San Diego California Promissory Note with Installment Payments

Description

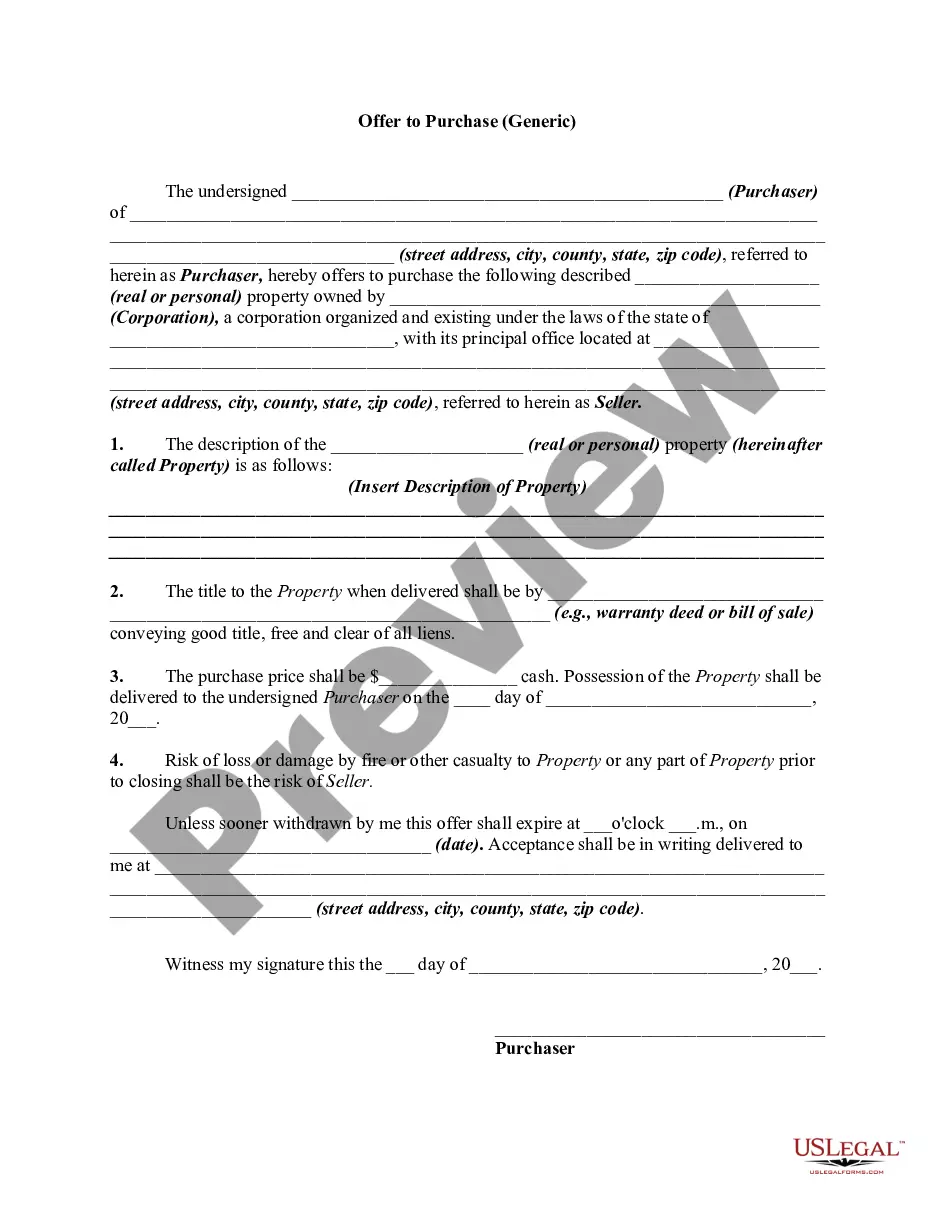

How to fill out Promissory Note With Installment Payments?

Organizing documentation for business or personal requirements is consistently a significant obligation.

When drafting an agreement, a public service application, or a power of attorney, it is vital to consider all federal and state regulations of the particular area.

However, small counties and even municipalities also possess legislative rules that must be taken into account.

Reconfirm that the template adheres to legal standards and click Buy Now. Select the subscription plan, then Log In or set up an account with the US Legal Forms. Use your credit card or PayPal account to pay for your subscription. Download the chosen file in your desired format, print it, or fill it out electronically. The advantage of the US Legal Forms library is that all the documents you've ever acquired remain accessible - you can retrieve them in your profile under the My documents tab anytime. Join the platform and swiftly obtain verified legal templates for any scenario with just a few clicks!

- These factors contribute to the anxiety and duration involved in composing a San Diego Promissory Note with Installment Payments without expert assistance.

- It’s simple to prevent unnecessary expenses on lawyers drafting your documents and prepare a legally sound San Diego Promissory Note with Installment Payments independently, utilizing the US Legal Forms online library.

- It is the premier online directory of state-specific legal documents that are professionally validated, ensuring their accuracy when selecting a template for your locality.

- Previous subscribers merely need to Log In to their accounts to retrieve the necessary form.

- If you haven’t subscribed yet, follow the step-by-step instructions below to procure the San Diego Promissory Note with Installment Payments.

- Browse through the opened page and confirm if it contains the sample you need.

- To do so, utilize the form description and preview if these features are available.

Form popularity

FAQ

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note.Accept full payment of the loan.Mark paid in full on the promissory note.Place a signature beside the paid in full notation.Mail the original promissory note to the borrower.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

The borrower and the lender execute the promissory note, and as a result, the borrower becomes legally bound to repay the loan to the lender. If the borrower does not repay the loan, the lender can pursue legal action. If the borrower does fully repay the loan, the lender should mark the promissory note paid in full.

A California promissory note is a written document that may be legally binding once it is properly executed. The purpose of the document is to prove the existence of a loan that was provided to the borrower by the lender. California promissory notes are either secured or unsecured.

What Does Installment Note Mean? An installment note, on the other hand, typically has a payment schedule where the borrower repays the lender in equal payments monthly, quarterly, semi-annually, or annually until the loan is fully repaid with interest. It works the same way a person mortgage works.

Some possible disadvantages are: You will likely pay a higher interest rate than for a secured loan. If you are using a promissory note because you don't have a good credit rating, you will likely pay a higher interest rate than if you obtained a commercial business loan from a bank or other institution.

Some promissory notes require the payment of the full amount owed, plus interest, on a certain date. If the promissory note requires that periodic payments be made, such as quarterly, monthly, or even weekly, it is called an installment promissory note.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.

An installment note is a form of promissory note calling for payment of both principal and interest in specified amounts, or specified minimum amounts, at specific time intervals.

A promissory note can be used for different types of loans such as a mortgage, student loan, car loan, business loan or personal loan. When lenders loan out money especially when it's a large sum it formalizes the loan by creating a promissory note.