Wake North Carolina Pledge of Stock for Loan is a legal agreement that allows individuals or organizations in Wake, North Carolina to obtain a loan using their stocks as collateral. This type of arrangement is commonly known as a stock-secured loan. A pledge of stock for a loan is an agreement where the borrower pledges their stocks as collateral in exchange for the lender providing them with a loan. The stocks act as security against the loan, thereby reducing the lender's risk. By utilizing a pledge of stock, borrowers can gain access to capital while still retaining ownership and possession of their stocks. The Wake North Carolina Pledge of Stock for Loan is a highly flexible financing option. It offers benefits to both borrowers and lenders. For borrowers, this type of loan allows them to use their stocks without needing to sell them, providing them with the desired liquidity while still maintaining their investment position. Since stocks tend to appreciate over time, borrowers can also benefit if the value of their stocks increases. Lenders, on the other hand, are provided with a secure investment since the stocks serve as collateral. In the event of borrower default, lenders have the authority to sell the pledged stocks to recover their loaned amount. This feature ensures lenders have a level of protection, making the loan safer and potentially enabling them to offer lower interest rates. Various types of Wake North Carolina Pledge of Stock for Loan include: 1. Personal Stock Loans: Individuals can use their personal stock holdings as collateral to obtain a loan, providing them with additional funds to meet personal financial needs. 2. Business Stock Loans: Business owners in Wake, North Carolina can pledge the shares of their company as collateral to secure loans for various purposes, such as expansion, working capital, or acquisition. 3. Non-Profit Stock Loans: Non-profit organizations in Wake, North Carolina can utilize the Pledge of Stock for Loan to access funds without having to liquidate their stock holdings, enabling them to continue their charitable activities. 4. Margin Loans: Although not strictly a Pledge of Stock for Loan, margin loans are a similar concept. Investors can borrow funds from brokerage firms, using their stocks as collateral. Margin loans allow investors to leverage their stock portfolios for additional investment opportunities. In Wake, North Carolina, the Pledge of Stock for Loan is a valuable tool for individuals, business owners, and non-profit organizations seeking financing while still retaining stock ownership. It provides a convenient and flexible funding solution, making it an attractive option across various sectors.

Wake North Carolina Pledge of Stock for Loan

Description

How to fill out Wake North Carolina Pledge Of Stock For Loan?

Creating forms, like Wake Pledge of Stock for Loan, to take care of your legal matters is a difficult and time-consumming process. Many cases require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can get your legal issues into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms crafted for various scenarios and life circumstances. We ensure each document is compliant with the regulations of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Wake Pledge of Stock for Loan template. Simply log in to your account, download the template, and customize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly straightforward! Here’s what you need to do before downloading Wake Pledge of Stock for Loan:

- Make sure that your document is compliant with your state/county since the regulations for writing legal paperwork may differ from one state another.

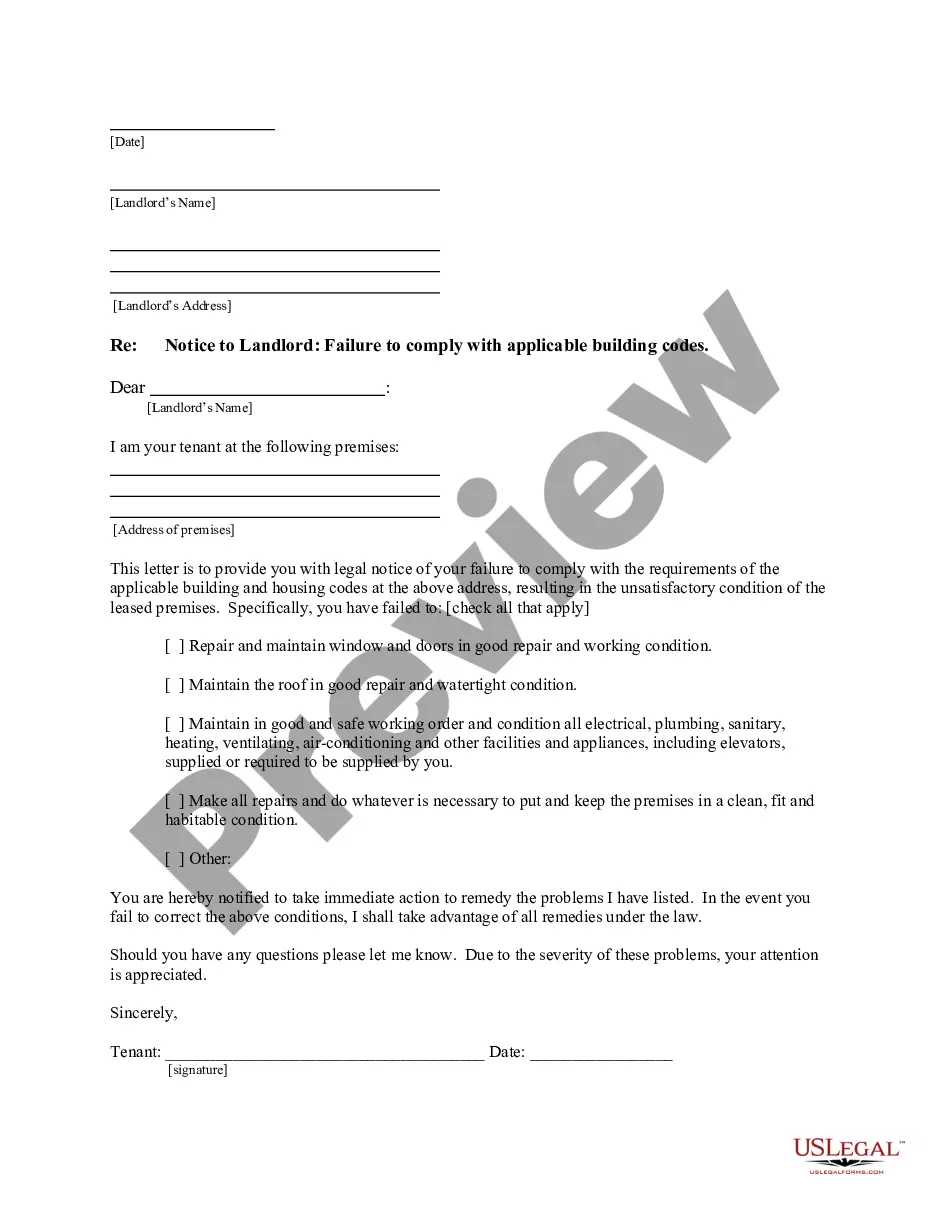

- Find out more about the form by previewing it or going through a brief intro. If the Wake Pledge of Stock for Loan isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to start utilizing our website and get the document.

- Everything looks great on your end? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your template is all set. You can try and download it.

It’s an easy task to find and buy the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!