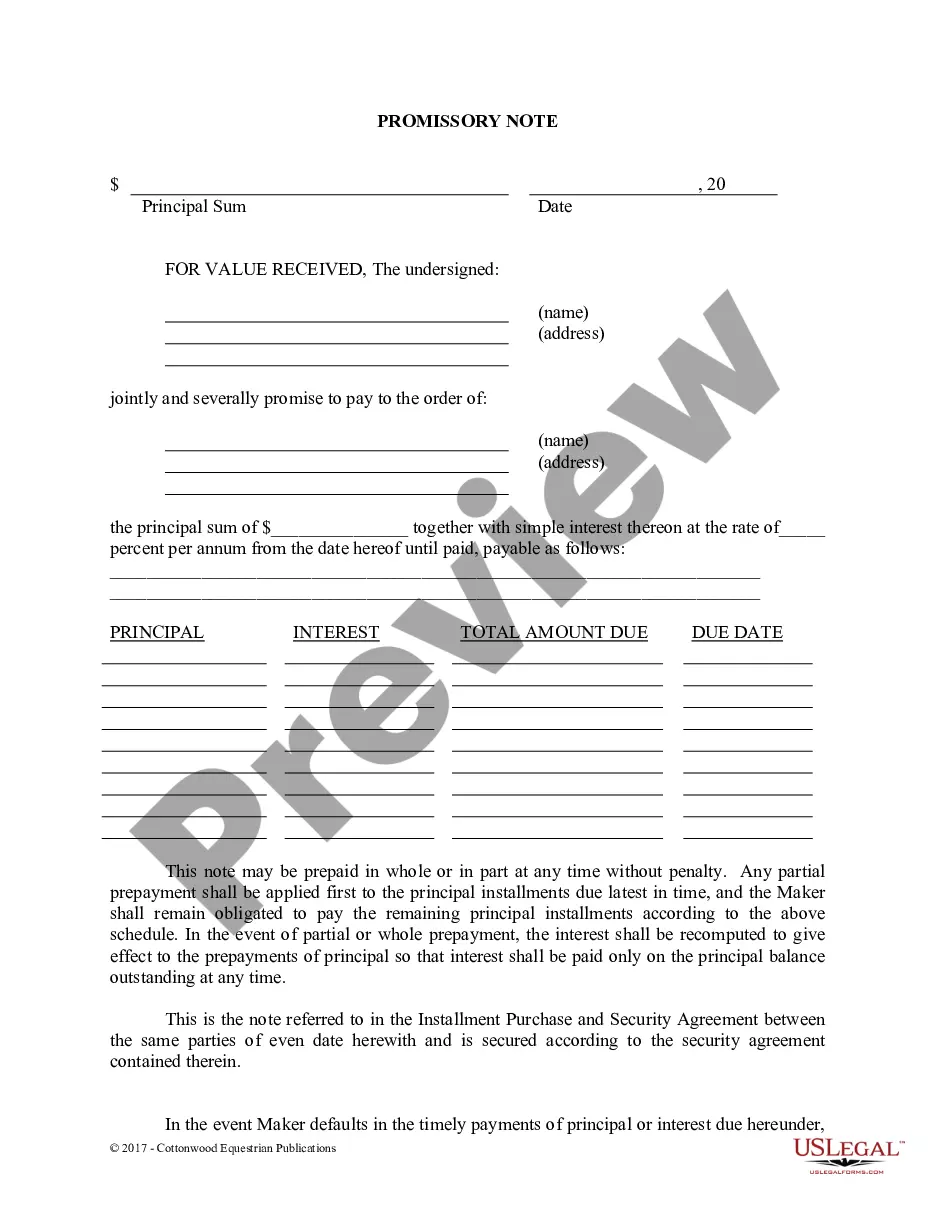

A Phoenix Arizona Secured Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between two parties, where the borrower promises to repay a specific amount of money along with any accrued interest within a specified timeframe. The use of the term "secured" refers to the inclusion of collateral that the borrower pledges to the lender to secure the repayment of the loan. In Phoenix Arizona, there are various types of Secured Promissory Notes that serve different purposes and cater to different kinds of loans. Some common types of Phoenix Arizona Secured Promissory Notes include: 1. Real Estate Secured Promissory Note: This type of note is used when the loan is specifically tied to a real estate property. The borrower pledges the property as collateral, and in the event of default, the lender has the right to foreclose and sell the property to recover the debt. 2. Vehicle Secured Promissory Note: This type of note is utilized when the loan is related to the purchase of a vehicle. The borrower pledges the vehicle as collateral, and in case of default, the lender has the right to repossess and sell the vehicle to cover the outstanding debt. 3. Business Asset Secured Promissory Note: This type of note is used when the loan is obtained for business purposes. The borrower pledges specific business assets, equipment, or property as collateral, and if the borrower defaults, the lender may seize and liquidate the assets to recover the loan amount. 4. Personal Property Secured Promissory Note: This note is employed when the loan is secured by personal property such as jewelry, electronics, or valuable assets owned by the borrower. The lender reserves the right to seize and sell the pledged property if the borrower fails to repay the loan. Regardless of the type of Phoenix Arizona Secured Promissory Note, it is crucial to clearly outline the loan amount, interest rate, repayment terms, consequences of default, and any specific provisions relevant to the pledged collateral. It is recommended to consult with a legal professional to ensure proper drafting and compliance with applicable Arizona laws.

Phoenix Arizona Secured Promissory Note

Description

How to fill out Phoenix Arizona Secured Promissory Note?

Creating legal forms is a must in today's world. However, you don't always need to look for professional help to create some of them from the ground up, including Phoenix Secured Promissory Note, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in various categories ranging from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching experience less frustrating. You can also find information resources and guides on the website to make any tasks related to document execution simple.

Here's how to locate and download Phoenix Secured Promissory Note.

- Go over the document's preview and outline (if available) to get a general idea of what you’ll get after downloading the document.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can affect the validity of some documents.

