Oakland Michigan Multistate Promissory Note — Secured: The Oakland Michigan Multistate Promissory Note — Secured is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This specific type of promissory note is tailored for individuals or businesses residing or operating in Oakland County, Michigan. A secured promissory note means that the borrower offers collateral as a form of security to the lender. In case of default, the lender has the right to seize the collateral to recover the outstanding loan amount. The collateral can be any valuable asset acceptable to the lender, such as real estate property or vehicles. Key elements included in this note are: 1. Parties Involved: The note identifies the lender, often referred to as the holder, and the borrower, known as the maker. 2. Loan Amount and Interest Rate: The note specifies the principal loan amount provided by the lender to the borrower. It also outlines the interest rate charged on the loan. 3. Repayment Schedule: The note includes a detailed repayment schedule indicating the dates and amounts of the installments the borrower must pay to the lender to repay the loan along with interest. 4. Default and Remedies: The note outlines the consequences of default, which may include acceleration (demanding immediate payment of the entire outstanding balance), late fees, or legal action. It also describes the remedies available to the lender in case of default, mainly the right to seize the collateral. 5. Governing Law: The Oakland Michigan Multistate Promissory Note — Secured is governed by the laws of the state of Michigan and, more specifically, those applicable to Oakland County. Different types of Oakland Michigan Multistate Promissory Note — Secured can include variations in terms and conditions depending on the specific agreement reached between the lender and the borrower. These variations can involve differences in the interest rate, repayment period, collateral, and any additional provisions agreed upon. It is important to consult with legal professionals specializing in loan agreements to draft a comprehensive and enforceable Oakland Michigan Multistate Promissory Note — Secured that meets the specific requirements of both the lender and the borrower.

Oakland Michigan Multistate Promissory Note - Secured

Description

How to fill out Oakland Michigan Multistate Promissory Note - Secured?

How much time does it normally take you to draft a legal document? Because every state has its laws and regulations for every life sphere, locating a Oakland Multistate Promissory Note - Secured suiting all regional requirements can be stressful, and ordering it from a professional attorney is often expensive. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, gathered by states and areas of use. In addition to the Oakland Multistate Promissory Note - Secured, here you can get any specific form to run your business or personal affairs, complying with your regional requirements. Experts verify all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can get the file in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your Oakland Multistate Promissory Note - Secured:

- Check the content of the page you’re on.

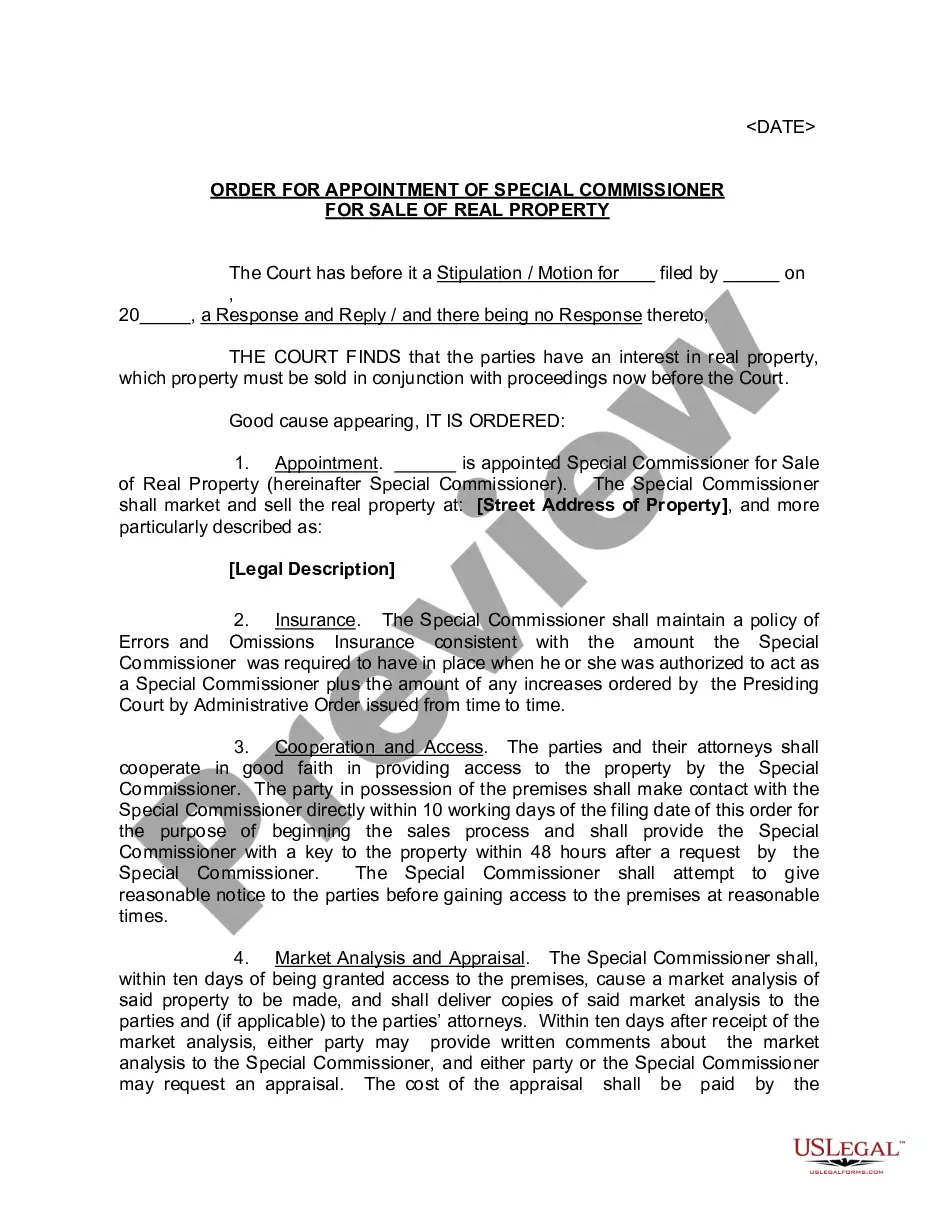

- Read the description of the template or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Oakland Multistate Promissory Note - Secured.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!