The Lima Arizona Pledge of Stock for Loan is a legal arrangement that allows individuals or businesses to obtain financing by using their stock or shares as collateral. This type of loan is commonly utilized by those who own stocks but temporarily require additional funds without having to sell their securities. The Lima Arizona Pledge of Stock for Loan offers borrowers the flexibility to use their stocks as collateral without losing ownership or control over their investments. Instead of liquidating their shares, individuals or business entities can pledge their stocks to secure a loan. This arrangement provides an additional avenue for obtaining funds, as lenders are willing to accept this type of collateral. Types of Lima Arizona Pledge of Stock for Loan: 1. Personal Stock Pledge: Individuals who own stocks in various companies can use their holdings as collateral to secure a loan. This allows them to access funds for personal expenses, such as purchasing a new car, funding a wedding, or covering medical bills, without selling their stock holdings. 2. Corporate Stock Pledge: Companies or businesses can also utilize the Lima Arizona Pledge of Stock for Loan. By pledging their corporate stock as collateral, businesses can secure funds to support expansion, finance new projects, or cover operational expenses. 3. Publicly Traded Stock Pledge: Individuals or businesses who own shares in publicly traded companies can leverage their holdings to obtain a loan. This type of pledge is commonly used by investors who want to access cash quickly while retaining ownership of their securities. 4. Restricted Stock Pledge: Employees or executives who receive company stock as part of their compensation may have restrictions on the sale or transfer of these stocks. However, they can still pledge their restricted stock as collateral for a loan, offering an alternative source of financing. In summary, the Lima Arizona Pledge of Stock for Loan is a financing option that allows individuals or businesses to secure loans by using their stocks or shares as collateral. It provides borrowers with the ability to access funds without selling their securities, offering flexibility and financial leverage. Different types of pledges include personal stock pledge, corporate stock pledge, publicly traded stock pledge, and restricted stock pledge, serving various purposes for borrowers.