- Check the related forms or start the search over to locate the correct document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a needed payment gateway, and buy Phoenix Secured Promissory Note.

- Select to save the form template in any available file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Phoenix Secured Promissory Note, log in to your account, and download it. Needless to say, our website can’t replace a lawyer completely. If you need to deal with an extremely challenging situation, we recommend using the services of an attorney to examine your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Join them today and get your state-compliant paperwork effortlessly!

Form popularity

FAQ

There is no legal requirement for a promissory note to be witnessed or notarized in Arizona. Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

Flexibility. A key benefit that a promissory note provides you, whether you are the borrower or the one providing the fund, is flexibility. A promissory note allows you to specify how payments will be made -- in installments, at a future point in time or on demand.

Loans from banks or other institutional lenders are always made using a number of documents, two of which are a promissory and security agreement. In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

How to Enforce a Promissory NoteTypes of Property that can be used as collateral.Speak to them in person.Draft a Demand / Notice Letter.Write and send a Follow Up Letter.Enlisting a Professional Collection Agency.Filing a petition or complaint in court.Selling the Promissory Note.Final Tips.More items...?

Secured Promissory NotesA secured promissory note is an obligation to pay that is secured by some type of property. This means that if the payor fails to pay, the payee can seize the designated property to obtain reimbursement of the loan.

With a secured promissory note, the borrower can offer collateral which will guarantee that they will repay the lender. If the borrower is then unable to repay the loan, the lender can repossess the assets that were included in the promissory note. The assets that can be repossessed can be both tangible and intangible.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

A secured promissory note is an obligation to pay that is secured by some type of property. This means that if the payor fails to pay, the payee can seize the designated property to obtain reimbursement of the loan.

A promissory note will include the agreed-upon terms between the two parties, such as the maturity date, principal, interest, and issuer's signature. Essentially, a promissory note allows entities aside from financial institutions the ability to provide lending mechanisms to other entities.

Enforcing a secured promissory note is simply a matter of either repossessing the secured asset through your own efforts, or hiring a professional agency to accomplish the task on your behalf. These agencies will charge a set fee for their services, but they usually have a very high rate of success.