Travis Texas Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone is an essential process that cardholders need to go through in the unfortunate event of their credit card being lost or stolen. This report helps to ensure the immediate and necessary actions are taken to prevent any unauthorized transactions or potential fraud from occurring. When a credit cardholder discovers that their Travis Texas credit card is missing, they must promptly report it to the designated telephone number provided by the credit card issuer. This report is crucial to mitigate any further financial repercussions and protect the cardholder from liability for unauthorized charges. The Travis Texas Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone is designed to be a hassle-free process for customers. By providing the necessary details such as the cardholder's full name, account number, contact information, and the date the card was lost or stolen, the issuer can promptly deactivate the credit card and prevent any unauthorized use. There may be different types of Travis Texas Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone, depending on the specific credit card issuer. Some variations may include specific security questions to verify the cardholder's identity, additional details about the last authorized transaction, or any suspicious activities noticed on the account. It is crucial for cardholders to remember that the telephone report of a lost or stolen credit card is just the first step in ensuring their financial security. After filing the report, it is recommended to closely monitor the credit card account for any unusual activities and work with the credit card issuer to resolve any fraudulent charges. In summary, when faced with a lost or stolen credit card, it is crucial for Travis Texas credit cardholders to promptly report it to the designated telephone number provided by the issuer. By doing so, immediate actions can be taken to secure the account and prevent any unauthorized use. Remaining vigilant and closely monitoring the account after the report is filed is equally important for safeguarding against potential fraud.

Travis Texas Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone

Description

How to fill out Travis Texas Credit Cardholder's Report Of Lost Or Stolen Credit Card After Notice By Telephone?

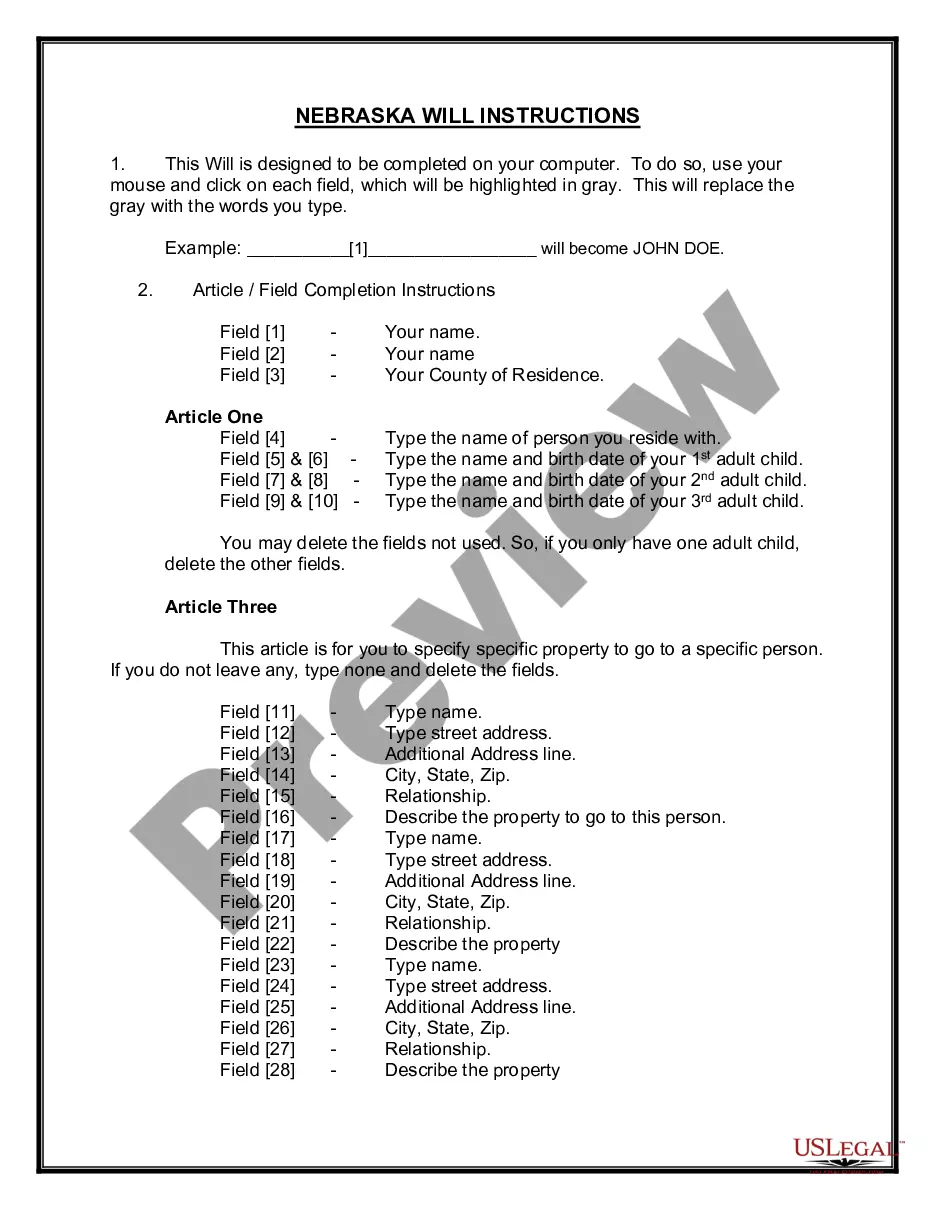

If you need to find a reliable legal paperwork provider to obtain the Travis Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone, consider US Legal Forms. Whether you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can search from more than 85,000 forms arranged by state/county and case.

- The self-explanatory interface, number of supporting materials, and dedicated support make it simple to locate and complete different papers.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply type to look for or browse Travis Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone, either by a keyword or by the state/county the document is intended for. After finding the required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Travis Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone template and check the form's preview and description (if available). If you're comfortable with the template’s legalese, go ahead and click Buy now. Register an account and select a subscription plan. The template will be instantly ready for download once the payment is completed. Now you can complete the form.

Taking care of your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive collection of legal forms makes these tasks less costly and more affordable. Set up your first business, arrange your advance care planning, draft a real estate contract, or complete the Travis Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone - all from the comfort of your sofa.

Sign up for US Legal Forms now!