Medicaid qualified individuals can receive care: in a traditional nursing home; in a hospice; in their home through a Home and Community Based Services (HCBS) Waiver; through a Program of All Inclusive Care for the Elderly (PACE); or through long term care insurance purchased through a state insurance partnership if you live in New York, Connecticut, Indiana, or California. This is an excellent guide to help you understand Medicaid, the benefits it provides for long term care, and who may qualify. The guide also contains tips and strategies to help you with your long term care planning, a planner to help you estimate your eligibility, and a state resource guide with state .gov websites, addresses and telephone numbers.

Mesa Arizona Medicaid Long Term Care Handbook, Planner, and State Resource Guide

State:

Multi-State

City:

Mesa

Control #:

US-005HB

Format:

Word

Instant download

Description

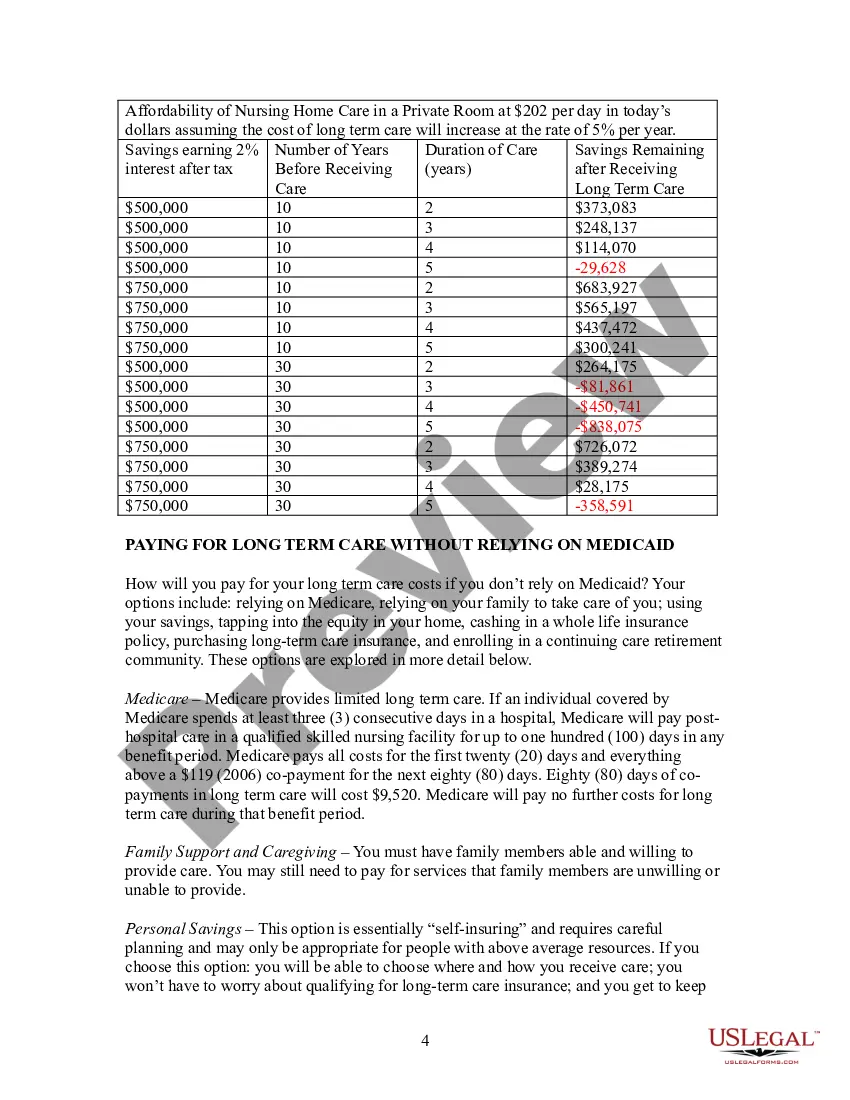

Saving enough to retire comfortable and leave a legacy to your loved ones requires sound investment and planning. However, many overlook what could be their most costly expense related to aging: paying for long term care. Long term care is expensive whether you receive care in a nursing home, assisted living facility, or in your home. Many people do not have the resources to pay for long term care, including individuals who did well for themselves in their working years. This leaves Medicaid as the only viable option many have to pay for their long term care needs.

Free preview