Houston Texas Balloon Secured Note is a type of financial instrument commonly used in real estate transactions. This note is specifically associated with the Houston area in Texas and is designed to provide a secure loan option for both borrowers and lenders. It offers flexibility in terms of repayment as it features a balloon payment at the end of the loan term. A Balloon Secured Note typically has a relatively short repayment schedule, typically ranging from three to ten years. During this period, borrowers make regular payments consisting of principal and interest. However, unlike a traditional loan where the principal is gradually reduced over time, the principal amount of a Houston Texas Balloon Secured Note remains the same or is minimally reduced. The distinguishing feature of a Balloon Secured Note is the lump sum payment, called a balloon payment, due at the end of the loan term. This balloon payment is typically significantly larger than the periodic payments made throughout the term. Borrowers are generally required to refinance or find alternative financing options to meet this payment. Houston Texas Balloon Secured Notes are commonly used in commercial real estate transactions, where the property's cash flow or value is expected to increase over time, providing borrowers the necessary liquidity to make the final balloon payment. This type of note can be particularly beneficial for property developers or individuals who anticipate substantial income or proceeds from the property before the loan term's expiration. While there may not be different types of Houston Texas Balloon Secured Notes, variations can exist in terms of loan amounts, interest rates, loan-to-value ratios, and repayment periods. These variations are subject to negotiation between the borrower and lender to meet specific financial needs and risk appetite. In summary, the Houston Texas Balloon Secured Note is a financing tool that provides borrowers with short-term capital while deferring a significant payment until the end of the loan term. It offers flexibility but also poses a risk if borrowers fail to secure appropriate refinancing or alternative funding to meet the balloon payment.

Houston Texas Balloon Secured Note

Description

How to fill out Houston Texas Balloon Secured Note?

Drafting papers for the business or personal needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's important to take into account all federal and state laws of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to draft Houston Balloon Secured Note without expert assistance.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Houston Balloon Secured Note by yourself, using the US Legal Forms web library. It is the most extensive online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed form.

In case you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Houston Balloon Secured Note:

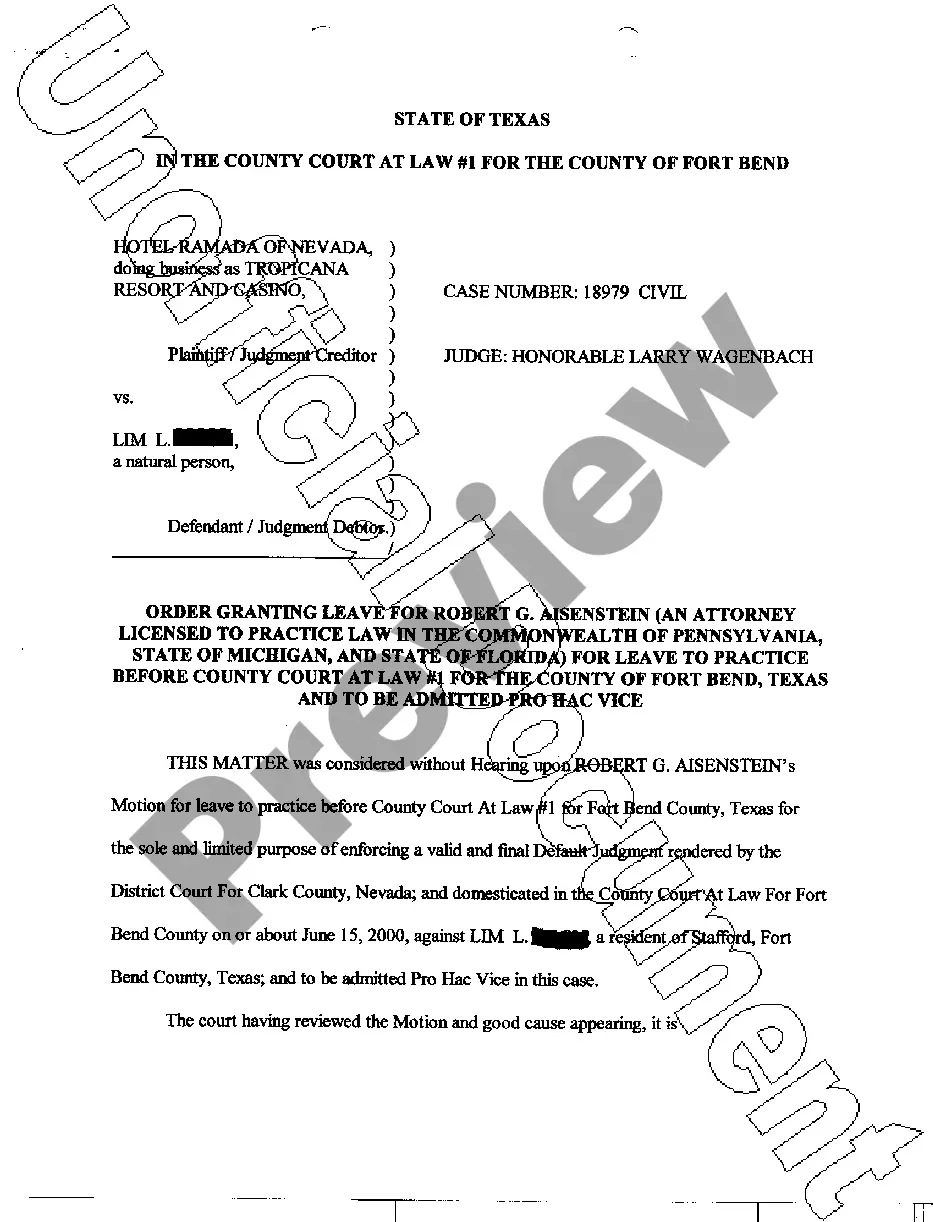

- Examine the page you've opened and check if it has the sample you need.

- To do so, use the form description and preview if these options are available.

- To find the one that suits your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any scenario with just a couple of clicks!