A Middlesex Massachusetts Secured Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Middlesex County, Massachusetts. This type of promissory note provides a secured loan option, meaning that it is backed by collateral or assets that the borrower pledges to the lender. This collateral acts as a form of security for the lender in case the borrower defaults on the loan. The Middlesex Massachusetts Secured Promissory Note includes specific keywords to ensure the clarity and enforceability of the agreement. Some relevant keywords often found in this document are: 1. Middlesex County: Refers to the specific location where the agreement is made and enforced, ensuring that the note complies with the local laws and regulations of Middlesex County, Massachusetts. 2. Secured Promissory Note: Indicates that this is a type of promissory note that provides security to the lender through collateral, reducing the risk of lending. 3. Collateral: Identifies the asset or property that the borrower pledges to the lender to secure the loan. Common types of collateral can include real estate, vehicles, or other valuable assets. 4. Principal Amount: Denotes the initial amount of the loan that the borrower receives from the lender. 5. Interest Rate: Specifies the percentage charged on the loan by the lender, often expressed as an annual percentage rate (APR). 6. Payment Terms: Outlines the repayment schedule, including the frequency of payments (monthly, quarterly, etc.) and the due dates. 7. Default: Explains the actions or circumstances considered as a breach of the agreement, which could lead to the lender initiating legal actions or seizing the collateral. 8. Acceleration Clause: Gives the lender the right to demand immediate payment of the entire remaining balance if the borrower defaults on the terms of the agreement. It is important to note that specific types of Middlesex Massachusetts Secured Promissory Notes may vary based on the purpose of the loan or the unique requirements of the parties involved. Some examples may include Business Secured Promissory Note, Real Estate Secured Promissory Note, or Vehicle Secured Promissory Note, depending on the nature of the loan and the collateral involved.

Middlesex Massachusetts Secured Promissory Note

Description

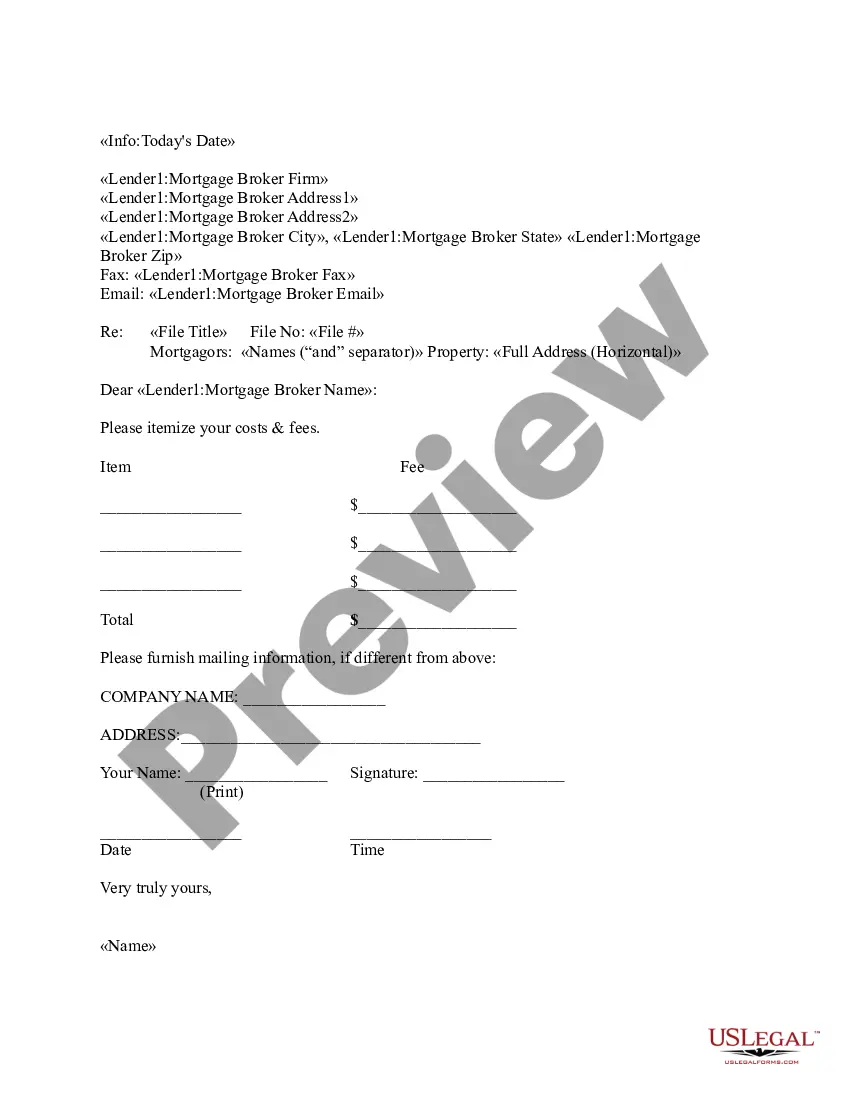

How to fill out Middlesex Massachusetts Secured Promissory Note?

