A Miami-Dade Florida Multistate Promissory Note — Secured is a legal document that outlines the terms and conditions of a loan agreement between a lender and borrower in Miami-Dade County, Florida. This type of promissory note is used when multiple states are involved in the transaction, providing flexibility and compliance with various state laws. Keywords: Miami-Dade Florida, Multistate Promissory Note, Secured, loan agreement, lender, borrower, terms and conditions, multiple states, flexibility, compliance, state laws. There are different types of Miami-Dade Florida Multistate Promissory Note — Secured, depending on the specific requirements and circumstances of the loan agreement. Here are a few examples: 1. Miami-Dade Florida Multistate Promissory Note — Secured with collateral: This type of promissory note includes specific provisions for using collateral to secure the loan. The collateral can be any valuable asset, such as real estate, vehicles, or personal belongings. 2. Miami-Dade Florida Multistate Promissory Note — Secured with guarantor: In this type of promissory note, a third party acts as a guarantor, providing an additional layer of security for the lender. The guarantor is responsible for fulfilling the borrower's obligations if they default on the loan. 3. Miami-Dade Florida Multistate Promissory Note — Secured with adjustable interest rate: This version of the promissory note allows the interest rate to change over time, based on specific factors such as market fluctuations or predefined terms. This provides flexibility for both the lender and the borrower. 4. Miami-Dade Florida Multistate Promissory Note — Secured with balloon payment: A balloon payment promissory note includes a large payment due at the end of the loan term. This can be beneficial for both parties, as it allows for lower monthly payments while ensuring the loan's total repayment. 5. Miami-Dade Florida Multistate Promissory Note — Secured with prepayment penalty: This type of promissory note includes a clause that imposes a penalty fee if the borrower pays off the loan before the agreed-upon term. The prepayment penalty compensates the lender for potential interest income loss. Regardless of the specific type, a Miami-Dade Florida Multistate Promissory Note — Secured serves as a legally binding agreement that protects the interests of both parties involved in the loan transaction. It is crucial to ensure that the document is drafted accurately and reviewed by legal professionals familiar with the laws of all the states involved.

Miami-Dade Florida Multistate Promissory Note - Secured

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-00601-A

Format:

Word;

