The San Jose California Charitable Remainder Inter Vivos Annuity Trust is a legal entity established for philanthropic purposes in San Jose, California. It allows individuals to make charitable contributions while retaining an income stream during their lifetime. This type of trust provides numerous benefits for both the donor and the designated charitable organizations. By creating a charitable remainder inter vivos annuity trust (CAT), donors can receive an immediate tax deduction for the charitable portion of their contribution. The trust is funded with assets such as cash, securities, or real estate, which are irrevocably placed into the trust. The donor then receives a fixed annual income from the trust, typically equal to a predetermined percentage of the initial contribution. There are different types of San Jose California Charitable Remainder Inter Vivos Annuity Trusts, each offering specific advantages: 1. Charitable Remainder Annuity Trust (CAT): Under this trust, donors receive a fixed annual income throughout their lives or for a specified term. The income does not change, regardless of the trust's investment performance. 2. Net Income Charitable Remainder Annuity Trust (NITRATE): This trust allows donors to receive income based on the trust's net income annually. If the trust's income exceeds the fixed payout, the excess amount is carried forward to the subsequent years. 3. Flip CAT: This type of trust is designed to delay the annuity payments until a triggering event occurs, such as the sale of an asset. Until the triggering event, the trust operates similarly to a standard CAT. 4. Net Income with Makeup Charitable Remainder Annuity Trust (SIMCHAT): Similar to the NITRATE, this trust pays the donor income based on the trust's net income. However, any shortfall in annual income can be made up in later years when the trust's income exceeds the fixed payout. The San Jose California Charitable Remainder Inter Vivos Annuity Trust provides donors with a way to support charitable causes while receiving potential tax benefits and a stable income. These trusts offer flexibility in tailoring the income payout according to the donor's preferences and financial objectives. It is crucial to consult with an experienced estate planning attorney or financial advisor to determine the most suitable type of trust based on individual circumstances and charitable goals.

San Jose California Charitable Remainder Inter Vivos Annuity Trust

Description

How to fill out San Jose California Charitable Remainder Inter Vivos Annuity Trust?

Preparing documents for the business or personal demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to draft San Jose Charitable Remainder Inter Vivos Annuity Trust without professional assistance.

