow their specific procedures for reporting such incidents. Additionally, cardholders should monitor their account statements regularly for any unfamiliar activity and consider enabling additional security features provided by the credit card issuer, such as two-factor authentication or transaction alerts. In conclusion, the Contra Costa California Credit Cardholder's Report of Lost or Stolen Credit Card serves as a vital tool for individuals who have suffered the loss or theft of their credit cards in Contra Costa County. By filing this report promptly and cooperating with their credit card issuer, cardholders can protect themselves from potential financial fraud and unauthorized transactions. Remember, it is crucial to check with your specific credit card issuer for their unique reporting procedures and requirements regarding lost or stolen credit cards.

Contra Costa California Credit Cardholder's Report of Lost or Stolen Credit Card

Description

How to fill out Contra Costa California Credit Cardholder's Report Of Lost Or Stolen Credit Card?

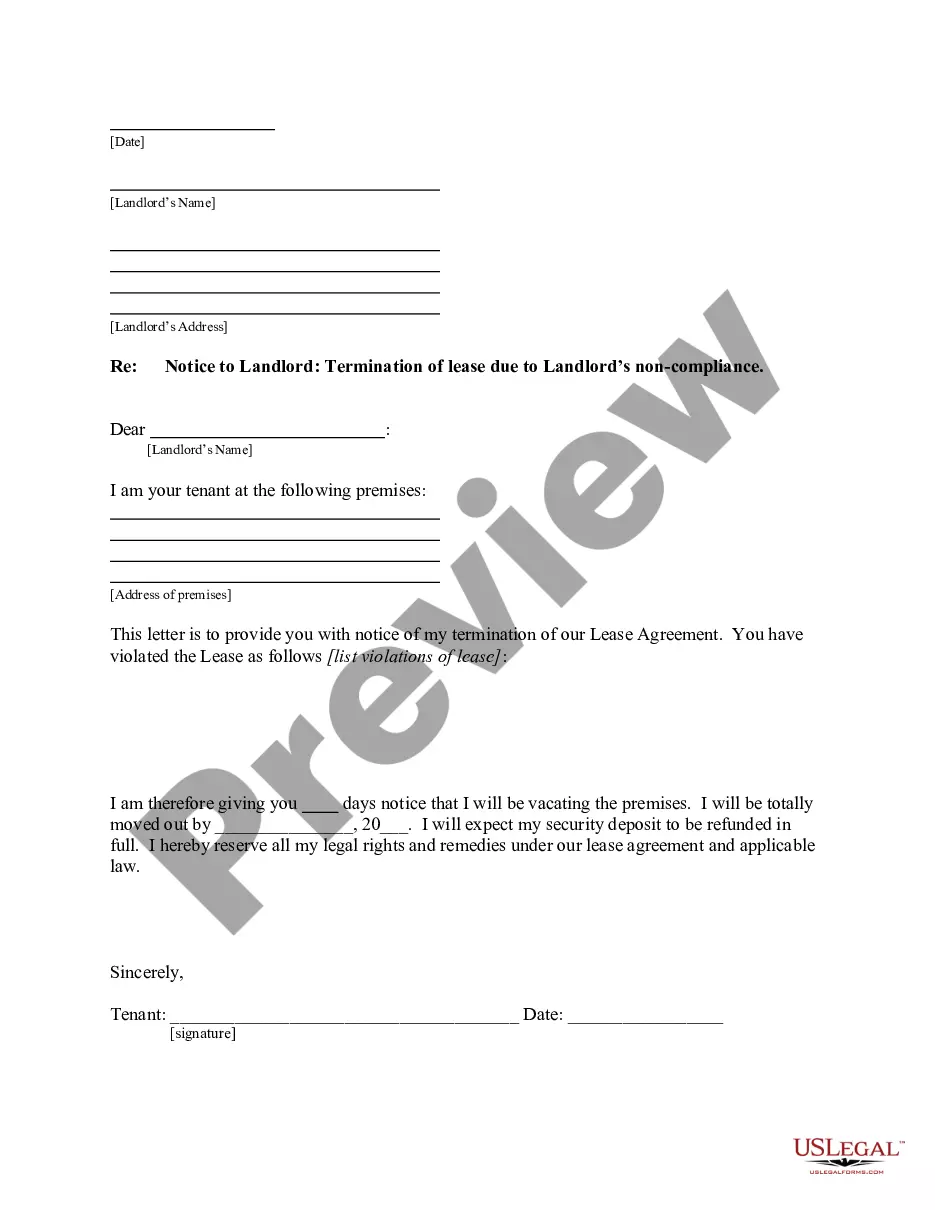

Laws and regulations in every area differ throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Contra Costa Credit Cardholder's Report of Lost or Stolen Credit Card, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you pick a sample, it remains accessible in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Contra Costa Credit Cardholder's Report of Lost or Stolen Credit Card from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Contra Costa Credit Cardholder's Report of Lost or Stolen Credit Card:

- Analyze the page content to ensure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the document when you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

How do I block my Lost / Stolen Credit Card? SMS send BLOCK XXXX (Last 4 digit of your card number) to 5676791 from your registered mobile number.

Wait more than 60 days to report unauthorized debit card transactions and you could be responsible for all the charges. This is just one more reason why it's typically best to pay for purchases with a credit card.

How to report a lost credit cardContact your card issuer to speak to a representative. Find your issuer's phone number from your credit card statements or, if they have a web-chat feature on their website, connect with a representative over chat.Consider locking the card.Confirm any recent charges.

What to Do If Credit Card Theft Happens to You. In the event that your credit card is stolen in the United States, federal law limits the liability of cardholders to $50, regardless of the amount charged on the card by the unauthorized user.

5 steps to take if you're a victim of credit card fraudCall your credit card company immediately.Check your credit card accounts and change your passwords.Notify the credit bureaus and call the police if necessary.Monitor your statements and credit reports.Check your online shopping accounts.

If the credit card company finds that the card was stolen, they may cover the purchase and refund the cardholder's money, while still paying you. However, this depends upon the cardholder agreement and your agreement with the merchant. In other cases, the card company might initiate a chargeback.

Here are five steps to take if your credit card is lost or stolen.Call your credit card issuer. Call your credit card issuer immediately to report the loss or theft of your missing card.Get prepped with information.Follow up and keep records.Check your credit card statement.Check your insurance coverage.

Contact your credit card issuer Once you suspect fraud on your credit card account, you should immediately contact your card issuer by calling the number on the back of your card.

What Happens After I Report My Lost Card? After you report your card as lost or stolen, your issuer will cancel the card and then mail you a new one with a new account number.

Call us Freephone in the UK (0800-89-1725) or call one of our global Freephone numbers. If your card is lost, stolen, damaged or compromised, we will work with your financial institution to approve and expedite the delivery of an emergency card to you.