A Phoenix Arizona Pledge of Stock for Loan, also known as a stock pledge agreement, is a legal contract where a borrower pledges their stock as collateral for a loan in the state of Arizona. This type of loan allows individuals or businesses to gain access to funds while using their stock holdings as security. The Phoenix Arizona Pledge of Stock for Loan involves the borrower offering their stocks, typically publicly traded securities, as collateral to the lender. The lender will have a security interest in the stock until the loan is repaid in full, providing them with the assurance that if the borrower fails to repay, they can seize and sell the pledged stock to recover the outstanding amount. It is important to note that there can be different types of Phoenix Arizona Pledge of Stock for Loan agreements. These may vary in terms of specific provisions, requirements, and obligations. Some common variations include: 1. General Stock Pledge Agreement: This is the standard form of the pledge, where the borrower pledges their stock as collateral for the loan, subject to the terms and conditions specified in the agreement. 2. Restricted Stock Pledge Agreement: In this type of pledge, the borrower may offer shares of restricted stock as collateral. Restricted stock refers to shares that have certain limitations or restrictions on their sale or transferability, typically due to being issued as part of an incentive plan. Lenders may evaluate these agreements differently as the marketability of restricted stock may be lower compared to freely tradable stock. 3. Employee Stock Ownership Plan (ESOP) Pledge Agreement: Sops are retirement plans that invest in the employer's stock, and some individuals or companies may use these plan assets as collateral for loans. ESOP Pledge Agreements involve specific provisions related to ESOP ownership and compliance with relevant laws and regulations. In all instances, the Phoenix Arizona Pledge of Stock for Loan is a financial tool that enables borrowers to leverage their stock holdings to secure funding. This type of loan can be beneficial for those seeking liquidity without liquidating their stock positions or for borrowers who do not meet traditional collateral requirements. However, it is crucial for borrowers to carefully review the terms and conditions of the agreement to ensure full understanding and compliance.

Phoenix Arizona Pledge of Stock for Loan

Description

How to fill out Phoenix Arizona Pledge Of Stock For Loan?

