The Suffolk New York Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust or Security Agreement is a legal document that pertains to real estate transactions involving balloon payments in the Suffolk County area of New York. This addendum and rider are essential components in the mortgage or deed of trust agreement, providing specific terms and conditions, as well as added security measures for the lender. The main purpose of the Suffolk New York Balloon Secured Note Addendum and Rider is to clearly outline the terms of a balloon payment, which is a large payment due at the end of a loan term after a series of smaller, regular payments. This addendum ensures that both the borrower and the lender fully understand their financial obligations and rights throughout the loan repayment process. Specific keywords relevant to this topic could include: 1. Suffolk New York: Refers to the geographical location of the real estate transaction, specifically the Suffolk County area in the state of New York. 2. Balloon Secured Note: Describes the type of loan agreement in which a larger "balloon" payment is due at the end of the loan term. 3. Addendum: Refers to an additional document that is attached to an existing contract (e.g., mortgage or deed of trust agreement) to modify or supplement certain terms. 4. Rider: Denotes an addendum or amendment to a contract that specifies additional terms or conditions that are not typically included in the main agreement. 5. Mortgage: A loan agreement in which the borrower pledges a property as collateral for the loan, granting the lender a security interest. 6. Deed of Trust: A similar agreement to a mortgage, where the borrower transfers legal title to a trustee to hold as security for the loan. 7. Security Agreement: Provides a legal framework outlining the rights and obligations concerning the collateral used to secure a loan. While there may not be different types of Suffolk New York Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust, or Security Agreement, there might be variations in terms and clauses depending on the specific needs and preferences of the parties involved. It's essential to consult with legal professionals and ensure that all relevant details are addressed in the document to protect the interests of both the borrower and the lender.

Suffolk New York Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust or Security Agreement

Description

How to fill out Suffolk New York Balloon Secured Note Addendum And Rider To Mortgage, Deed Of Trust Or Security Agreement?

Whether you plan to open your business, enter into an agreement, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business occurrence. All files are collected by state and area of use, so opting for a copy like Suffolk Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust or Security Agreement is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several additional steps to get the Suffolk Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust or Security Agreement. Follow the instructions below:

- Make certain the sample fulfills your personal needs and state law requirements.

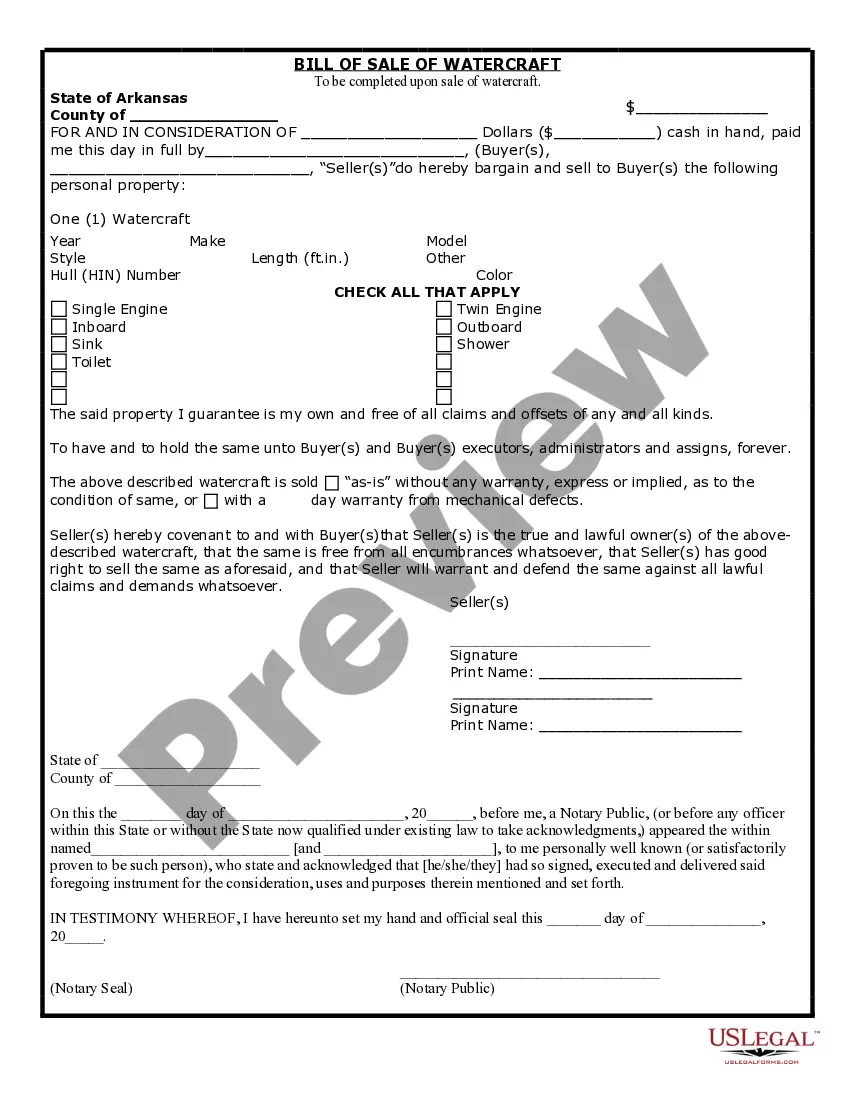

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to obtain the sample when you find the right one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Suffolk Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust or Security Agreement in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!