Harris Texas Promissory Note Assignment and Notice of Assignment are legal documents that pertain to the transfer of rights and obligations related to promissory notes in the Harris County area of Texas. Promissory notes are written promises to pay back a specified amount of money, usually with interest, within a specific timeframe. The Harris Texas Promissory Note Assignment refers to the process of transferring the rights and benefits of a promissory note from the original lender, known as the assignor, to a new party, called the assignee. This assignment typically occurs when the original lender wants to either sell or transfer the promissory note to another entity. The Harris Texas Promissory Note Assignment document outlines the terms and conditions of this transfer, including any outstanding obligations, interest rates, and repayment schedules. On the other hand, the Harris Texas Notice of Assignment is a formal written notification that informs the borrower, also known as the obliged, of the transfer of the promissory note's ownership. This notice alerts the borrower about the change in the party to whom future payments should be made and serves as a legal record of the assignment. The Harris Texas Notice of Assignment includes details such as the names and contact information of the assignor and assignee, the effective date of assignment, the outstanding balance, and any necessary instructions for future payments. It is essential to mention that there may be multiple types of Harris Texas Promissory Note Assignment and Notice of Assignment, depending on the specific requirements of the parties involved or the purpose of the assignment. Examples of these variations include: 1. Individual to Individual Assignment: This type of assignment occurs when an individual lender assigns their promissory note to another individual. It may involve a family member, friend, or private investor who agrees to take over the loan. 2. Individual to Institution Assignment: In this scenario, an individual lender assigns their promissory note to a financial institution such as a bank or credit union. This type of assignment often occurs when the original lender wants to remove the loan from their portfolio or requires liquidity. 3. Institution to Institution Assignment: This type of assignment involves a financial institution transferring a promissory note from one institution to another. It could happen due to various reasons, including loan securitization, consolidation, or portfolio management strategies. 4. Collateralized Note Assignment: Sometimes, a promissory note is secured by collateral, such as real estate or personal property. In these cases, the assignment may include the transfer of both the note and the associated collateral to the assignee. In summary, the Harris Texas Promissory Note Assignment and Notice of Assignment documents facilitate the legal transfer of promissory notes within the jurisdiction of Harris County, Texas. These documents ensure that all parties involved in the assignment are fully aware of the transfer, its terms, and their respective obligations. As with any legal documentation, it is advisable to consult with a legal professional familiar with local laws and regulations to ensure the assignment process is conducted smoothly and accurately.

