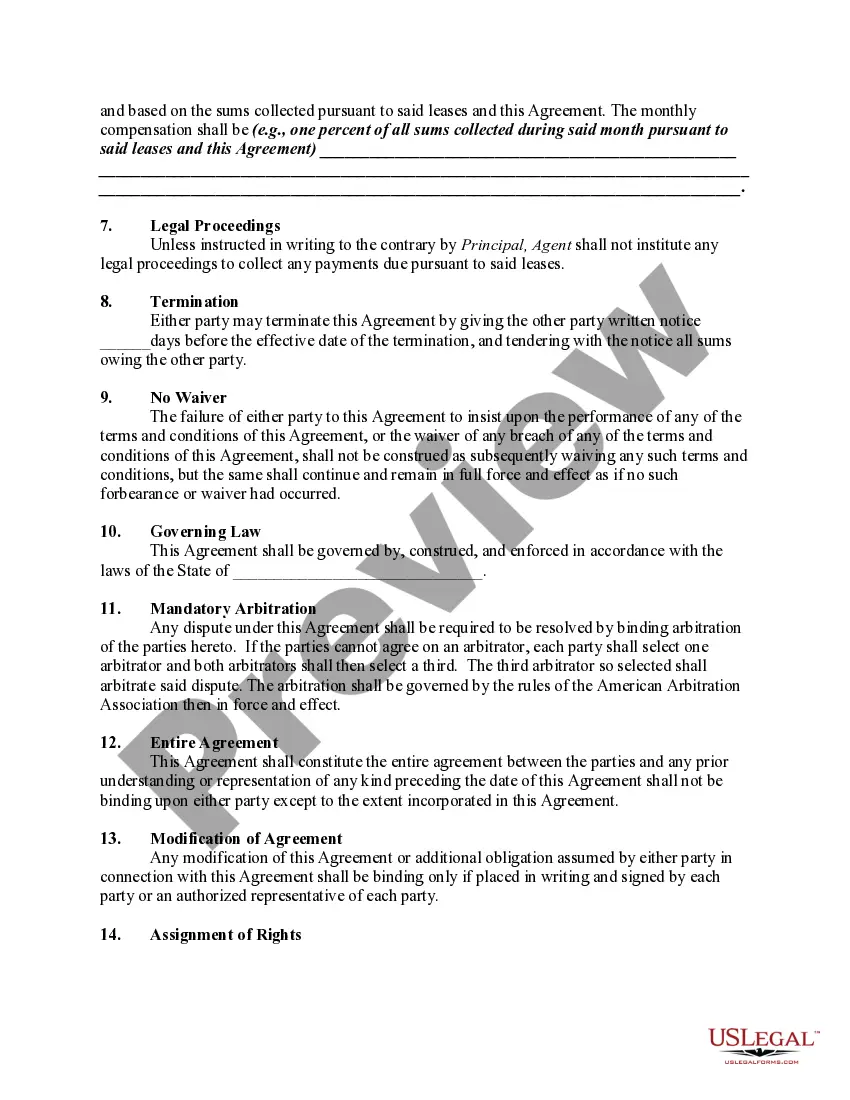

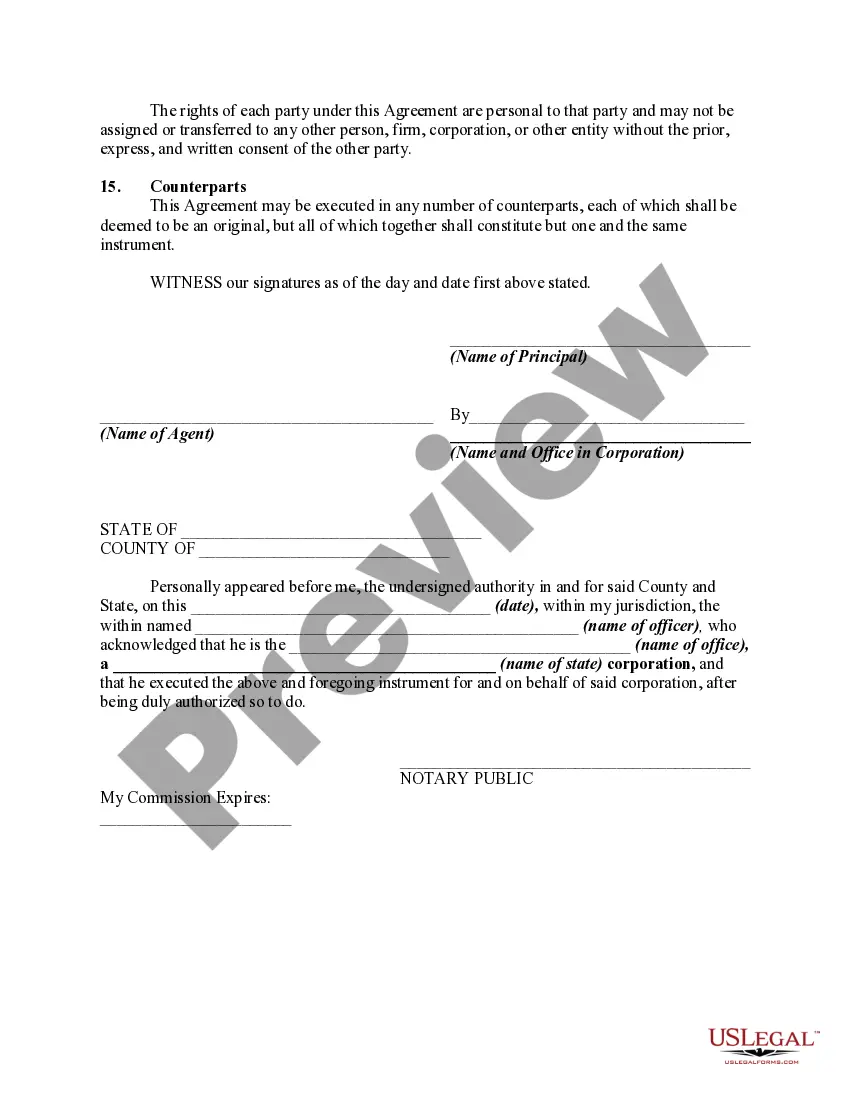

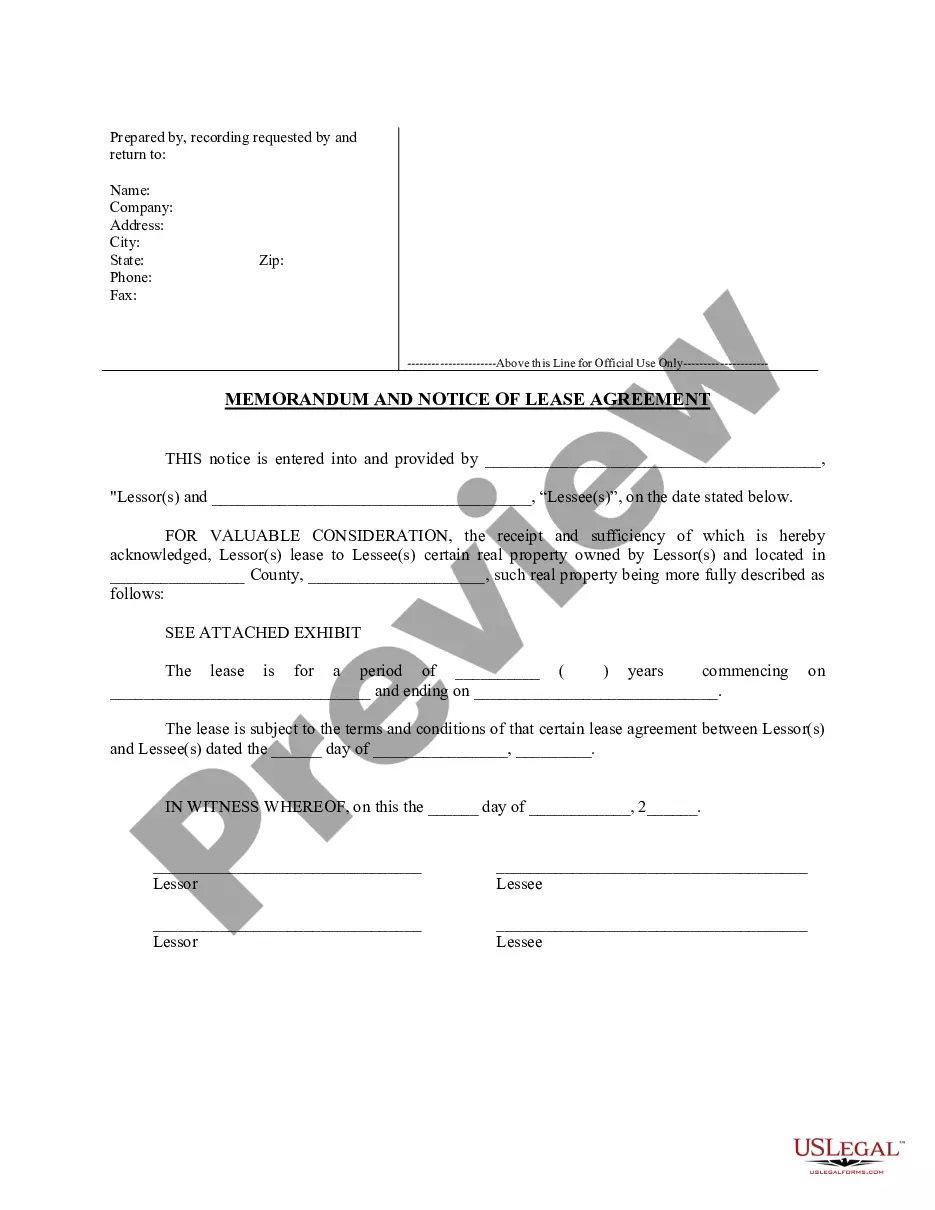

Philadelphia Pennsylvania Agreement Appointing an Agent to Collect Payments Owed Pursuant to Leases of Real Property is a legally binding document executed between a property owner (the "Principal") and an appointed agent (the "Agent") to facilitate the collection of rental payments from tenants (the "Lessees"). This agreement plays a crucial role in streamlining the payment process and ensuring timely collection of rental income. The Philadelphia Pennsylvania Agreement is tailored specifically to properties located within the city of Philadelphia, Pennsylvania, and is designed to align with the municipality's leasing laws and regulations. The agreement outlines the responsibilities and obligations of both the Principal and the Agent, ensuring a transparent and harmonious relationship throughout the payment collection process. This agreement serves to appoint the Agent as the exclusive representative of the Principal for all matters related to collecting rental payments from Lessees. It explicitly defines the scope of authority granted to the Agent, allowing them to act on behalf of the Principal in all matters concerning payment collection, disputes, and communication with Lessees. Key provisions of the Philadelphia Pennsylvania Agreement Appointing an Agent to Collect Payments Owed Pursuant to Leases of Real Property include: 1. Appointment and Authority: The document states the appointment of the Agent and outlines their authority to manage and collect payments on the Principal's behalf. It also emphasizes the Agent's responsibility to act in the Principal's best interests and comply with applicable laws and regulations. 2. Rental Payment Collection: The agreement specifies the method of payment collection, including the schedule, acceptable payment methods, and any applicable fees or penalties for late payments. It also addresses the allocation of collected funds, with provisions for deductions related to property management fees or repair expenses, if agreed upon. 3. Record-Keeping and Accounting: Both the Principal and the Agent are obligated to maintain accurate and up-to-date records of rental payments. This ensures transparency and facilitates regular reporting to the Principal, including detailed financial statements and reconciliation of collected funds. 