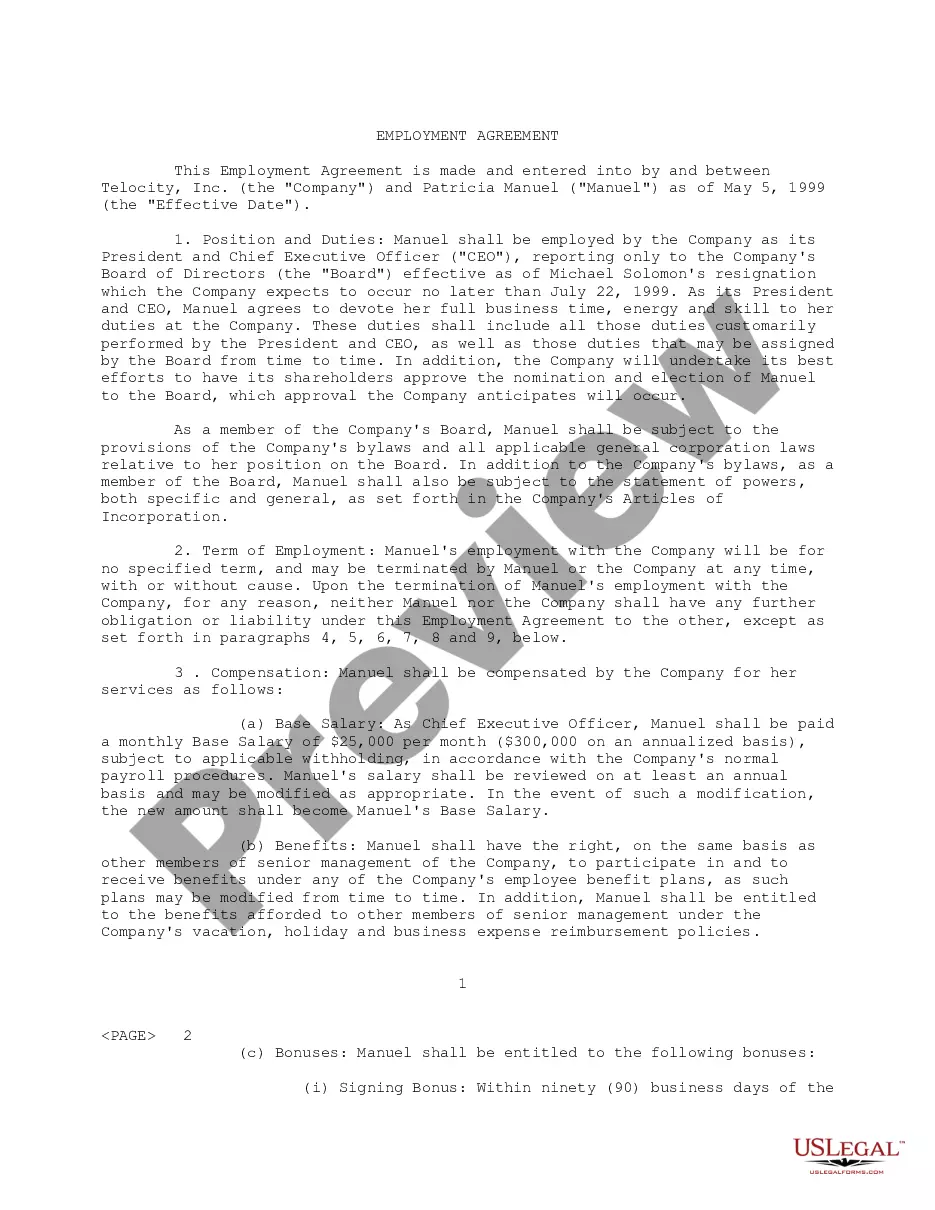

A Wake North Carolina Promissory Note — Payable on Demand is a legal document used in Wake County, North Carolina, that outlines the details of a loan agreement between two parties: the borrower and the lender. This type of promissory note is specifically designed to be payable on demand, meaning that the lender can request repayment at any time. The Wake North Carolina Promissory Note — Payable on Demand typically includes the following key elements: 1. Parties Involved: The promissory note identifies the borrower (also known as the debtor) and the lender (also known as the creditor). It includes their names, addresses, and contact information. 2. Loan Amount: The promissory note specifies the amount of money that the borrower has received from the lender. It can be a fixed amount or a range, depending on the agreement. 3. Interest Rate: If applicable, the promissory note states the interest rate charged on the loan. This ensures that the borrower understands the additional amount they will owe in interest. 4. Terms of Repayment: The note outlines the terms and conditions for repaying the loan. Since it is payable on demand, it typically indicates that the lender can request repayment at any time, without providing a specific repayment schedule. 5. Collateral: If the borrower has provided collateral to secure the loan, such as property or assets, the promissory note includes details about these assets and the consequences if the borrower fails to repay the loan. 6. Governing Law: The promissory note specifies that the agreement is subject to the laws of Wake County, North Carolina. This ensures that any legal disputes or actions will be resolved in accordance with the local jurisdiction. Types of Wake North Carolina Promissory Note — Payable on Demand may include: 1. Personal Promissory Note: This type of promissory note is used for loans between individuals, such as friends or family members, rather than business entities. 2. Business Promissory Note: This type of note is used for loans between two business entities or individuals representing a business. 3. Secured Promissory Note: If the borrower has provided collateral to secure the loan, this type of promissory note specifies the details of the collateral and the lender's rights in case of default. 4. Unsecured Promissory Note: In contrast to a secured note, this type of promissory note does not require collateral and depends solely on the borrower's creditworthiness and promise to repay the loan. In summary, a Wake North Carolina Promissory Note — Payable on Demand is a legal document establishing a loan agreement between a borrower and a lender. It details the loan amount, repayment terms, interest rate (if applicable), and the option for the lender to demand repayment at any time. Additionally, there can be various types of promissory notes, including personal, business, secured, and unsecured notes.

