The Orange California Multistate Promissory Note — Secured is a legal document that serves as a written agreement between a borrower and a lender. This specific type of promissory note is designed to secure the repayment of a loan with collateral in Orange County, California. The Orange California Multistate Promissory Note — Secured provides a detailed description of the loan terms, including the principal amount, interest rate, repayment schedule, late fees, and other relevant terms and conditions. The note also specifies the collateral that is being pledged as security for the loan. This could include real estate, vehicles, or other valuable assets. There are different types of Orange California Multistate Promissory Note — Secured, each tailored to specific lending situations. Some of these variations include: 1. Real Estate Secured Promissory Note: This type of promissory note is used when the borrower pledges real estate as collateral. It outlines the property details, such as address, legal description, and any relevant encumbrances or liens. 2. Vehicle Secured Promissory Note: This variation is used when the borrower pledges a vehicle as collateral. It provides details about the vehicle make, model, year, VIN number, and other relevant information. 3. Asset-Backed Promissory Note: This type of promissory note allows the borrower to pledge any valuable asset (besides real estate or vehicles) as collateral. The note specifies the nature of the asset and provides detailed information about its value and ownership. 4. Cross-Collateralized Promissory Note: In some cases, borrowers may pledge multiple assets as collateral. This type of promissory note outlines the specifics of each asset and how they collectively secure the loan. The Orange California Multistate Promissory Note — Secured is an essential legal document that protects the interests of both the borrower and the lender. It provides a clear understanding of the loan terms, ensures repayment, and allows the lender to take legal action in case of default. Borrowers should carefully review and understand the terms before signing the note, and it is recommended to consult legal professionals for advice specific to their situation.

Orange California Multistate Promissory Note - Secured

Description

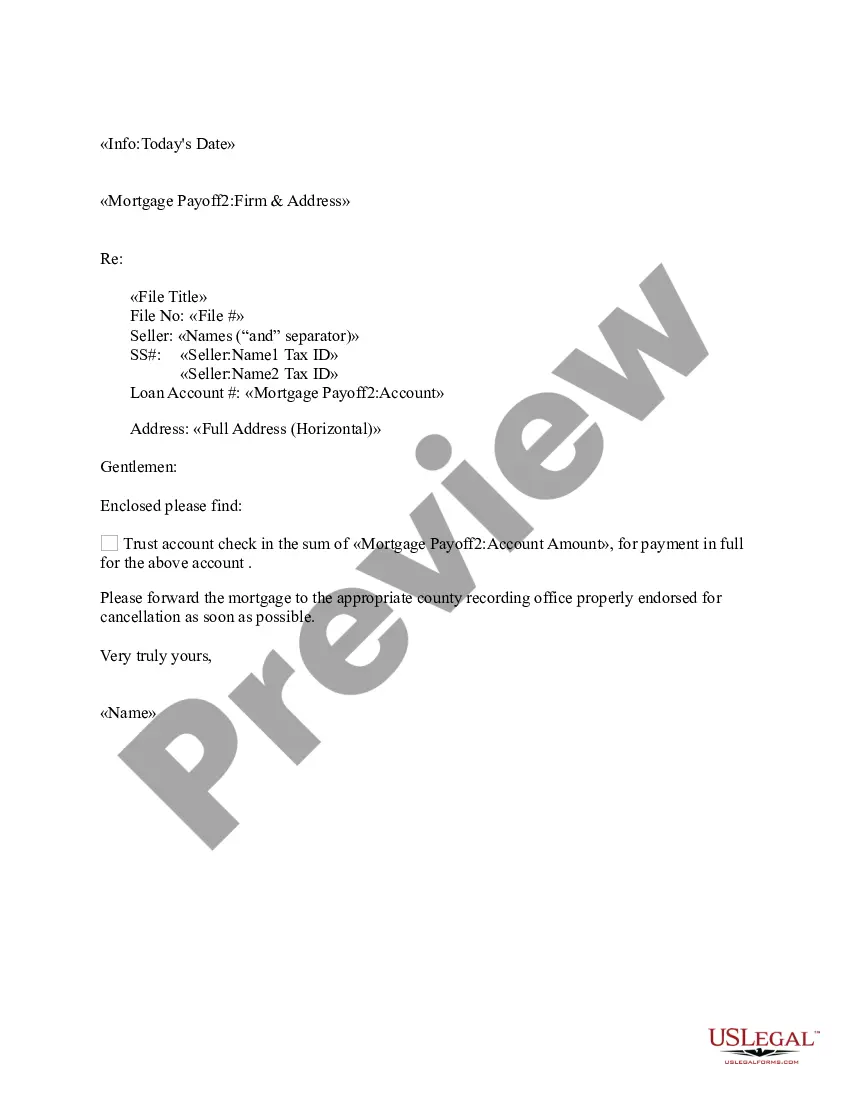

How to fill out Orange California Multistate Promissory Note - Secured?

How much time does it normally take you to create a legal document? Since every state has its laws and regulations for every life scenario, locating a Orange Multistate Promissory Note - Secured suiting all regional requirements can be stressful, and ordering it from a professional attorney is often expensive. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, collected by states and areas of use. Apart from the Orange Multistate Promissory Note - Secured, here you can find any specific document to run your business or personal deeds, complying with your regional requirements. Specialists check all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can retain the file in your profile at any moment later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Orange Multistate Promissory Note - Secured:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Orange Multistate Promissory Note - Secured.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!