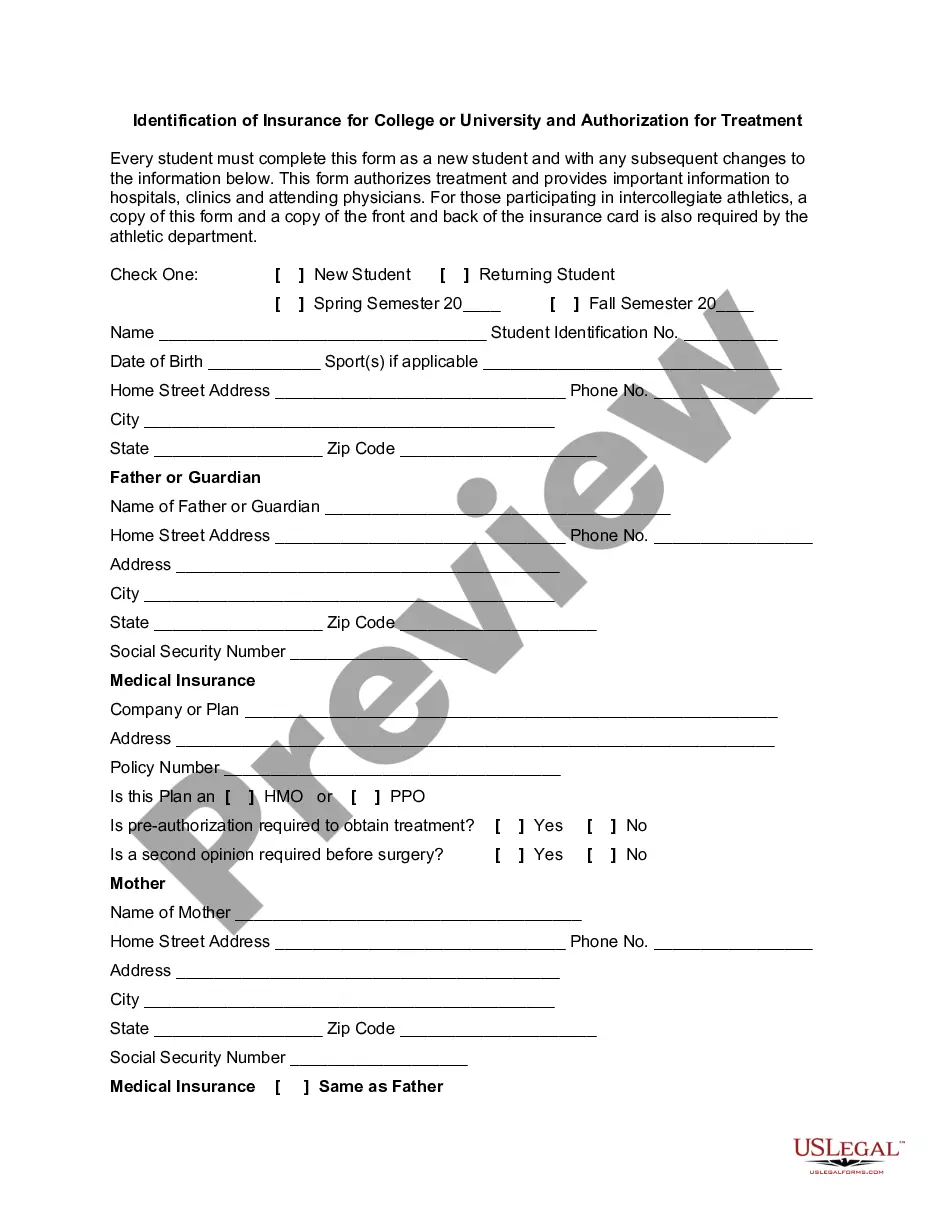

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Middlesex Secured Promissory Note, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business occasions. All the documents can be used many times: once you obtain a sample, it remains available in your profile for future use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Middlesex Secured Promissory Note from the My Forms tab.