4. Dispute Resolution: The agreement outlines the procedure for handling any disputes or issues that may arise between the Lessees and the Agent regarding payment collection. It may also include provisions for arbitration or mediation in case of unresolved disputes. Additional types of Philadelphia Pennsylvania agreements appointing an agent to collect payments owed pursuant to leases of real property may include variations specific to different types of properties, such as residential, commercial, or industrial. These agreements would encompass similar provisions but may have certain clauses tailored to the unique aspects and legal requirements of each property type.

Philadelphia Pennsylvania Agreement Appointing an Agent to Collect Payments Owed Pursuant to Leases of Real Property

Description

How to fill out Philadelphia Pennsylvania Agreement Appointing An Agent To Collect Payments Owed Pursuant To Leases Of Real Property?

Laws and regulations in every sphere vary throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Philadelphia Agreement Appointing an Agent to Collect Payments Owed Pursuant to Leases of Real Property, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you pick a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Philadelphia Agreement Appointing an Agent to Collect Payments Owed Pursuant to Leases of Real Property from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Philadelphia Agreement Appointing an Agent to Collect Payments Owed Pursuant to Leases of Real Property:

- Examine the page content to ensure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template once you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

When you fall behind in your property taxes in Pennsylvania, your home may be sold at an upset tax sale under Pennsylvania's Real Estate Tax Sale Law to satisfy the debt. If the property doesn't sell at the upset tax sale, then the tax claim bureau may proceed with a judicial tax sale.

