A Contra Costa California Secured Promissory Note is a legally binding contract between a lender and a borrower in Contra Costa County, California. It serves as evidence of a loan agreement in which the borrower promises to repay a specific amount of money borrowed from the lender, usually with interest, within a predetermined time frame. This type of promissory note is referred to as "secured" because it is backed by collateral provided by the borrower, generally in the form of a property or asset. The inclusion of collateral ensures that the lender has a legal claim to the secured property in case of default on the loan. This provides the lender with added protection and increases the likelihood of loan repayment. Contra Costa California Secured Promissory Notes can be used for various purposes, such as personal loans, business loans, real estate transactions, or any situation where a borrower needs to secure a loan and is willing to offer collateral. The terms and conditions of the note, including interest rates, repayment schedules, and penalties for default, are agreed upon by both parties before signing the document. Different types of Contra Costa California Secured Promissory Notes may include: 1. Real Estate Secured Promissory Note: This type of note is commonly used in real estate transactions, where the borrower pledges a property as collateral. It outlines the terms of repayment, including interest rates, installment amounts, and the consequences of defaulting on the loan. 2. Business Secured Promissory Note: When a business entity or individual requires financing, this note is often utilized. Collateral such as business assets, equipment, or inventory is provided by the borrower to secure the loan. 3. Vehicle Secured Promissory Note: This type of note is applicable to loans taken to purchase a vehicle, where the vehicle serves as collateral. It specifies the terms of the loan, including payment installments, interest rates, and the lender's rights in case of default. 4. Personal Property Secured Promissory Note: In situations where personal property, such as valuable possessions or financial assets, are used as collateral to secure a loan, this note is employed. It includes specific information about the property being offered as security. In all types of Contra Costa California Secured Promissory Notes, it is crucial for both parties to carefully read and understand the terms outlined in the document before signing. Seeking legal advice and guidance is recommended to ensure compliance with applicable laws and regulations in Contra Costa County, California, and to protect the rights and interests of both the lender and the borrower.

Contra Costa California Secured Promissory Note

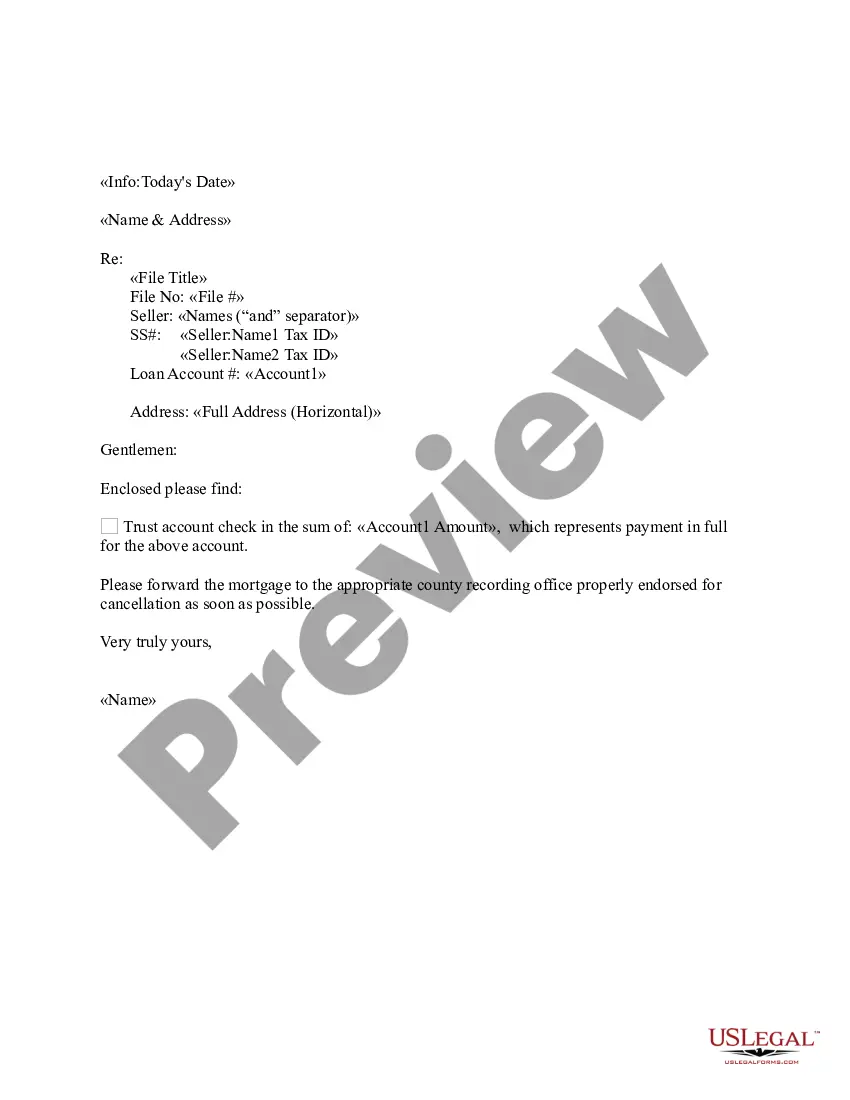

Description

How to fill out Contra Costa California Secured Promissory Note?

Do you need to quickly create a legally-binding Contra Costa Secured Promissory Note or probably any other document to take control of your personal or corporate matters? You can go with two options: contact a professional to write a valid document for you or draft it entirely on your own. Luckily, there's an alternative solution - US Legal Forms. It will help you receive neatly written legal documents without paying unreasonable prices for legal services.

US Legal Forms offers a rich collection of over 85,000 state-specific document templates, including Contra Costa Secured Promissory Note and form packages. We provide templates for an array of use cases: from divorce paperwork to real estate document templates. We've been out there for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed document without extra troubles.

- To start with, double-check if the Contra Costa Secured Promissory Note is tailored to your state's or county's regulations.

- If the document includes a desciption, make sure to verify what it's intended for.

- Start the search again if the document isn’t what you were hoping to find by using the search box in the header.

- Select the subscription that best fits your needs and proceed to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Contra Costa Secured Promissory Note template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to find and download legal forms if you use our catalog. In addition, the paperwork we offer are reviewed by law professionals, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!