A Salt Lake Utah Multistate Promissory Note — Secured is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender. In this case, it specifically applies to the state of Utah, with Salt Lake City being the capital. This type of promissory note is classified as "secured," which means that the borrower pledges collateral as security for the loan. The collateral can be any valuable asset, such as real estate, vehicles, or other personal property. By securing the loan, the lender has a legal right to seize and sell the collateral if the borrower fails to repay the loan according to the agreed terms. There are several types of Salt Lake Utah Multistate Promissory Notes — Secured that may be utilized, depending on the specific loan agreement. Some common variations include: 1. Real Estate Secured Promissory Note: This type of promissory note involves a loan secured by real property, such as a house, land, or commercial building. 2. Vehicle Secured Promissory Note: This variation applies when the loan is secured by a vehicle, such as a car, motorcycle, or boat. 3. Personal Property Secured Promissory Note: In this case, tangible personal property, like jewelry, artwork, or machinery, serves as collateral for the loan. When drafting a Salt Lake Utah Multistate Promissory Note — Secured, certain essential elements should be included: a. Loan Amount: Clearly state the principal amount that the borrower is receiving from the lender. b. Interest Rate: Specify the agreed-upon interest rate that will be applied to the loan. c. Repayment Terms: Outline the repayment schedule, including the frequency of payments and the due dates. d. Collateral Description: Detail the collateral being pledged as security for the loan, including a clear description and its estimated value. e. Default and Remedies: Explain the consequences if the borrower fails to repay the loan, including the lender's rights to seize and sell the collateral. It's crucial for both the borrower and lender to carefully review and understand the terms and conditions of a Salt Lake Utah Multistate Promissory Note — Secured before signing. Consulting with a legal professional experienced in financial contracts is advisable to ensure compliance with Utah state law and protect the interests of both parties involved.

Salt Lake Utah Multistate Promissory Note - Secured

Description

How to fill out Salt Lake Utah Multistate Promissory Note - Secured?

Whether you intend to start your business, enter into an agreement, apply for your ID update, or resolve family-related legal concerns, you must prepare specific paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business case. All files are collected by state and area of use, so opting for a copy like Salt Lake Multistate Promissory Note - Secured is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few additional steps to obtain the Salt Lake Multistate Promissory Note - Secured. Adhere to the guidelines below:

- Make sure the sample fulfills your individual needs and state law requirements.

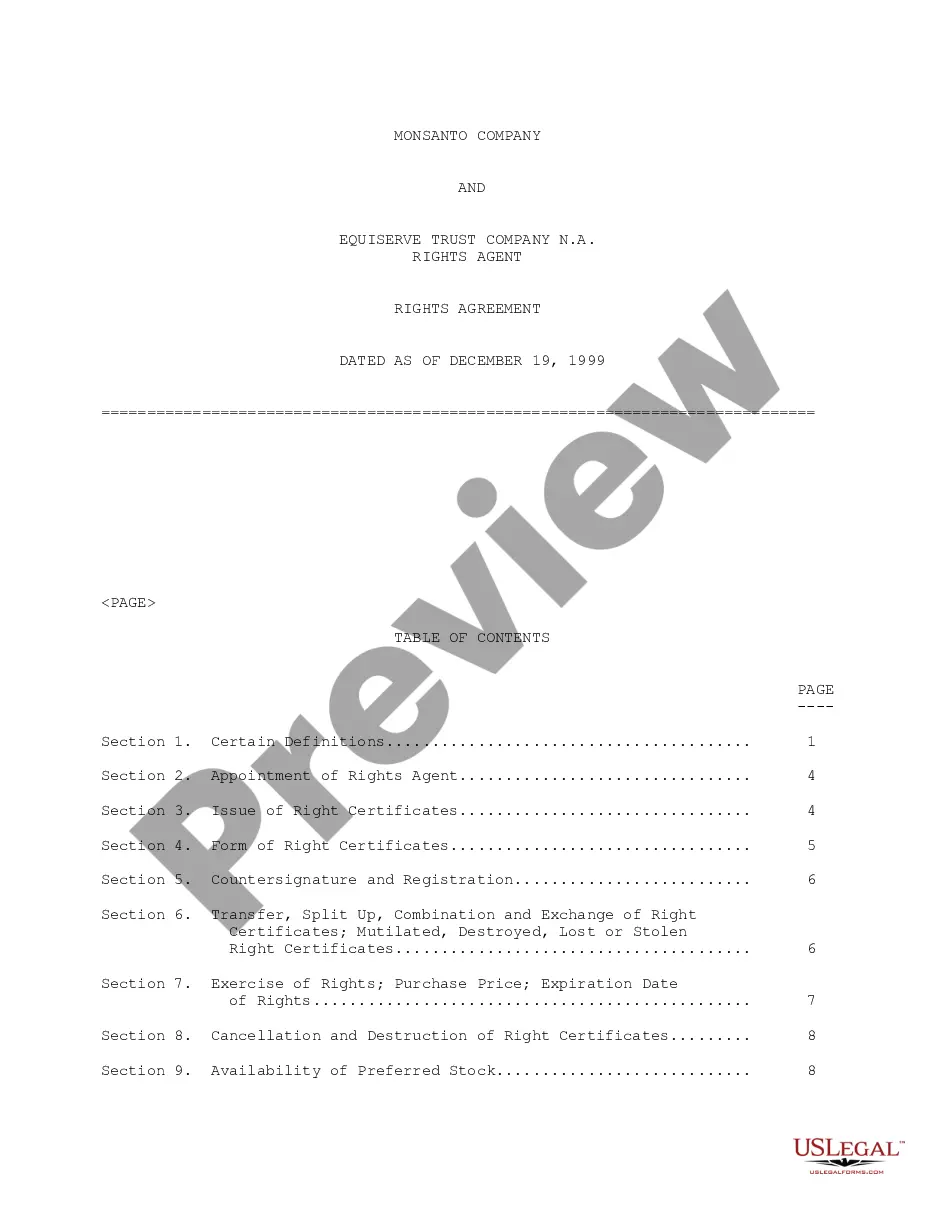

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to obtain the file when you find the right one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Salt Lake Multistate Promissory Note - Secured in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!