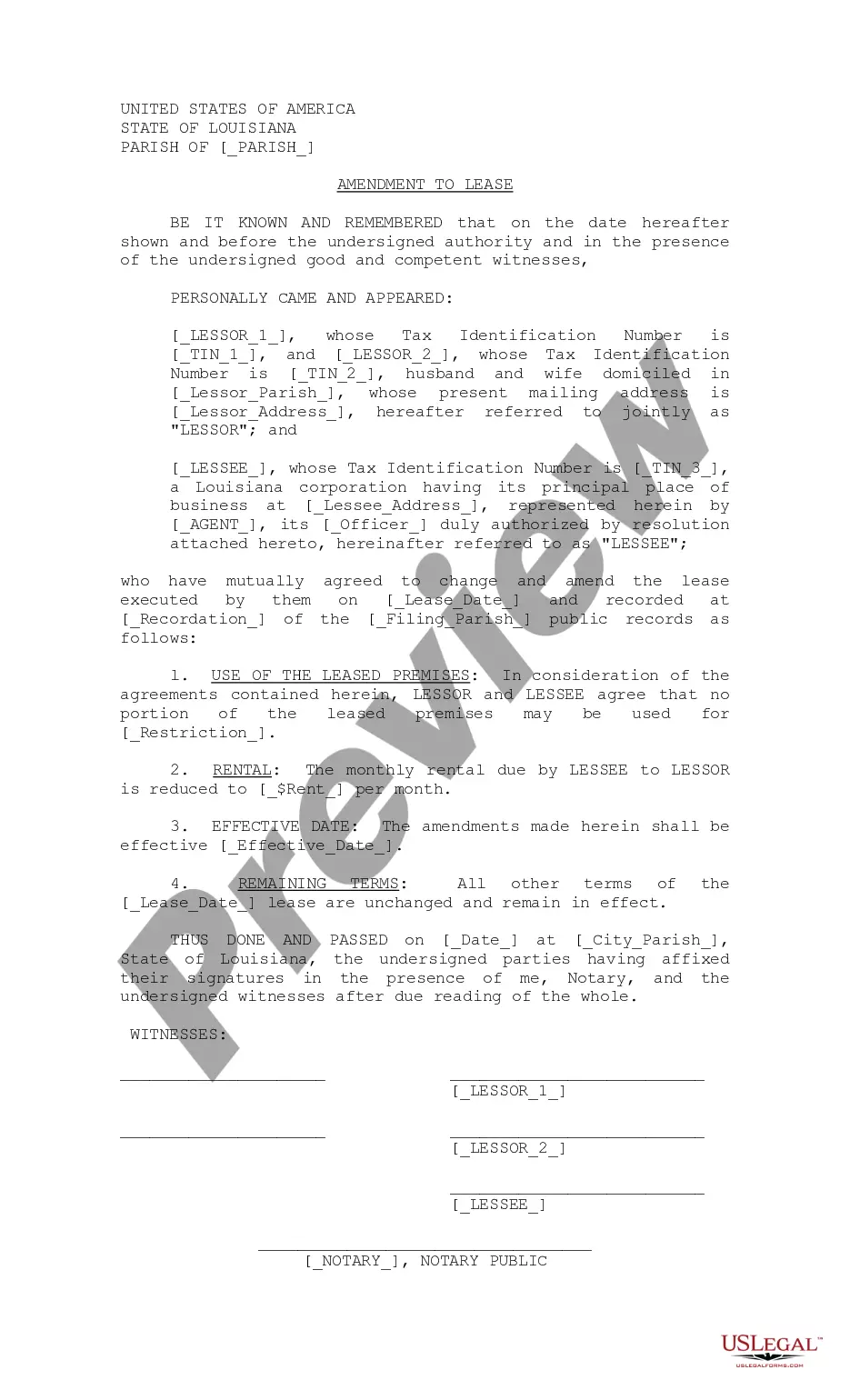

Preparing legal documentation can be difficult. In addition, if you decide to ask a legal professional to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Phoenix Pledge of Stock for Loan, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case accumulated all in one place. Therefore, if you need the current version of the Phoenix Pledge of Stock for Loan, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Phoenix Pledge of Stock for Loan:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your Phoenix Pledge of Stock for Loan and save it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

The customer needs to select the shares and their quantity to be pledged and submit the online request. Authorising pledge request. Once the request is submitted, the customer receives an email from the clearing corporation. The customer then needs to authorise the pledge request to be able to activate it.

Stock-Secured LoansWith a stock-based loan, you pledge shares of stock as collateral against the repayment of the loan. Typically you do not make payments until the loan is due in two to three years and any dividends paid on the shares go toward the interest and principal of the loan.

A pledged asset is a valuable possession that is transferred to a lender to secure a debt or loan. A pledged asset is collateral held by a lender in return for lending funds. Pledged assets can reduce the down payment that is typically required for a loan as well as reduces the interest rate charged.

A pledge loan differs from a standard loan in that the loaned amount is completely backed with collateral from the borrower. A borrower can use their funds, such as a savings account, as collateral to obtain a loan. The funds used as collateral then become "frozen" until the loan is paid back in full.

The most important criterion to avail of this type of loan is to have a demat account from any financial institution. You can only pledge those shares as leverage that have been bought and invested in, in your name. Shares in another individual or organisation's name cannot be pledged as collateral.

Pledging simply means taking loans against the shares that one holds. Shares are considered a type of asset. They act as a collateral against loans. Any individual or institution that holds shares can pledge them.

A pledged asset is a valuable possession that is transferred to a lender to secure a debt or loan. A pledged asset is collateral held by a lender in return for lending funds. Pledged assets can reduce the down payment that is typically required for a loan as well as reduces the interest rate charged.

A pledge, also called a pawn or a security interest, is a piece of property, or chattel, used to secure financing. A pledge can be any physical thing with liquid value, although the type of property that a lender requires typically relates to the reason for the loan.

1 ) How to get a Loan Against Shares?Step 1: Login to NetBanking and select the securities you want to pledge.Step 2: Accept the Terms of Agreement via an OTP.Step 3: Pledge the shares and mutual funds online by confirming an OTP.A savings or current account and a demat account with HDFC Bank.More items...

Interesting Questions

More info

House. OF FCP. Secured by Home Mortgage Loans. The 1 largest lender of home mortgages in America—of all types of loans. Offers a range of home loan products including Home Equity Lines of Credit, Home Improvement Loans, Reverse Mortgages, Mortgages, Government/Government Sponsored Development, Realty Loans, and more. 2. National Credit Union Administration. Secured by credit, securities and cash investments. The largest union in the United States. Offers a range of home loan products including Home Equity Lines of Credit, Home Improvement Loans, Reverse Mortgages, Mortgages, Government/Government Sponsored Development, Realty Loans and more. 3. Bank of America. Secured by mortgage loans, commercial loans, certificates of deposit, certificates of savings account, and commercial and industrial loans. One of the top 6 large lenders of mortgages in America with a presence in all 50 states and 7 foreign countries.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.