Wake North Carolina Promissory Note - Payable on Demand

Description

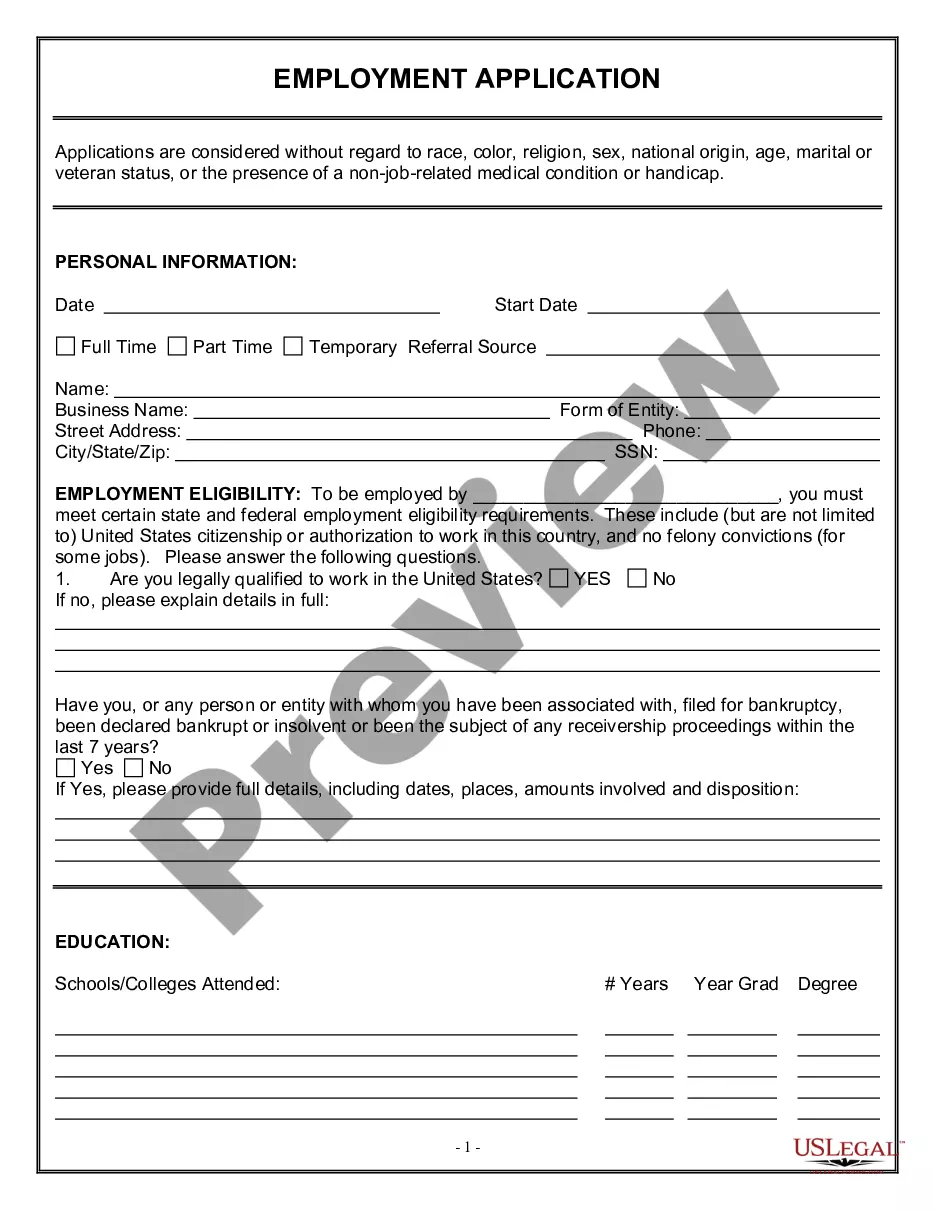

How to fill out Wake North Carolina Promissory Note - Payable On Demand?

If you need to find a reliable legal paperwork provider to get the Wake Promissory Note - Payable on Demand, look no further than US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed form.

- You can browse from over 85,000 forms arranged by state/county and case.

- The intuitive interface, variety of learning resources, and dedicated support team make it simple to locate and complete different paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

Simply select to look for or browse Wake Promissory Note - Payable on Demand, either by a keyword or by the state/county the form is created for. After locating necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to start! Simply find the Wake Promissory Note - Payable on Demand template and take a look at the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Register an account and choose a subscription option. The template will be instantly available for download as soon as the payment is processed. Now you can complete the form.

Handling your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our rich collection of legal forms makes this experience less costly and more reasonably priced. Create your first company, arrange your advance care planning, draft a real estate agreement, or execute the Wake Promissory Note - Payable on Demand - all from the comfort of your sofa.

Sign up for US Legal Forms now!

Form popularity

FAQ

Demand and Time Instruments A promissory note is how a borrower shows their intent to repay the note. All rules associated with promissory notes are from the Uniform Commercial Code Article 3 (Article 3). This stipulates the notes can act as instruments of demand or time.