? ABOUT PENNSYLVANIA. So Pennsylvania is a tax deed state. That means the county will seize/confiscate the property from the delinquent property tax owner.

All states have laws that allow the local government to sell a home through a tax sale process to collect delinquent taxes. Accordingly, failing to pay your real property taxes in Pennsylvania could lead to an upset tax sale or a judicial tax sale and the loss of your property.

Who pays transfer taxes in Pennsylvania: the buyer or the seller? According to the Pennsylvania Department of Revenue, both the seller and buyer are held jointly liable for the payment of transfer tax. What that means is that the two parties often split the cost equally between themselves.

There's also a 3.27% Philadelphia Realty Transfer Tax to take care of, in addition to a 1% tax from the Commonwealth. The Transfer Tax is imposed on the property's sale price or assessed value, plus any debts (liens or judgments) the seller may have, which the buyer agrees to pay.

The quickest way to check for liens in Pennsylvania is to visit the Pennsylvania Centre County official website and look up the lien records available there. In Pennsylvania, liens are public records uploaded on the assessor's website for public access.

The notice advises the taxpayer that a one year grace period is given in which to fully pay the claims, interest accrual (9% per year) and costs, otherwise the property will be advertised and subject to an Upset Tax Sale.

The tax is usually split evenly between the buyer and the seller, but this is not a legal requirement. The City has the right to collect 100% of the tax from either party, so it's in the best interest of the buyer to make sure the tax is paid in full at the closing of the sale.

The Upset Sale is conducted once a year and is the first sale at which a delinquent taxpayer's property may be sold. Properties which are delinquent in real estate taxes for the past two years are eligible for the Upset Sale. The sale of the property is subject to all liens and encumbrances at the time of sale.