A Dallas Texas Multistate Promissory Note — Secured is a legal document that outlines the terms and conditions of a financial arrangement between two parties, commonly known as the lender and the borrower, in the state of Texas. This note serves as evidence of a debt obligation and provides a clear understanding of the borrower's responsibilities and the lender's rights. Keywords: Dallas Texas, Multistate Promissory Note, Secured, legal document, financial arrangement, lender, borrower, debt obligation, responsibilities, rights. In Dallas, Texas, there are various types of Multistate Promissory Notes — Secured that cater to different situations and needs. Some key types include: 1. Real Estate Secured Promissory Note: This type of promissory note is used when the borrowed funds are specifically for real estate purposes. It ensures that the lender has a legal claim on the property until the debt is fully repaid. 2. Commercial Secured Promissory Note: This type of promissory note is utilized for business purposes, such as financing equipment, inventory, or other commercial assets. It typically includes additional provisions to protect the lender's interests in the event of default. 3. Personal Secured Promissory Note: This type of promissory note is used for personal loans, typically between family members or acquaintances. It may involve collateral such as a vehicle or valuable possession to secure the loan. 4. Small Business Secured Promissory Note: This type of promissory note is designed specifically for small businesses seeking financing. It ensures that the lender has a claim on the business assets until the loan is fully repaid. 5. Bridge Loan Secured Promissory Note: This type of promissory note is utilized when a borrower needs short-term financing to bridge the gap between two transactions, such as buying a new property before selling the existing one. It is secured by the collateral involved in the transaction. Dallas, Texas, being a major city with a diverse economy, offers a range of secured promissory notes to suit various financial needs and situations. These notes provide legal protection to both lenders and borrowers, outlining the terms of repayment and ensuring clarity in the loan transaction. Note: It is important to consult with a legal professional or attorney to ensure the proper drafting and execution of a Dallas Texas Multistate Promissory Note — Secured, as laws and regulations may vary.

Dallas Texas Multistate Promissory Note - Secured

Description

How to fill out Dallas Texas Multistate Promissory Note - Secured?

How much time does it normally take you to draft a legal document? Since every state has its laws and regulations for every life sphere, locating a Dallas Multistate Promissory Note - Secured meeting all local requirements can be exhausting, and ordering it from a professional attorney is often costly. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, grouped by states and areas of use. Aside from the Dallas Multistate Promissory Note - Secured, here you can get any specific document to run your business or individual deeds, complying with your county requirements. Experts check all samples for their validity, so you can be sure to prepare your paperwork properly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can retain the file in your profile anytime later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Dallas Multistate Promissory Note - Secured:

- Check the content of the page you’re on.

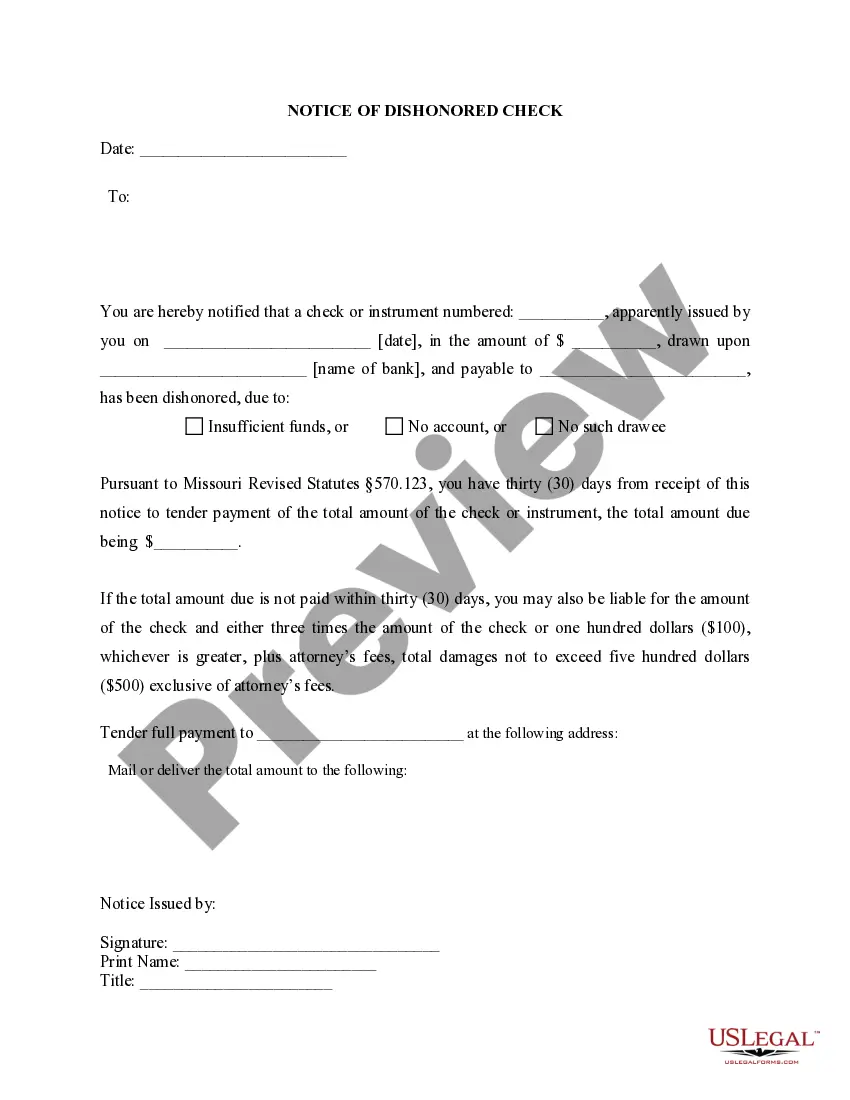

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Dallas Multistate Promissory Note - Secured.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!