Mecklenburg North Carolina Agreement between General Sales Agent and Manufacturer

Description

How to fill out Agreement Between General Sales Agent And Manufacturer?

Laws and statutes in every sector differ across the nation.

If you are not a lawyer, it's simple to become confused by various standards when it involves constructing legal papers.

To evade expensive legal help while preparing the Mecklenburg Agreement between General Sales Agent and Manufacturer, you require a certified template that is valid for your locality.

That's the simplest and most economical way to obtain current templates for any legal needs. Find them all with just a few clicks and organize your documents with US Legal Forms!

- That's when utilizing the US Legal Forms platform becomes extremely advantageous.

- US Legal Forms is esteemed by millions and comprises a web catalog of over 85,000 state-specific legal forms.

- It serves as a fantastic solution for professionals and individuals seeking do-it-yourself templates for various personal and business circumstances.

- All forms can be utilized multiple times: once you purchase a template, it stays accessible in your account for future use.

- Thus, if you have an account with an active subscription, you can simply Log In and re-download the Mecklenburg Agreement between General Sales Agent and Manufacturer from the My documents section.

- For new users, a few additional steps are required to acquire the Mecklenburg Agreement between General Sales Agent and Manufacturer.

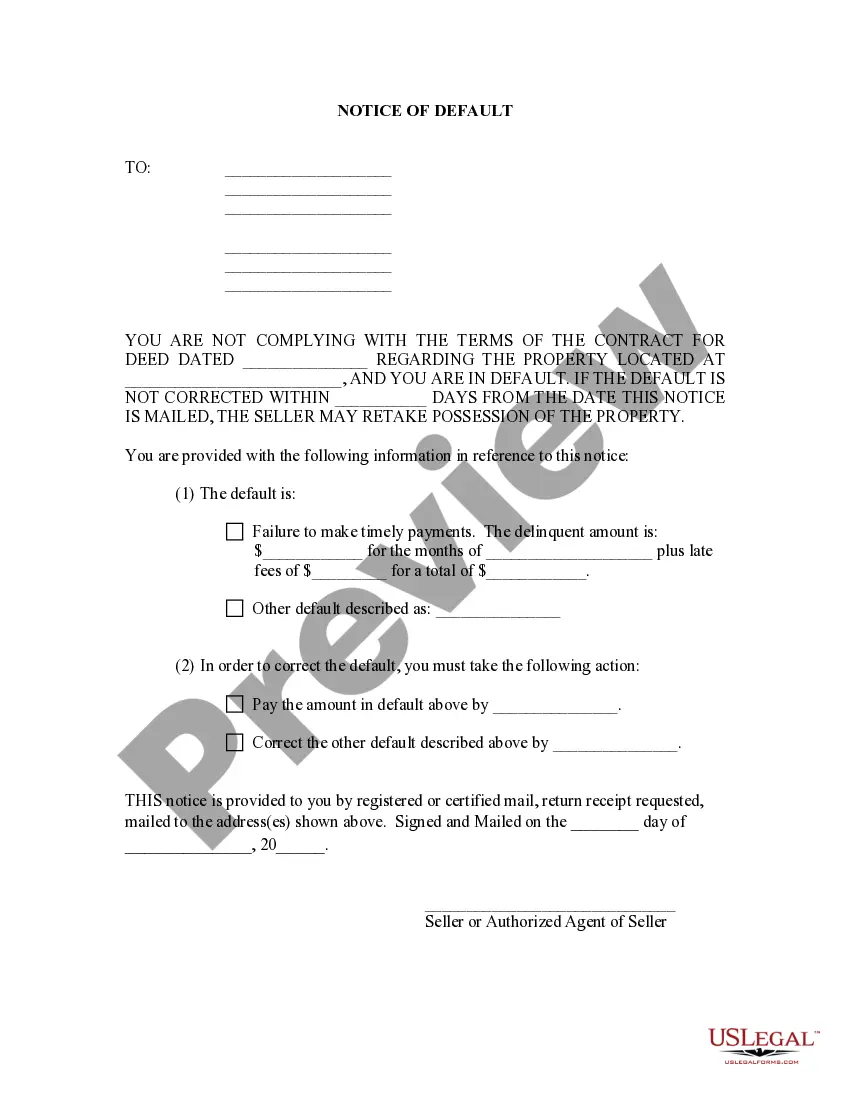

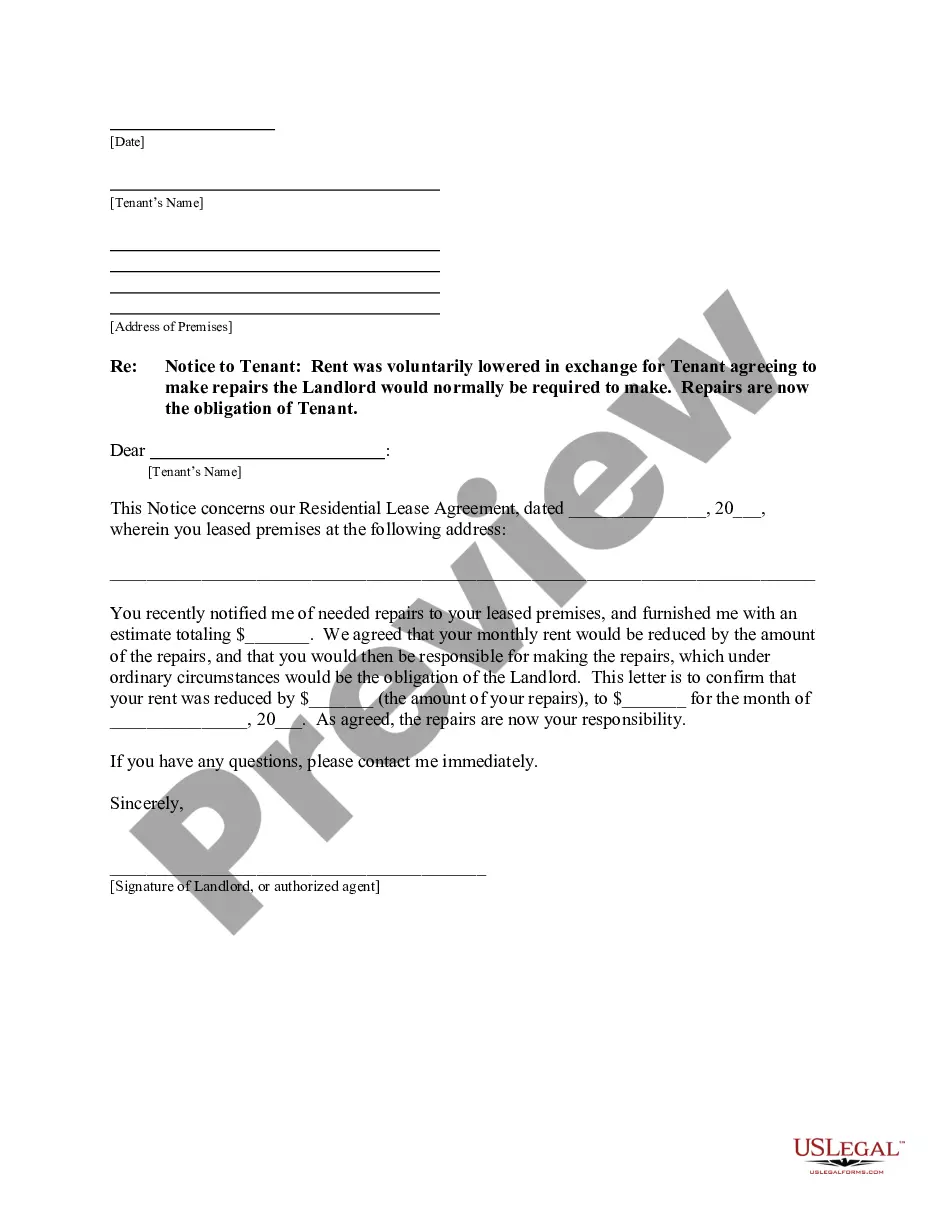

- Review the page content to ensure you have located the correct sample.

- Utilize the Preview feature or read the form description if provided.

Form popularity

FAQ

