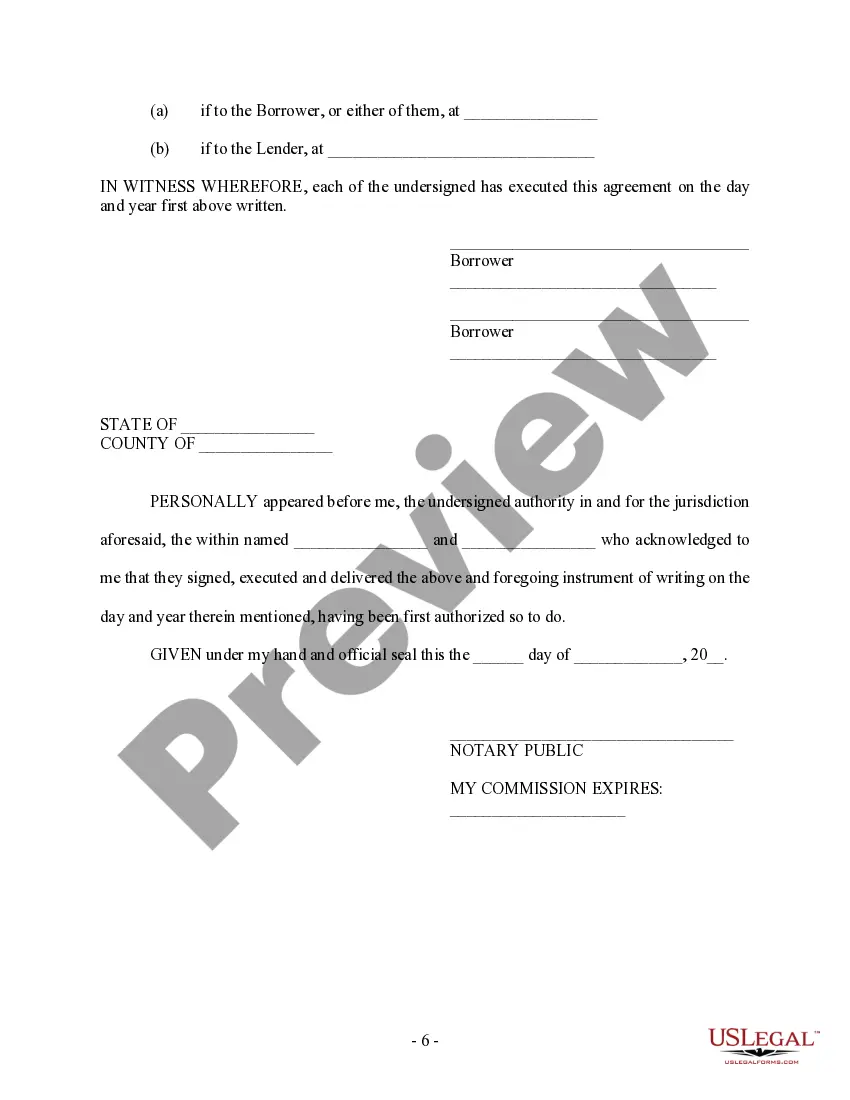

The Miami-Dade Florida Security Agreement for Promissory Note is a legal document used to provide security for a promissory note in the Miami-Dade County area of Florida. This agreement serves as a guarantee that the lender has certain collateral that they can claim in the event of default by the borrower. This Security Agreement is an essential component of a promissory note transaction, as it helps protect the lender's interest and ensure they have recourse if the borrower fails to fulfill their repayment obligations. The document outlines the terms and conditions of the collateral attached and provides legal protection for both parties involved. There are various types of security agreements for promissory notes depending on the specific arrangement between the borrower and the lender. These agreements often include specific details such as the type of collateral, its value, and how it will be secured and maintained. Some common types of Miami-Dade Florida Security Agreements for Promissory Notes include: 1. Real Estate Security Agreement: This type of agreement involves using real estate property as collateral. The property's legal description, value, and any existing liens or mortgages are typically included in this agreement. 2. Personal Property Security Agreement: In cases where borrowers do not have real estate to offer as collateral, they can use personal property such as vehicles, machinery, equipment, or inventory. This agreement would describe the specific personal property used as security. 3. Business Asset Security Agreement: For businesses, this type of security agreement involves using specific business assets as collateral, such as accounts receivable, intellectual property rights, or equipment. The agreement would outline the assets being used as collateral and any restrictions or conditions. 4. Commingled Asset Security Agreement: This agreement is relevant when the borrower combines multiple types of collateral, such as real estate, personal property, and business assets, to secure the promissory note. It details each asset and its respective value as well as any interactions or restrictions related to the commingling of collateral. The Miami-Dade Florida Security Agreement for Promissory Note provides legal protection and clarity for both borrowers and lenders. It ensures that lenders have a means to recover their investment in the event of default while providing borrowers with clear guidelines regarding the collateral put at risk. It is crucial for all parties involved to seek legal counsel when creating and signing this agreement to ensure compliance with Florida laws and protect their interests.

Miami-Dade Florida Security Agreement for Promissory Note

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-00601-F

Format:

Word;

Rich Text

Instant download

Description

This Security Agreement for Promissory Note is an agreement that the Lender has required as a condition to making the Loan to the Borrower. The Borrower will offer collateral to the Lender in return for the advancing of the loan. This form can be used in all states.

The Miami-Dade Florida Security Agreement for Promissory Note is a legal document used to provide security for a promissory note in the Miami-Dade County area of Florida. This agreement serves as a guarantee that the lender has certain collateral that they can claim in the event of default by the borrower. This Security Agreement is an essential component of a promissory note transaction, as it helps protect the lender's interest and ensure they have recourse if the borrower fails to fulfill their repayment obligations. The document outlines the terms and conditions of the collateral attached and provides legal protection for both parties involved. There are various types of security agreements for promissory notes depending on the specific arrangement between the borrower and the lender. These agreements often include specific details such as the type of collateral, its value, and how it will be secured and maintained. Some common types of Miami-Dade Florida Security Agreements for Promissory Notes include: 1. Real Estate Security Agreement: This type of agreement involves using real estate property as collateral. The property's legal description, value, and any existing liens or mortgages are typically included in this agreement. 2. Personal Property Security Agreement: In cases where borrowers do not have real estate to offer as collateral, they can use personal property such as vehicles, machinery, equipment, or inventory. This agreement would describe the specific personal property used as security. 3. Business Asset Security Agreement: For businesses, this type of security agreement involves using specific business assets as collateral, such as accounts receivable, intellectual property rights, or equipment. The agreement would outline the assets being used as collateral and any restrictions or conditions. 4. Commingled Asset Security Agreement: This agreement is relevant when the borrower combines multiple types of collateral, such as real estate, personal property, and business assets, to secure the promissory note. It details each asset and its respective value as well as any interactions or restrictions related to the commingling of collateral. The Miami-Dade Florida Security Agreement for Promissory Note provides legal protection and clarity for both borrowers and lenders. It ensures that lenders have a means to recover their investment in the event of default while providing borrowers with clear guidelines regarding the collateral put at risk. It is crucial for all parties involved to seek legal counsel when creating and signing this agreement to ensure compliance with Florida laws and protect their interests.

Free preview