A promissory note payable on demand is a way to get repaid when you loan money to someone. It is a document that states the terms of the loan and includes the payable on demand notation on it. This means that you can demand full payment of the loan at any time you deem necessary.

When payment is requested, a time period will be given for repayment. A promissory note, in contrast, can have the option for payment to be 'on demand' or at a specified date. A demand note is not required to show cause notice to be given to a borrower who is delinquent, unlike a mortgage loan.

A due on demand promissory note lets you be in control of when you will be paid in full. It is helpful in getting more control on a loan made to someone close to you. It is different from other promissory notes because it is on demand. This means the full repayment is due as soon as you ask for it.

A promissory note cannot be made payable to the bearer, no matter whether it is payable on demand or after a certain time. 2. A bill of exchange cannot be made payable to the bearer on demand though it can be made payable to the bearer after a certain time.

The legal nature of loans payable on demand The law defines a loan made that has no specified date for repayment, or that is payable on request, as a 'loan payable on demand'. Once the money is handed over the lender has an immediate right to sue for recovery of the debt.

Key Takeaways. A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.

A promissory note cannot be made payable to the bearer, no matter whether it is payable on demand or after a certain time. 2. A bill of exchange cannot be made payable to the bearer on demand though it can be made payable to the bearer after a certain time.

A cheque is always payable on demand.