Some items are exempt from sales and use tax, including:Sales of certain food products for human consumption (many groceries)Sales to the U.S. Government.Sales of prescription medicine and certain medical devices.Sales of items paid for with food stamps.

Prescription Medicine, groceries, and gasoline are all tax-exempt. Some services in North Carolina are subject to sales tax.

Effective March 1, 2016 NC imposes the general 4.75 state rate of sales and use tax on repair, maintenance, and installation services sold at retail and sourced to the state. The applicable local (2% or 2.25%) and applicable transit (. 5%) rates of sales and use tax also apply.

Stat. § 105-164.4B . The retailer of a service contract is required to collect the tax at the time of the retail sale of the contract and is liable for payment of the tax.

When it comes to sales tax, the general rule of thumb has always been products are taxable, while services are non-taxable. Under that scenario, if your business sells coffee mugs, you should charge sales tax for those products.

Services in North Carolina are generally not taxable, with important exceptions. If the service you provide includes creating or manufacturing a product, you may have to deal with the sales tax on products.

The NC Department of Revenue says that if you are selling anything at retail (and thus collecting sales tax thereon), and you provide repair, maintenance, or installation services with respect to that item sold at retail, you are a retailer and will collect sales tax on labor.

Services in North Carolina are generally not taxable, with important exceptions. If the service you provide includes creating or manufacturing a product, you may have to deal with the sales tax on products.

In order to have a valid contract in North Carolina, there must be an offer, an acceptance, along with consideration. The parties must also have the capacity to enter into the contract.

Prescription Medicine, groceries, and gasoline are all tax-exempt.