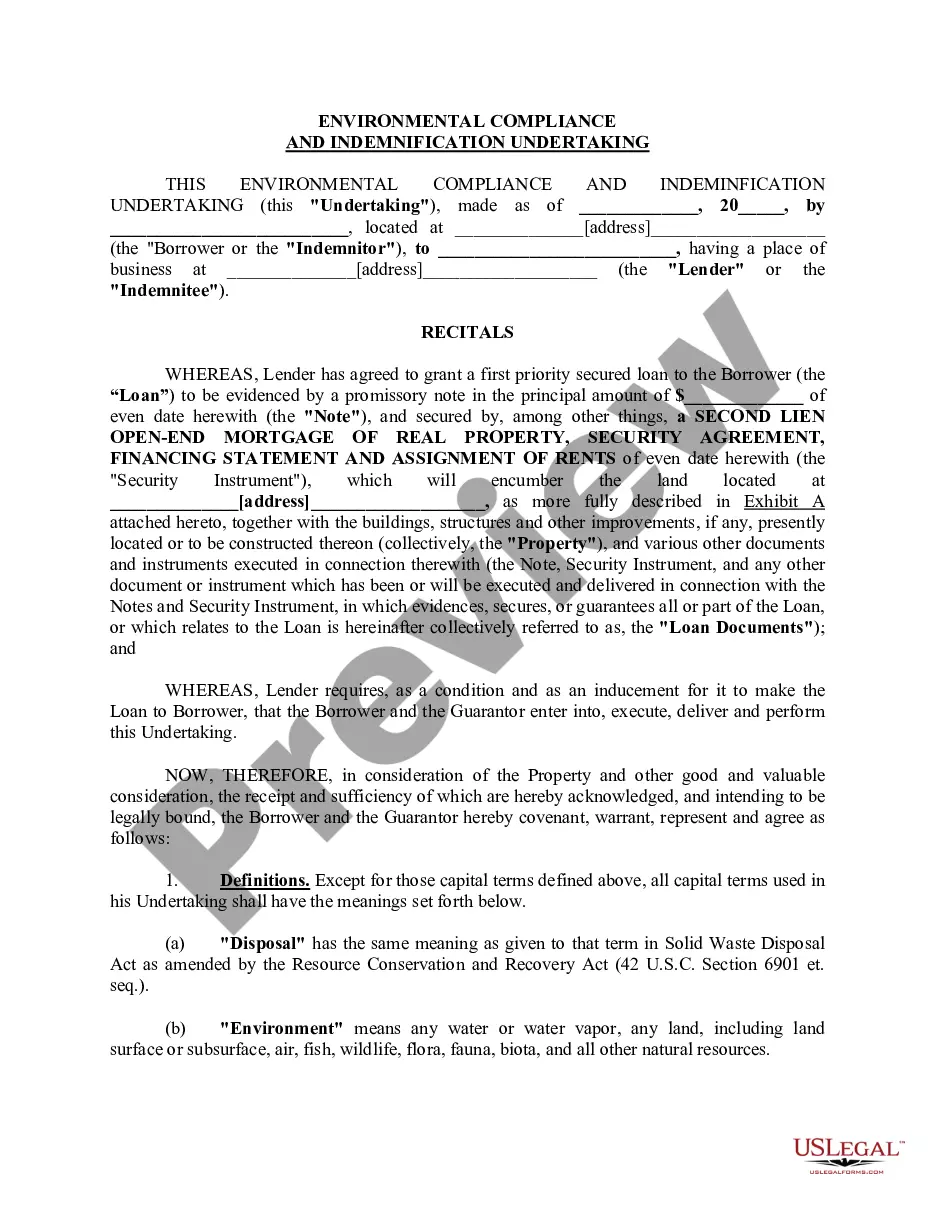

A Phoenix Arizona Security Agreement for Promissory Note is a legally binding document that adds an extra layer of security to a promissory note. Promissory notes are commonly used in business transactions where one party extends credit to another and outlines the repayment terms. The Security Agreement serves to protect the lender's interests by providing collateral in case of default or non-payment by the borrower. In Phoenix, Arizona, there are several types of Security Agreements for Promissory Notes, tailored to specific situations and needs. These might include: 1. Real Estate Security Agreement: This type of agreement involves using property, usually real estate, as collateral for the promissory note. It provides the lender with security in the form of the property and allows them to foreclose on the property in the event of default. 2. Personal Property Security Agreement: In cases where the borrower does not have real estate assets to offer as collateral, a Personal Property Security Agreement can be used. This agreement allows the lender to take possession of and sell the borrower's personal property, such as vehicles, equipment, or inventory, to recover the debt. 3. Accounts Receivable Security Agreement: Businesses that have outstanding invoices or accounts receivable can use this type of agreement. It allows the lender to take control of the borrower's accounts receivable and collect payments directly from customers if the borrower fails to repay the promissory note. 4. Investment Security Agreement: When a borrower has various investment assets, such as stocks, bonds, or mutual funds, they can be used as collateral. An Investment Security Agreement enables the lender to seize and sell these investments if the borrower defaults on the promissory note. The Phoenix Arizona Security Agreement for Promissory Note typically includes essential information such as the names of the parties involved, details of the promissory note, a description of the collateral, and any specific terms or conditions agreed upon. Moreover, it will outline the rights and obligations of both the lender and borrower in case of default. Creating a Security Agreement for Promissory Note in Phoenix, Arizona is crucial to ensure that lenders have legal protection and recourse if the borrower fails to fulfill their repayment obligations. It is advisable to consult with a legal professional or attorney to ensure the agreement conforms to all applicable laws and provides the necessary security for the lender.

Phoenix Arizona Security Agreement for Promissory Note

Description

How to fill out Phoenix Arizona Security Agreement For Promissory Note?

How much time does it normally take you to create a legal document? Considering that every state has its laws and regulations for every life situation, finding a Phoenix Security Agreement for Promissory Note suiting all regional requirements can be exhausting, and ordering it from a professional lawyer is often expensive. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. Aside from the Phoenix Security Agreement for Promissory Note, here you can get any specific document to run your business or individual deeds, complying with your county requirements. Experts verify all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can get the document in your profile anytime in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Phoenix Security Agreement for Promissory Note:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Phoenix Security Agreement for Promissory Note.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Security agreements are generally used to supplement a secured promissory note. The note is the borrower's actual promise to repay the money it received. The enclosed security agreement assumes the existence of a secured promissory note, but that agreement is not included with this package.

Unlike a deed of trust or mortgage, the promissory note is typically not recorded in the county land records (except in a few states like Florida). Instead, the lender holds on to this document until the amount borrowed is repaid.

Secured Promissory Notes A secured promissory note is an obligation to pay that is secured by some type of property. This means that if the payor fails to pay, the payee can seize the designated property to obtain reimbursement of the loan.

A security agreement is used in conjunction with a secured promissory note. The terms of the secured promissory note typically includes a reference to the security agreement and a brief description of the related collateral.

The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

Loans from banks or other institutional lenders are always made using a number of documents, two of which are a promissory and security agreement. In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

So, what's the difference between secured and unsecured promissory notes? It's actually quite simple. A secured note is any debt collateralized with real property like a first deed of trust or car title. Conversely, an unsecured note is any debt not secured by collateral (or uncollateralized).

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.

Generally, a Secured Promissory Note will be secured using an additional document. If the property being used as collateral is personal property, the Note will be secured using a Security Agreement. If the property being used as collateral is real property, the Note will be secured using a Deed of Trust.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.