For new users, it's necessary to make some more steps to get the Middlesex Secured Promissory Note:

- Take a look at the page content to ensure you found the correct sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template once you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

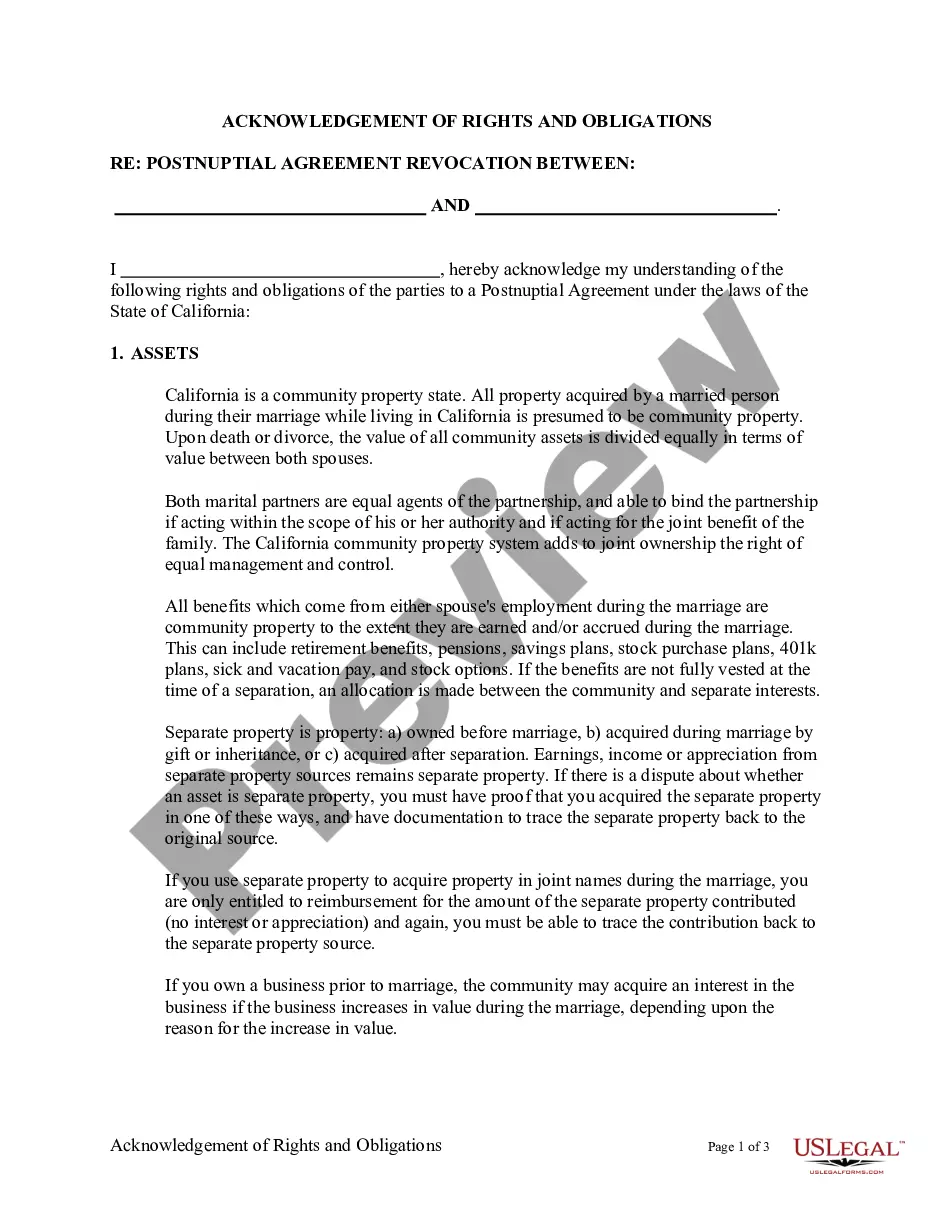

A secured promissory note, as the name partially implies, is secured by some form of property (i.e. collateral), while an unsecured promissory note does not involve collateral. If the borrower defaults on a Secured Promissory Note, the lender gets to keep the collateral (the property that was used to secure the loan).

A Promissory note is essentially an unconditional written promise to repay a loan or other debts, at a fixed or determinable future date. Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved.

A form of debt instrument, a promissory note represents a written promise on the part of the issuer to pay back another party. A promissory note will include the agreed-upon terms between the two parties, such as the maturity date, principal, interest, and issuer's signature.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