Pima Arizona Pledge of Stock for Loan

Description

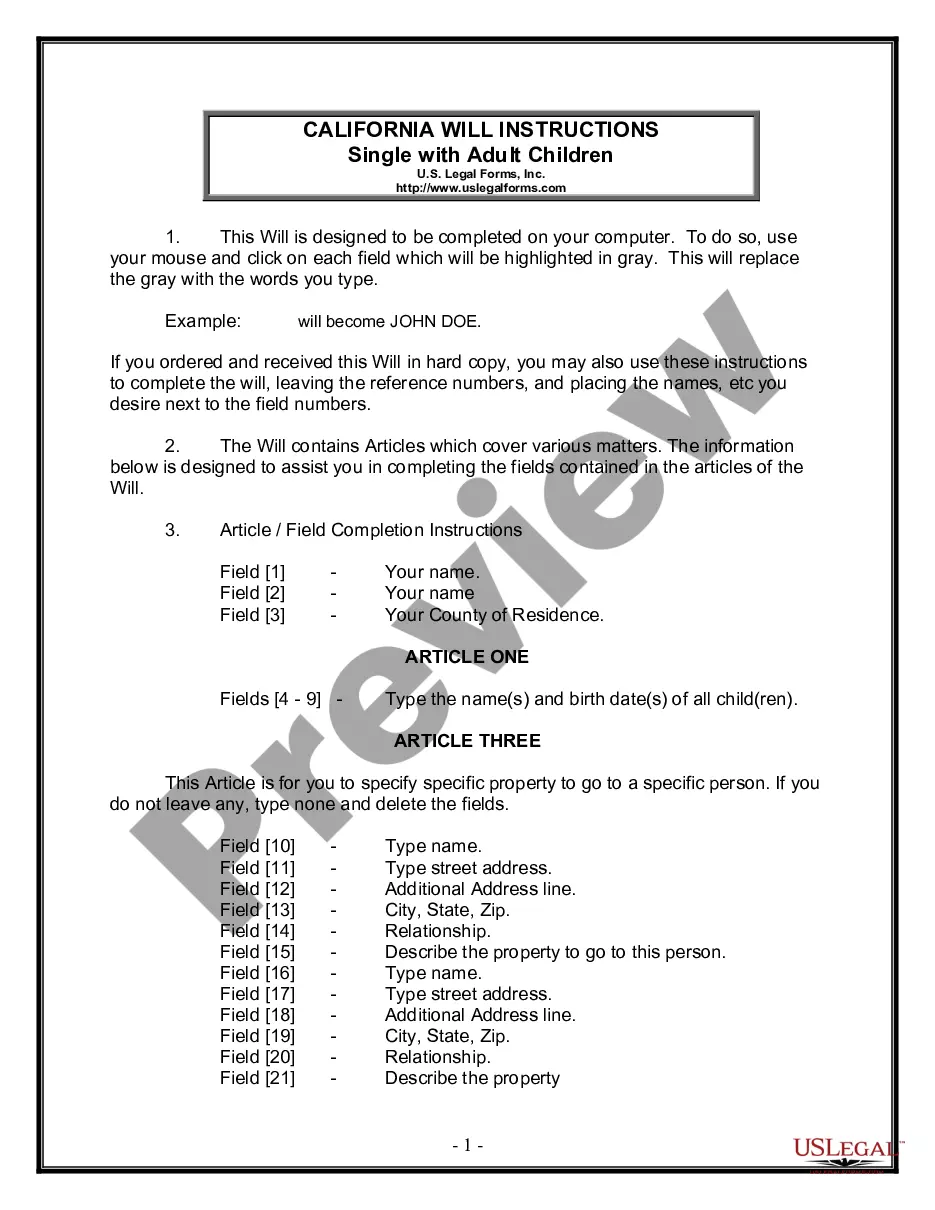

How to fill out Pima Arizona Pledge Of Stock For Loan?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for professional help to draft some of them from scratch, including Pima Pledge of Stock for Loan, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in different categories varying from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching process less frustrating. You can also find detailed materials and tutorials on the website to make any tasks related to document completion simple.

Here's how to purchase and download Pima Pledge of Stock for Loan.

- Take a look at the document's preview and description (if available) to get a general idea of what you’ll get after downloading the form.

- Ensure that the document of your choosing is specific to your state/county/area since state laws can affect the legality of some records.

- Examine the related forms or start the search over to find the appropriate document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment method, and buy Pima Pledge of Stock for Loan.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Pima Pledge of Stock for Loan, log in to your account, and download it. Needless to say, our website can’t take the place of a lawyer entirely. If you need to deal with an extremely challenging situation, we recommend getting a lawyer to check your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Become one of them today and get your state-specific paperwork effortlessly!

Form popularity

FAQ

A pledge loan differs from a standard loan in that the loaned amount is completely backed with collateral from the borrower. A borrower can use their funds, such as a savings account, as collateral to obtain a loan. The funds used as collateral then become "frozen" until the loan is paid back in full.

Loan against share is offered against listed securities. Investors can borrow funds against existing investment portfolios to meet investment and liquidity requirements. The money that the borrower has invested in can get him a loan.

The customer needs to select the shares and their quantity to be pledged and submit the online request. Authorising pledge request. Once the request is submitted, the customer receives an email from the clearing corporation. The customer then needs to authorise the pledge request to be able to activate it.

1 ) How to get a Loan Against Shares?Step 1: Login to NetBanking and select the securities you want to pledge.Step 2: Accept the Terms of Agreement via an OTP.Step 3: Pledge the shares and mutual funds online by confirming an OTP.A savings or current account and a demat account with HDFC Bank.More items...

The most important criterion to avail of this type of loan is to have a demat account from any financial institution. You can only pledge those shares as leverage that have been bought and invested in, in your name. Shares in another individual or organisation's name cannot be pledged as collateral.

Stocks or other investments can also be used to get a secured personal loan. Loans that use investments as collateral are often called securities-based loans or stock-based loans. These are often offered by investment brokerages or private banks to clients who already have investments with these companies.

Pledged loans allow you to borrow against your savings or certificates of deposit (CD) without a credit check. So, even if you have little or no credit or your score needs improvement, you're more likely to be approved. And, making all your payments on time can boost your credit score.

When one takes loans against the shares held, it is called pledging shares. This means that shares are offered as collateral or security against the loan taken by the individual that has pledged his/her shares. Shares can be pledged by a promoter or an investor.

A loan against your demat shares is a process through which you can avail of a loan by pledging your shares as collateral. A loan against demat shares helps you monetise your investments without selling them off to realise the capital amount.