A Broward Florida Security Agreement for Promissory Note is a legal document that establishes a security interest in collateral to secure the repayment of a promissory note in Broward County, Florida. This agreement provides protection to the lender by outlining the terms and conditions under which the borrower grants a security interest in specified assets as collateral for the loan. The Broward Florida Security Agreement for Promissory Note typically contains the following key elements: 1. Parties: It identifies the parties involved in the agreement, namely the lender (often referred to as the secured party) and the borrower (often referred to as the debtor). 2. Description of collateral: This section describes the specific assets or property that the borrower pledges as collateral to secure the promissory note. The collateral can include real estate, personal property, vehicles, equipment, inventory, or any other valuable asset. 3. Security interest: The agreement establishes a security interest in the collateral, allowing the lender to repossess and sell the assets in the event of non-payment or default. 4. Representations and warranties: The borrower typically represents and warrants that they have legal ownership of the collateral, free from any liens or claims, and that they have the right to pledge the assets as security. 5. Default provisions: The agreement states the conditions under which the borrower will be considered in default, such as non-payment or violation of other loan terms. It also outlines the rights and remedies available to the lender in case of default, including repossession and sale of the collateral. 6. Release of collateral: Once the borrower fulfills their obligations under the promissory note, this section specifies the conditions under which the security interest in the collateral will be released. Different types of Broward Florida Security Agreement for Promissory Notes may exist depending on the specific circumstances and nature of the loan. Some common variations include: 1. Real Estate Security Agreement: This type of security agreement focuses on using real estate as collateral for the promissory note. It specifies the property's details, such as address, legal description, and any encumbrances. 2. Personal Property Security Agreement: This agreement primarily deals with using personal property, such as equipment, inventory, or accounts receivable, as collateral. 3. Vehicle Security Agreement: In cases where a vehicle is used as collateral, this agreement specifically outlines the details of the vehicle, including make, model, VIN, and any liens or encumbrances against it. 4. Cross-Collateralization Agreement: This type of agreement applies when multiple assets are pledged as collateral for multiple promissory notes. It allows the lender to use any of the pledged collateral to satisfy a default in any of the underlying loans. It is essential to consult with legal professionals specializing in Broward County, Florida, to ensure the accuracy and validity of the Broward Florida Security Agreement for Promissory Note.

Broward Florida Security Agreement for Promissory Note

Description

How to fill out Broward Florida Security Agreement For Promissory Note?

How much time does it typically take you to draw up a legal document? Considering that every state has its laws and regulations for every life sphere, locating a Broward Security Agreement for Promissory Note meeting all regional requirements can be stressful, and ordering it from a professional lawyer is often costly. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, grouped by states and areas of use. In addition to the Broward Security Agreement for Promissory Note, here you can get any specific form to run your business or individual deeds, complying with your regional requirements. Specialists check all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can retain the file in your profile at any time later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Broward Security Agreement for Promissory Note:

- Check the content of the page you’re on.

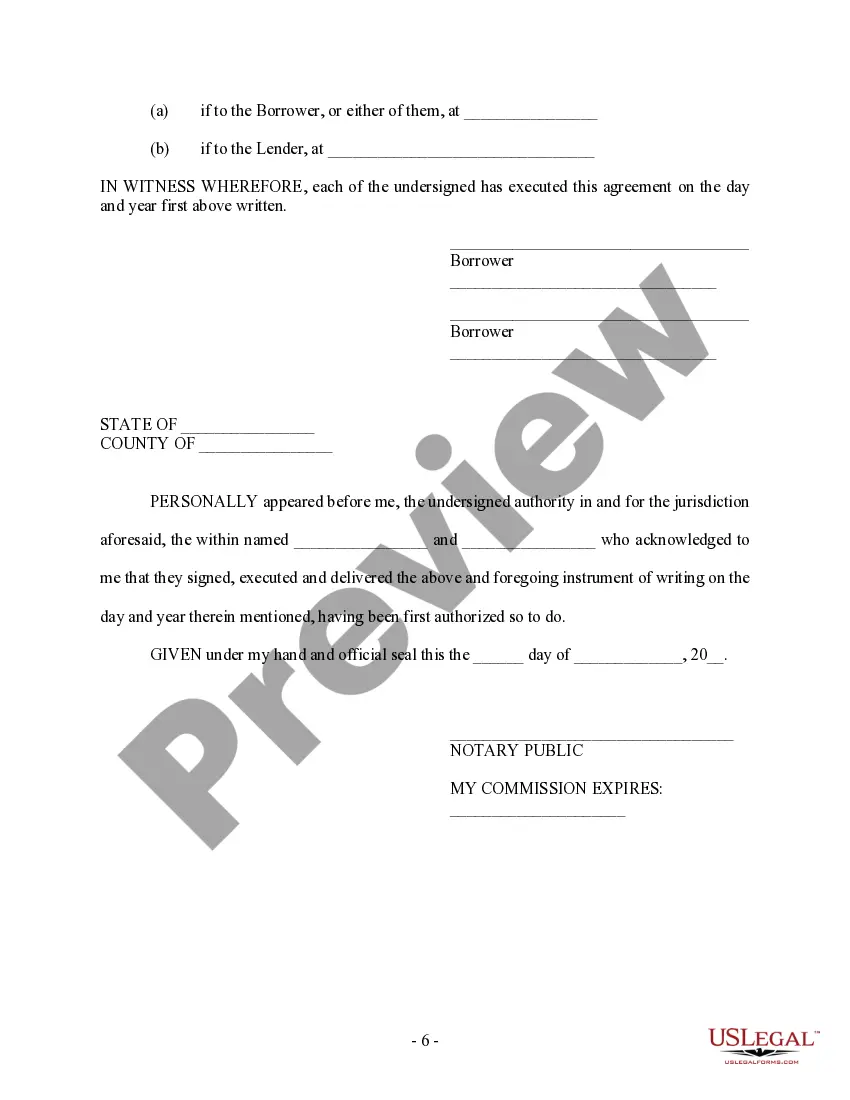

- Read the description of the sample or Preview it (if available).

- Search for another form using the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Broward Security Agreement for Promissory Note.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!