A Suffolk New York Secured Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Suffolk County, New York. This note serves as evidence of the debt and describes the repayment terms, including the principal amount, interest rate, payment schedule, and any additional fees or penalties. One type of Suffolk New York Secured Promissory Note is the Mortgage Secured Promissory Note. This type of note is secured by a mortgage on real property located within Suffolk County. In the event of default, the lender has the right to foreclose on the property and sell it to recover the outstanding debt. Another type is the Car Secured Promissory Note, where the debt is secured by a vehicle owned by the borrower. If the borrower fails to make payments as agreed, the lender can repossess the vehicle to satisfy the debt. Additionally, there are Business Secured Promissory Notes that involve commercial transactions. These notes are secured by specific business assets, such as equipment, inventory, or accounts receivable. In case of default, the lender can seize the assets outlined in the note to recover the unpaid amount. A Suffolk New York Secured Promissory Note provides legal protection to both the lender and the borrower. It ensures that the borrower understands the terms of the loan and is obligated to repay the debt according to the agreement. Meanwhile, the lender gains a level of assurance through the specified collateral, which acts as a form of security to help minimize potential losses. When drafting a Suffolk New York Secured Promissory Note, it is crucial to consult an attorney to ensure compliance with local statutes and regulations. Both parties should thoroughly review the note to understand their rights and obligations, avoiding potential disputes and misunderstandings. Seeking professional guidance can help ensure a legally sound and enforceable agreement.

Suffolk New York Secured Promissory Note

Description

How to fill out Suffolk New York Secured Promissory Note?

