A Hillsborough Florida Secured Promissory Note is a legally binding document that establishes a financial agreement between a lender and a borrower in Hillsborough County, Florida. This type of promissory note provides extra security to the lender by securing the borrower's assets as collateral against the loan. By incorporating relevant keywords into the description, such as "Hillsborough Florida," "secured promissory note," and "types," we can enhance its SEO value. A secured promissory note in Hillsborough Florida is commonly used when individuals or businesses want to borrow funds for various purposes, such as starting a business, purchasing property, or financing personal expenses. The note outlines the specific terms and conditions of the loan, including the principal amount borrowed, interest rate, repayment schedule, and any other additional terms agreed upon by the lender and borrower. In Hillsborough Florida, there are several types of secured promissory notes available: 1. Real Estate Secured Promissory Note: This type of promissory note is often used for real estate transactions where the property being purchased serves as collateral. The note specifies the property details and ensures that if the borrower defaults on the loan, the lender can seize the property to recover the outstanding balance. 2. Vehicle Secured Promissory Note: This type of promissory note is used when the borrower wants to use a vehicle as collateral for the loan. It includes details of the vehicle, such as make, model, and VIN, and allows the lender to repossess the vehicle if the borrower defaults on the loan. 3. Personal Property Secured Promissory Note: This type of promissory note involves using personal assets, such as jewelry, art, or valuable goods, as collateral for the loan. The note specifies the assets being used as security and grants the lender the right to take possession of them in case of default. 4. Business Assets Secured Promissory Note: This type of secured promissory note is commonly used by businesses to obtain funding. It enables a business to borrow money while using its assets, such as inventory, equipment, or accounts receivable, as collateral. The note outlines the assets being pledged and allows the lender to recover the funds by seizing or liquidating these assets if necessary. Hillsborough Florida Secured Promissory Notes provide protection to lenders in the event of default, making them a popular choice for individuals and businesses seeking loans. It is important for both parties involved to carefully review and understand the terms outlined in the promissory note before signing to ensure compliance with Florida laws and to protect their interests.

Hillsborough Florida Secured Promissory Note

Description

How to fill out Hillsborough Florida Secured Promissory Note?

Drafting paperwork for the business or individual demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to create Hillsborough Secured Promissory Note without professional assistance.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Hillsborough Secured Promissory Note by yourself, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed document.

In case you still don't have a subscription, adhere to the step-by-step instruction below to get the Hillsborough Secured Promissory Note:

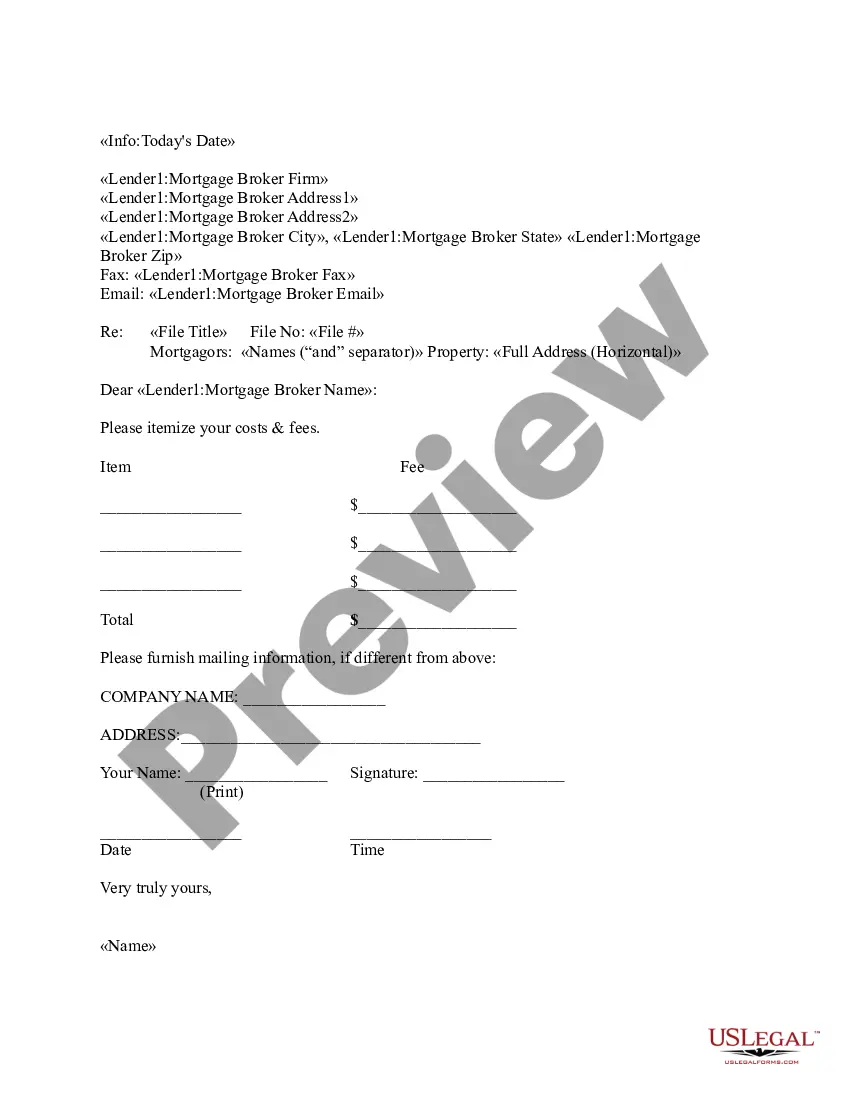

- Examine the page you've opened and check if it has the document you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that meets your requirements, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any situation with just a couple of clicks!