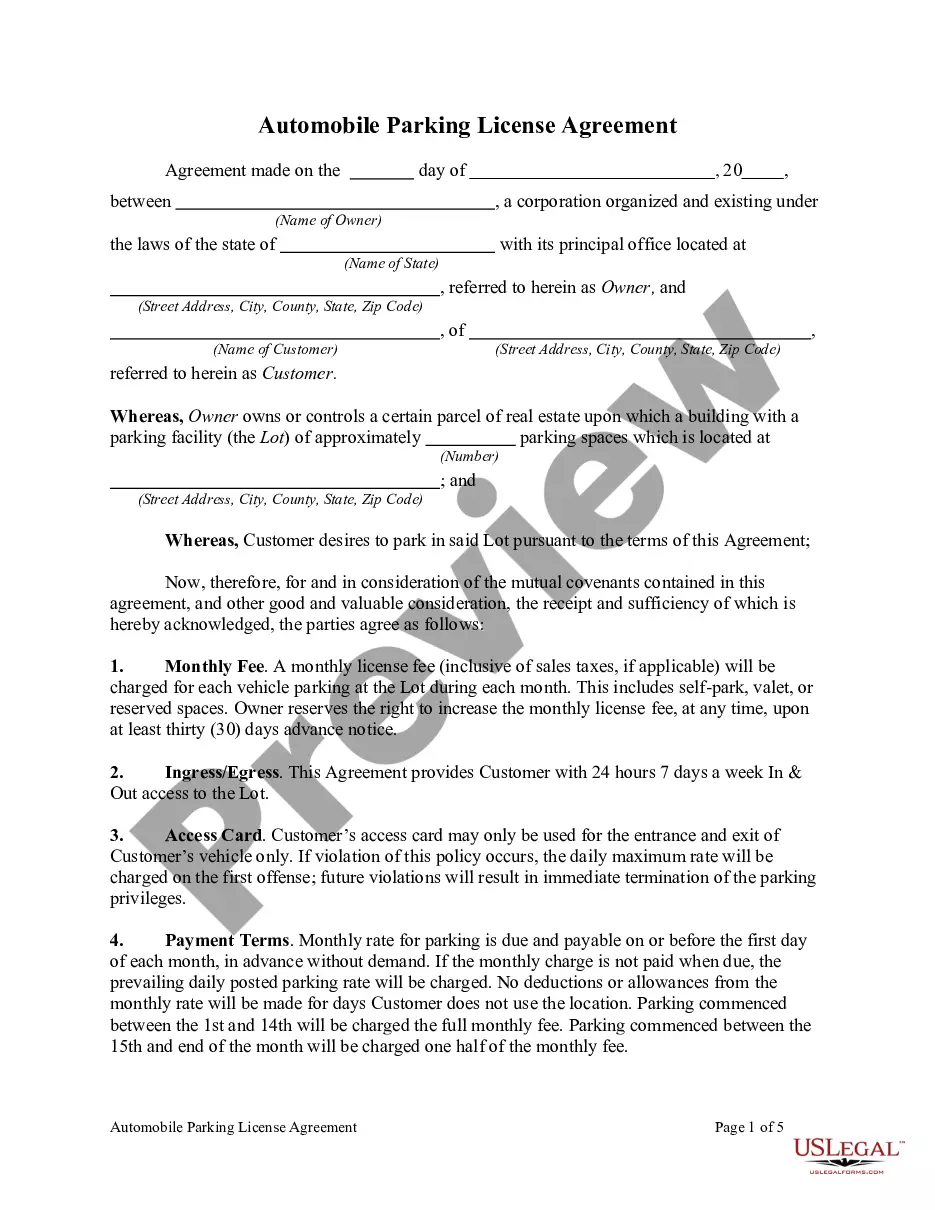

The Difference Between a Promissory Note & a Mortgage. The main difference between a promissory note and a mortgage is that a promissory note is the written agreement containing the details of the mortgage loan, whereas a mortgage is a loan that is secured by real property.

A note is a debt security obligating repayment of a loan, at a predetermined interest rate, within a defined time frame. Notes are similar to bonds but typically have an earlier maturity date than other debt securities, such as bonds.

It must include all the mandatory elements such as the legal names of the payee and maker's name, amount being loaned / to be repaid, full terms of the agreement and the full amount of liability, beside other elements. The note must clearly mention only the promise of making the repayment and no other conditions.

A secured promissory note, as the name partially implies, is secured by some form of property (i.e. collateral), while an unsecured promissory note does not involve collateral. If the borrower defaults on a Secured Promissory Note, the lender gets to keep the collateral (the property that was used to secure the loan).

The borrower agrees to pay a certain amount of money (which may include interest on principle), in installments, on demand or in full at a specified time. Today's promissory notes usually fall into two camps: secured and unsecured.

A promissory note is a key piece of a home loan application and mortgage agreement, ensuring that a borrower agrees to be indebted to a lender for loan repayment. Ultimately, it serves as a necessary piece of the legal puzzle that helps guarantee that sums are repaid in full and in a timely fashion.

Interesting Questions

More info

This should explain how the defendant can be held responsible for what happens and give an outline of every defense the plaintiff would be able to make against the allegation. The defendant will want to know exactly what you found, and the details that went into it. The demands letter goes more in depth on this in the following examples. Demand Letter Example 1 — Definite Amount of Restitution Amount of time you are looking for 1,000.00 in damages plus all costs You will provide documentation of damage suffered by the plaintiff, the total amount of your discovery, the plaintiff's financial situation including bank accounts, cash on hand, and expenses, and any statements concerning the plaintiff and the defendant's behavior, financial or otherwise. If we have enough information we will ask to meet when you are available. The demands letter is the beginning. It is a short, detailed document to give the defendant some background on the allegations.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.