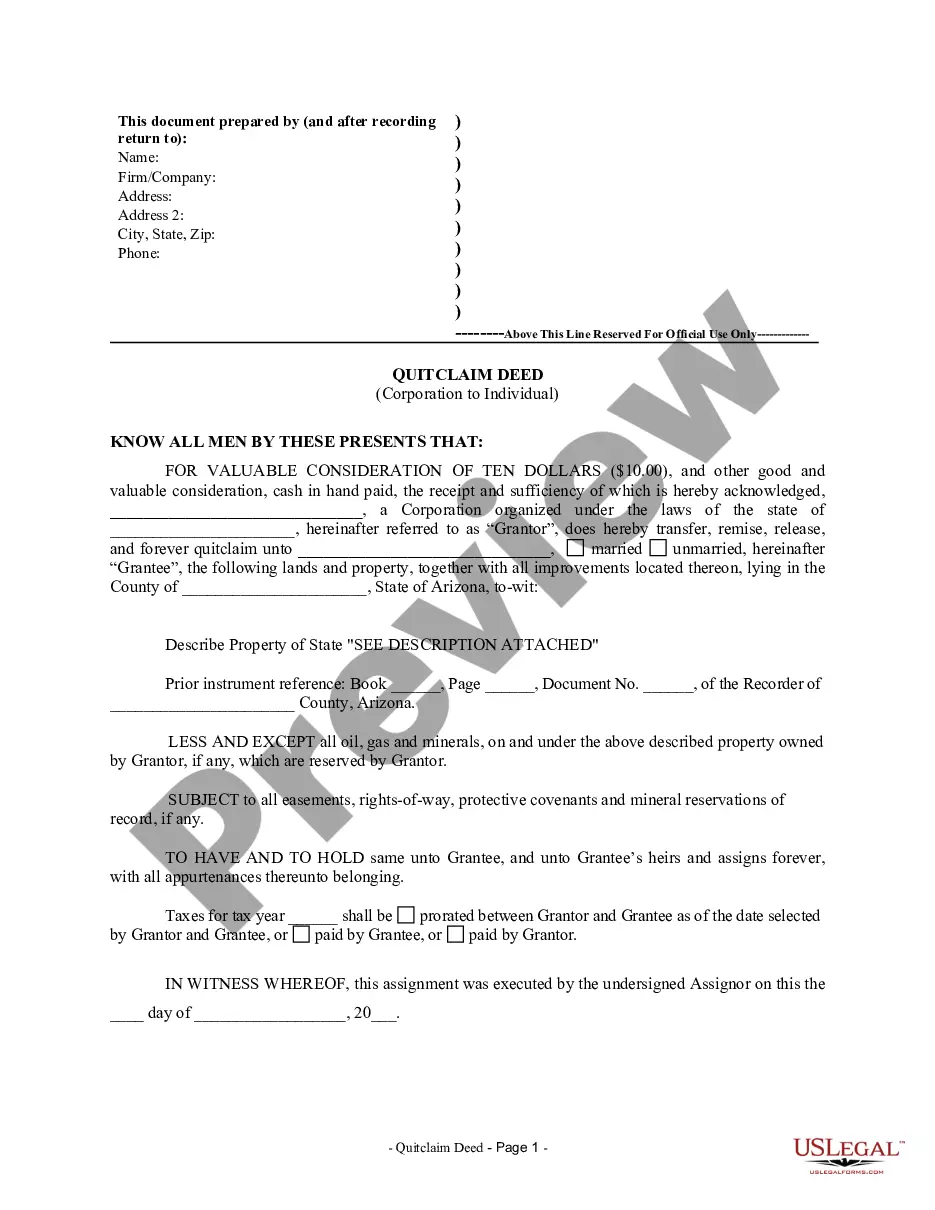

Do you need to quickly create a legally-binding Suffolk Secured Promissory Note or probably any other form to take control of your personal or business matters? You can go with two options: contact a legal advisor to write a legal document for you or create it completely on your own. Thankfully, there's a third solution - US Legal Forms. It will help you get neatly written legal paperwork without having to pay sky-high fees for legal services.

US Legal Forms offers a rich catalog of more than 85,000 state-compliant form templates, including Suffolk Secured Promissory Note and form packages. We offer templates for an array of use cases: from divorce papers to real estate document templates. We've been on the market for more than 25 years and got a spotless reputation among our clients. Here's how you can become one of them and get the needed document without extra troubles.

- First and foremost, carefully verify if the Suffolk Secured Promissory Note is adapted to your state's or county's regulations.

- If the form comes with a desciption, make sure to verify what it's suitable for.

- Start the search again if the form isn’t what you were seeking by utilizing the search box in the header.

- Select the subscription that is best suited for your needs and move forward to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Suffolk Secured Promissory Note template, and download it. To re-download the form, just go to the My Forms tab.

It's easy to buy and download legal forms if you use our services. In addition, the paperwork we offer are reviewed by industry experts, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

A promissory note is a key piece of a home loan application and mortgage agreement, ensuring that a borrower agrees to be indebted to a lender for loan repayment. Ultimately, it serves as a necessary piece of the legal puzzle that helps guarantee that sums are repaid in full and in a timely fashion.

Secured Promissory NotesA secured promissory note is an obligation to pay that is secured by some type of property. This means that if the payor fails to pay, the payee can seize the designated property to obtain reimbursement of the loan.

So, what's the difference between secured and unsecured promissory notes? It's actually quite simple. A secured note is any debt collateralized with real property like a first deed of trust or car title. Conversely, an unsecured note is any debt not secured by collateral (or uncollateralized).

A promissory note is the document that sets forth the terms of a loan's repayment. A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

Senior Secured Promissory Note. This Note is being issued pursuant to a Securities Purchase Agreement (the Purchase Agreement) among the Company and the original holders of the Notes pursuant to which the Company has issued an aggregate principal amount of $ of Notes.

Promissory notes are legally binding contracts. That means when you don't pay back your loan, you could lose your collateral. If there's no collateral to secure the loan, the lender on the promissory note can take the borrower to court seeking repayment.

Enforcing a secured promissory note is simply a matter of either repossessing the secured asset through your own efforts, or hiring a professional agency to accomplish the task on your behalf. These agencies will charge a set fee for their services, but they usually have a very high rate of success.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

A mortgage is a loan secured by property that is used as collateral, which the lender can seize if the borrower defaults on the loan. The promissory note is exactly what it sounds like the borrower's written, signed promise to repay the loan.

Interesting Questions

More info

The notes, which can be held as collateral or security in an account, are intended to serve the same purpose as a security. Securities. Securities can be either physical or electronic and are made of one or more elements that can be classified as cash instruments; U.S. government securities. A U.S. government security is a security whose value derives entirely or largely from support in the form of either currency (or a government note), gold, silver, or foreign exchange. Transferable Security. A transferable security is one that can be transferred from one custodian to another in the event of the custodian's death, bankruptcy, merger or liquidation, or other similar occurrence. U.S. Notes and U.S. government securities. U.S. government securities are made up of one or more types of instruments, most notably interest-bearing bonds, U.S. treasury bills, and mortgage-backed securities. U.S. government securities. U.S.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.