Harris Texas Promissory Note Assignment and Notice of Assignment

Description

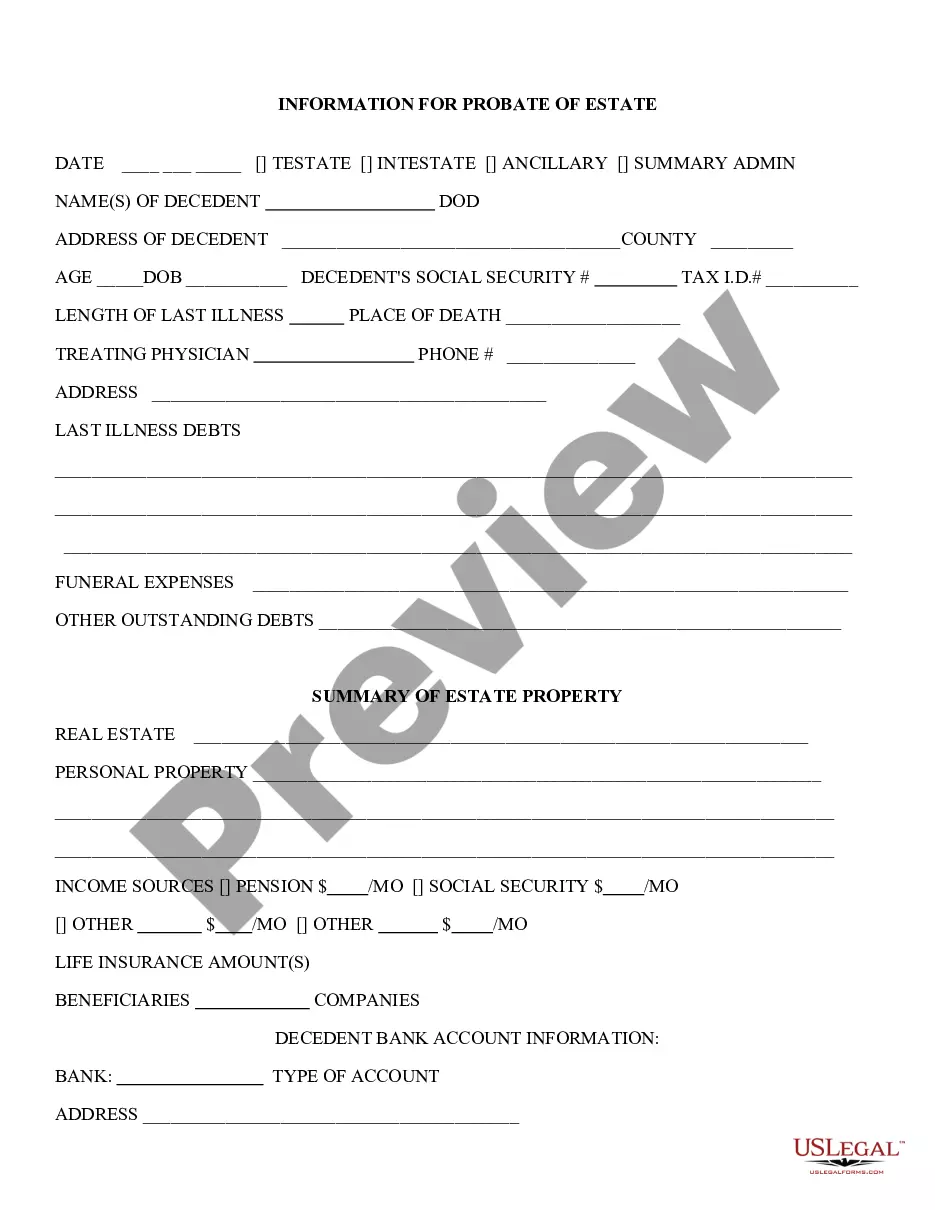

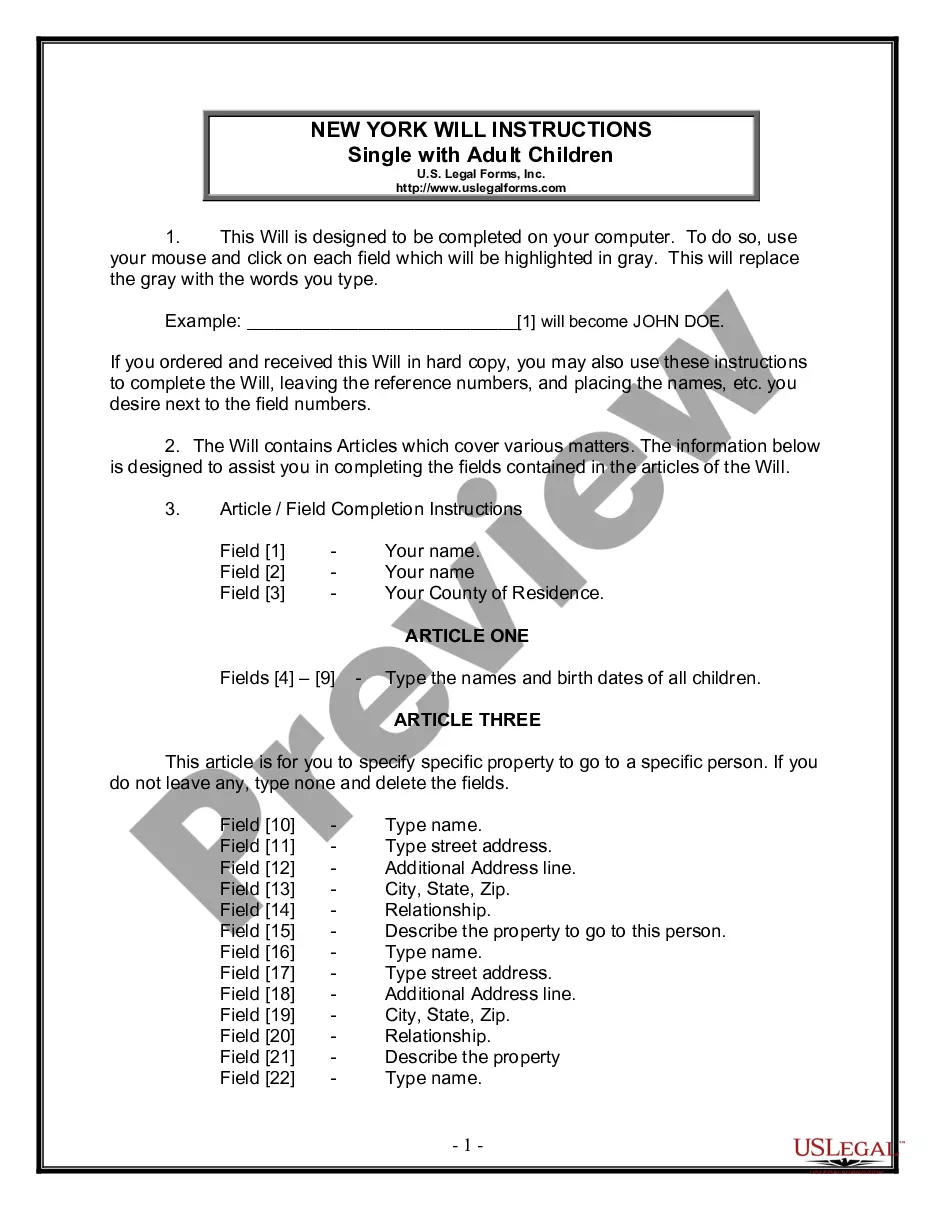

How to fill out Harris Texas Promissory Note Assignment And Notice Of Assignment?

Creating legal forms is a must in today's world. However, you don't always need to seek qualified assistance to draft some of them from the ground up, including Harris Promissory Note Assignment and Notice of Assignment, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to choose from in different categories varying from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching experience less overwhelming. You can also find information resources and tutorials on the website to make any activities related to document completion straightforward.

Here's how to purchase and download Harris Promissory Note Assignment and Notice of Assignment.

- Go over the document's preview and description (if available) to get a general idea of what you’ll get after downloading the form.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can affect the validity of some records.

- Examine the related forms or start the search over to locate the appropriate file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment gateway, and purchase Harris Promissory Note Assignment and Notice of Assignment.

- Select to save the form template in any offered format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Harris Promissory Note Assignment and Notice of Assignment, log in to your account, and download it. Of course, our platform can’t replace a lawyer completely. If you need to cope with an exceptionally difficult situation, we advise getting an attorney to examine your form before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Join them today and purchase your state-compliant documents with ease!