Rich Text

Instant download

Description

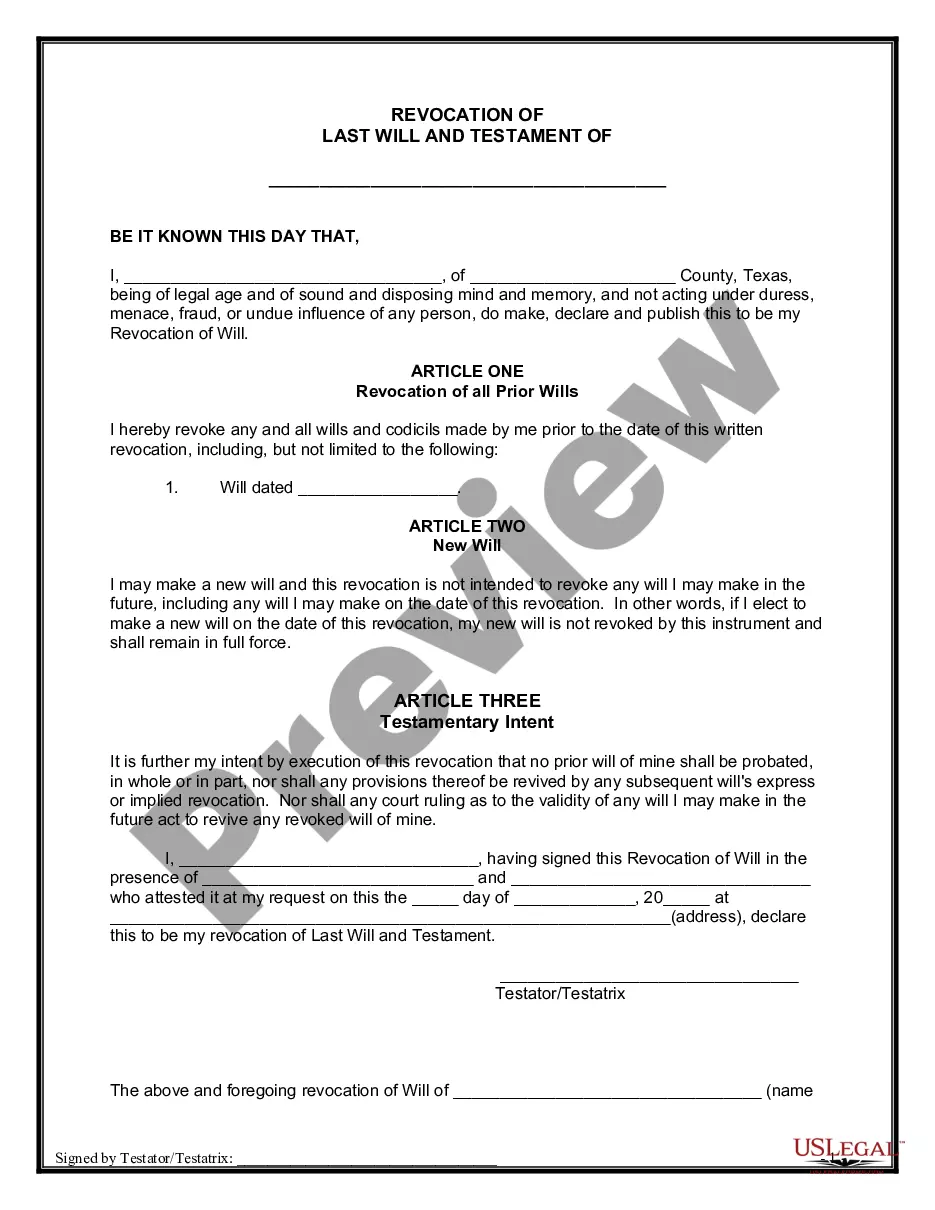

This form is a secured Promissory Note. The borrower promises to make all payments on the loan, with interest, to the lender. The form also provides that the maker has the right to make full or partial prepayments without paying prepayment charges.

A Miami-Dade Florida Multistate Promissory Note — Secured is a legal document that outlines the terms and conditions of a loan agreement between a lender and borrower in Miami-Dade County, Florida. This type of promissory note is used when multiple states are involved in the transaction, providing flexibility and compliance with various state laws. Keywords: Miami-Dade Florida, Multistate Promissory Note, Secured, loan agreement, lender, borrower, terms and conditions, multiple states, flexibility, compliance, state laws. There are different types of Miami-Dade Florida Multistate Promissory Note — Secured, depending on the specific requirements and circumstances of the loan agreement. Here are a few examples: 1. Miami-Dade Florida Multistate Promissory Note — Secured with collateral: This type of promissory note includes specific provisions for using collateral to secure the loan. The collateral can be any valuable asset, such as real estate, vehicles, or personal belongings. 2. Miami-Dade Florida Multistate Promissory Note — Secured with guarantor: In this type of promissory note, a third party acts as a guarantor, providing an additional layer of security for the lender. The guarantor is responsible for fulfilling the borrower's obligations if they default on the loan. 3. Miami-Dade Florida Multistate Promissory Note — Secured with adjustable interest rate: This version of the promissory note allows the interest rate to change over time, based on specific factors such as market fluctuations or predefined terms. This provides flexibility for both the lender and the borrower. 4. Miami-Dade Florida Multistate Promissory Note — Secured with balloon payment: A balloon payment promissory note includes a large payment due at the end of the loan term. This can be beneficial for both parties, as it allows for lower monthly payments while ensuring the loan's total repayment. 5. Miami-Dade Florida Multistate Promissory Note — Secured with prepayment penalty: This type of promissory note includes a clause that imposes a penalty fee if the borrower pays off the loan before the agreed-upon term. The prepayment penalty compensates the lender for potential interest income loss. Regardless of the specific type, a Miami-Dade Florida Multistate Promissory Note — Secured serves as a legally binding agreement that protects the interests of both parties involved in the loan transaction. It is crucial to ensure that the document is drafted accurately and reviewed by legal professionals familiar with the laws of all the states involved.

Free preview