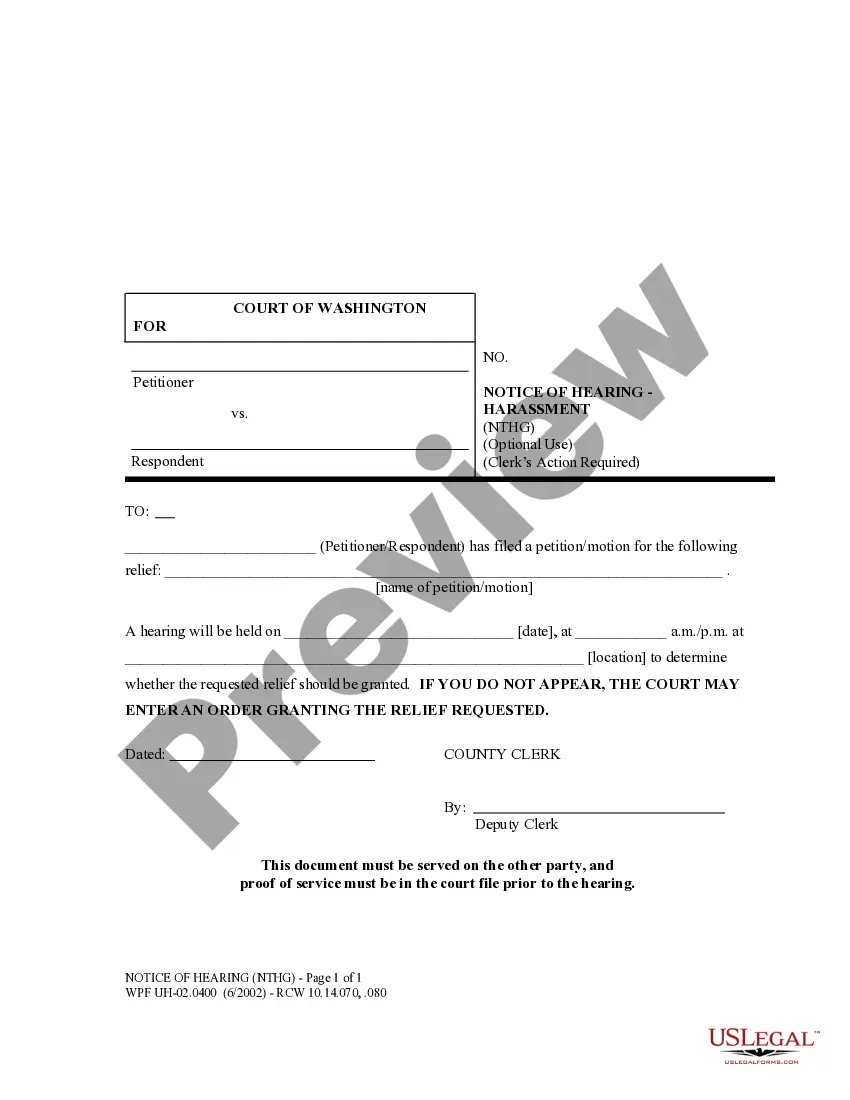

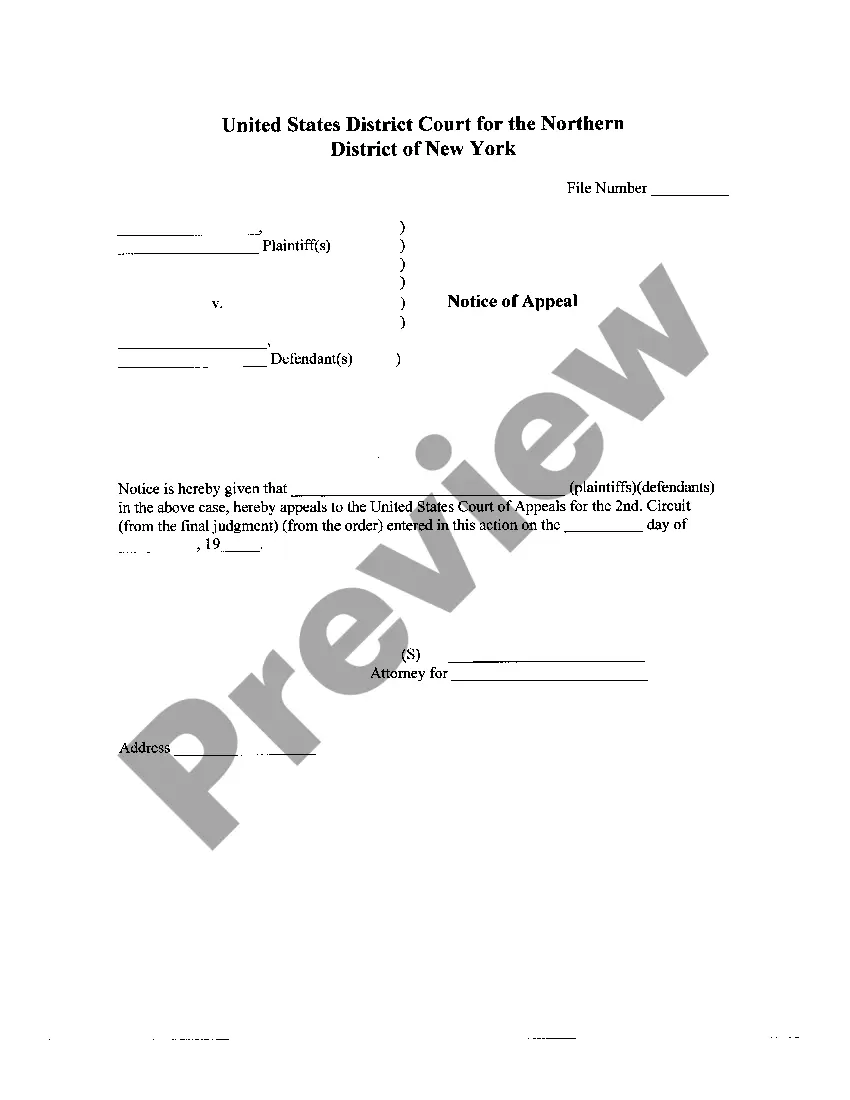

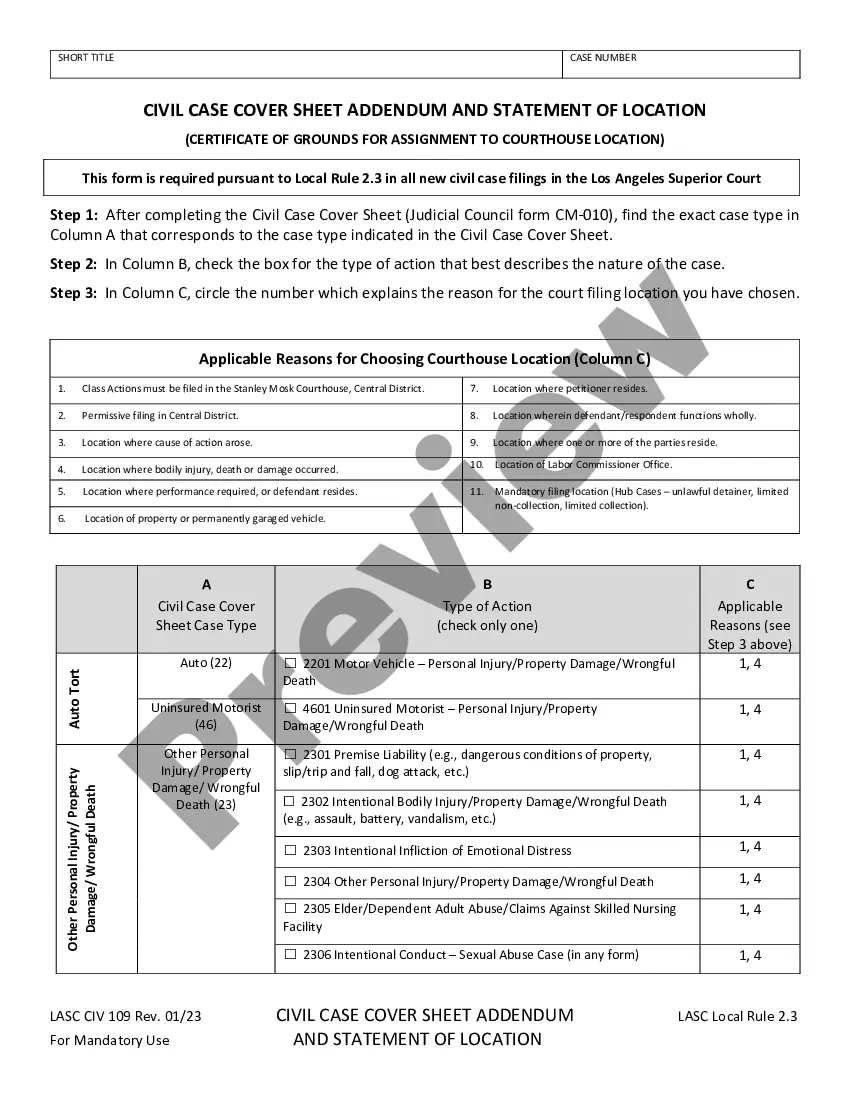

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid San Jose Charitable Remainder Inter Vivos Annuity Trust by yourself, using the US Legal Forms web library. It is the largest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to obtain the San Jose Charitable Remainder Inter Vivos Annuity Trust:

- Examine the page you've opened and check if it has the document you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that meets your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any scenario with just a couple of clicks!

Form popularity

FAQ

There are two basic types of charitable remainder trusts: the charitable remainder unitrust (CRUT) and the charitable remainder annuity trust (CRAT).Charitable remainder unitrust.Charitable remainder annuity trust.Trust management services.

Any income that you receive from your charitable trust could reduce the total contribution that you end up leaving to your charity. You may risk leaving nothing to your charity if you plan to receive high payments from the trust while you're alive.

Disadvantages of CRT :Big back and take up space on a desk.Not suitable for very brightly environment because less bright than LCD.They are large, heavy and bulky.Consume a lot of electricity and also produce a lot of heat.Geometrical error at edges.Flickering at 50-80 Hz.Harmful DC and AC electric and magnetic fields.

Any income that you receive from your charitable trust could reduce the total contribution that you end up leaving to your charity. You may risk leaving nothing to your charity if you plan to receive high payments from the trust while you're alive.

A charitable remainder trust is a tax-exempt irrevocable trust designed to reduce the taxable income of individuals. A charitable remainder trust dispenses income to one or more noncharitable beneficiaries for a specified period and then donates the remainder to one or more charitable beneficiaries.

A CRT lets you convert a highly appreciated asset like stock or real estate into lifetime income. It reduces your income taxes now and estate taxes when you die. You pay no capital gains tax when the asset is sold. It also lets you help one or more charities that have special meaning to you.

A charitable lead trust (CLT) is like the reverse of a charitable remainder trust. This type of trust disperses income to a named charity, while the noncharitable beneficiaries receive the remainder of the donated assets upon your death or at the end of a specific term, similar to a CRT.

The CRT is a good option if you want an immediate charitable deduction, but also have a need for an income stream to yourself or another person. It is also a good option if you want to establish one by will to provide for heirs, with the remainder going to charities of your choosing.

If the CRT is funded with cash, the donor can use a charitable deduction of up to 60% of Adjusted Gross Income (AGI); if appreciated assets are used to fund the trust, up to 30% of their AGI may be deducted in the current tax year.

Charitable remainder annuity trusts (CRATs) distribute a fixed annuity amount each year, and additional contributions are not allowed.