Orange California Promissory Note — Payable on Demand is a legal document that outlines the details of a loan agreement between a lender and a borrower based in Orange, California. This type of promissory note is specifically designed to ensure the payment of a debt on demand by the lender. The Orange California Promissory Note — Payable on Demand serves as evidence of a loan between two parties and specifies the terms and conditions of repayment. It includes important information such as the names and contact details of both the lender and the borrower, the loan amount, the interest rate (if applicable), and the repayment schedule. This type of promissory note is commonly used in various financial transactions, such as personal loans, business loans, and real estate deals, among others. It offers flexibility for the lender, allowing them to demand full payment at any time. This means that the borrower needs to be prepared to fulfill the repayment obligations promptly. Different types of Orange California Promissory Note — Payable on Demand may vary depending on the specific terms and conditions set by the parties involved. Some common variations of this promissory note include: 1. Secured Promissory Note: This type of promissory note includes additional collateral to secure the loan, such as real estate or other valuable assets. It provides an extra layer of protection for the lender in case the borrower defaults on repayment. 2. Unsecured Promissory Note: Unlike a secured promissory note, an unsecured promissory note does not involve any collateral. In this case, the borrower's creditworthiness and reputation become even more crucial factors for the lender. 3. Interest-bearing Promissory Note: With this type of promissory note, the borrower agrees to pay interest on top of the loan amount. The interest rate is typically specified in the document, ensuring that the lender receives additional compensation for lending the money. Regardless of the specific type, an Orange California Promissory Note — Payable on Demand serves as a legally binding contract that protects the interests of both parties involved in a loan transaction. It provides clarity and structure to the repayment process and helps prevent any misunderstandings or disputes that could arise.

Orange California Promissory Note - Payable on Demand

Description

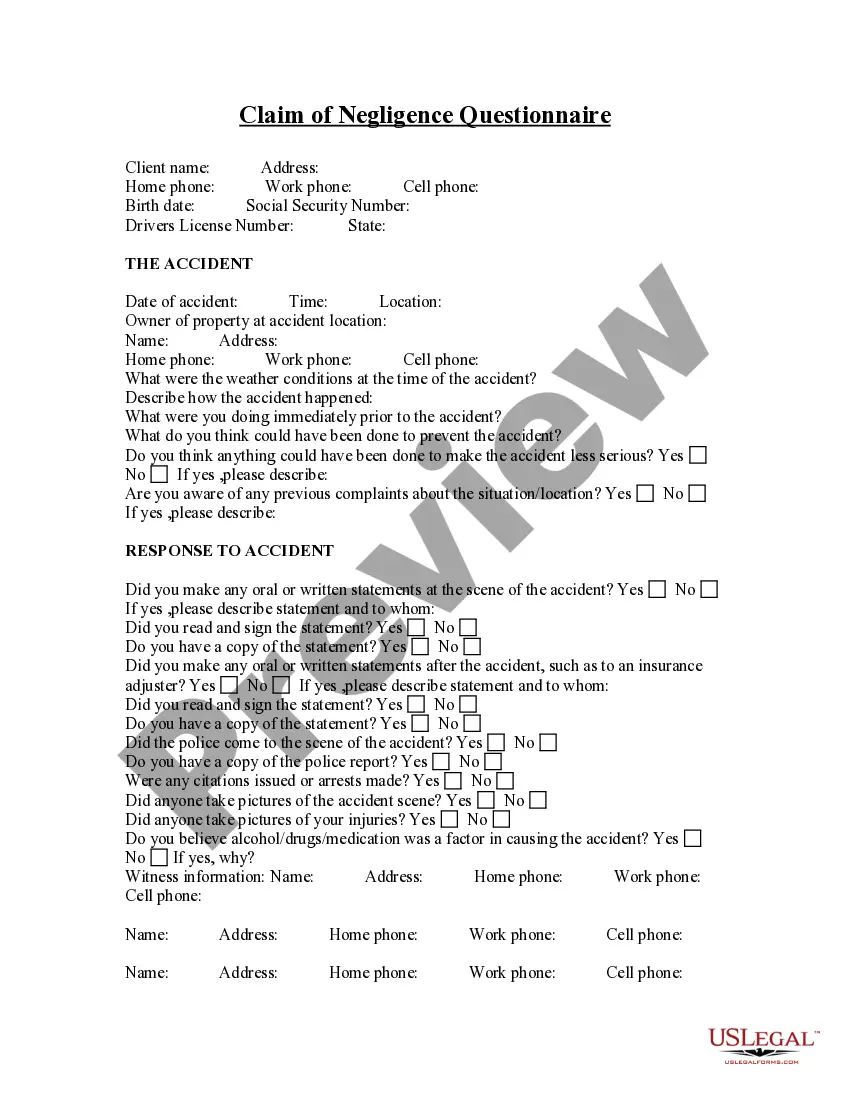

How to fill out Orange California Promissory Note - Payable On Demand?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and many other life situations require you prepare formal paperwork that varies from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and download a document for any personal or business purpose utilized in your county, including the Orange Promissory Note - Payable on Demand.

Locating templates on the platform is amazingly straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Orange Promissory Note - Payable on Demand will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to obtain the Orange Promissory Note - Payable on Demand:

- Ensure you have opened the proper page with your regional form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template satisfies your requirements.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the suitable subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Orange Promissory Note - Payable on Demand on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!