Travis Texas Charitable Remainder Inter Vivos Annuity Trust (TRC RI VAT) is a type of legal trust established in Travis County, Texas, which allows donors to support charitable causes while receiving financial benefits during their lifetime. This trust is specifically designed to provide income to the donor or other beneficiaries, with the remainder passing to a designated charity upon the donor's death. In a TRC RI VAT, the donor transfers assets such as cash, securities, or real estate into the trust. These assets are then managed by a trustee, who must follow the terms outlined in the trust agreement. One important aspect of this type of charitable trust is that it may provide immediate income tax benefits to the donor, as the donated assets can be deducted from the donor's income tax. There are two main types of TRC RI VAT's: Charitable Remainder Annuity Trust (CAT) and Charitable Remainder Unit rust (CUT). 1. Charitable Remainder Annuity Trust (CAT): In a CAT, the donor receives a fixed and predetermined annual income, which is a fixed percentage of the initial value of the trust assets. This fixed income remains the same throughout the trust's existence, regardless of any changes in the trust's value or income generated by the trust assets. The remainder interest is then transferred to the chosen charitable beneficiaries upon the donor's death. 2. Charitable Remainder Unit rust (CUT): In a CUT, the donor receives a variable annual income based on a fixed percentage of the trust's value, which is determined annually. Unlike the CAT, the income in a CUT can fluctuate with changes in the trust's value. This can be advantageous for donors who anticipate their trust assets to appreciate in value over time. Similar to CAT, the remaining trust assets pass to the designated charitable beneficiaries upon the donor's death. Travis Texas Charitable Remainder Inter Vivos Annuity Trust provides an excellent opportunity for individuals who wish to support charitable causes while securing their financial interests. By establishing a TRC RI VAT, donors can leave a significant impact on their chosen charities while enjoying income benefits. It is crucial to consult with legal and financial professionals to understand all the implications and requirements associated with this type of trust.

Travis Texas Charitable Remainder Inter Vivos Annuity Trust

Description

How to fill out Travis Texas Charitable Remainder Inter Vivos Annuity Trust?

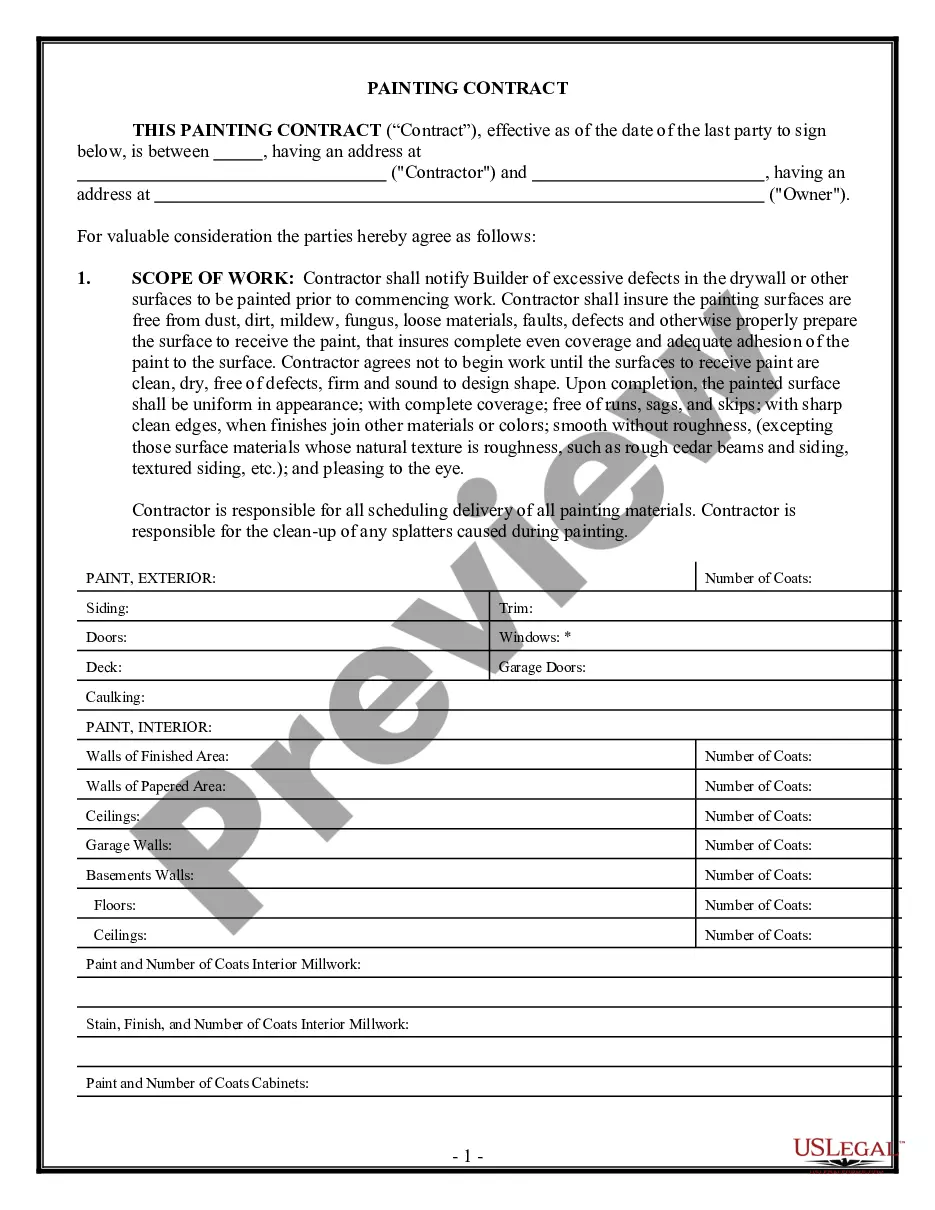

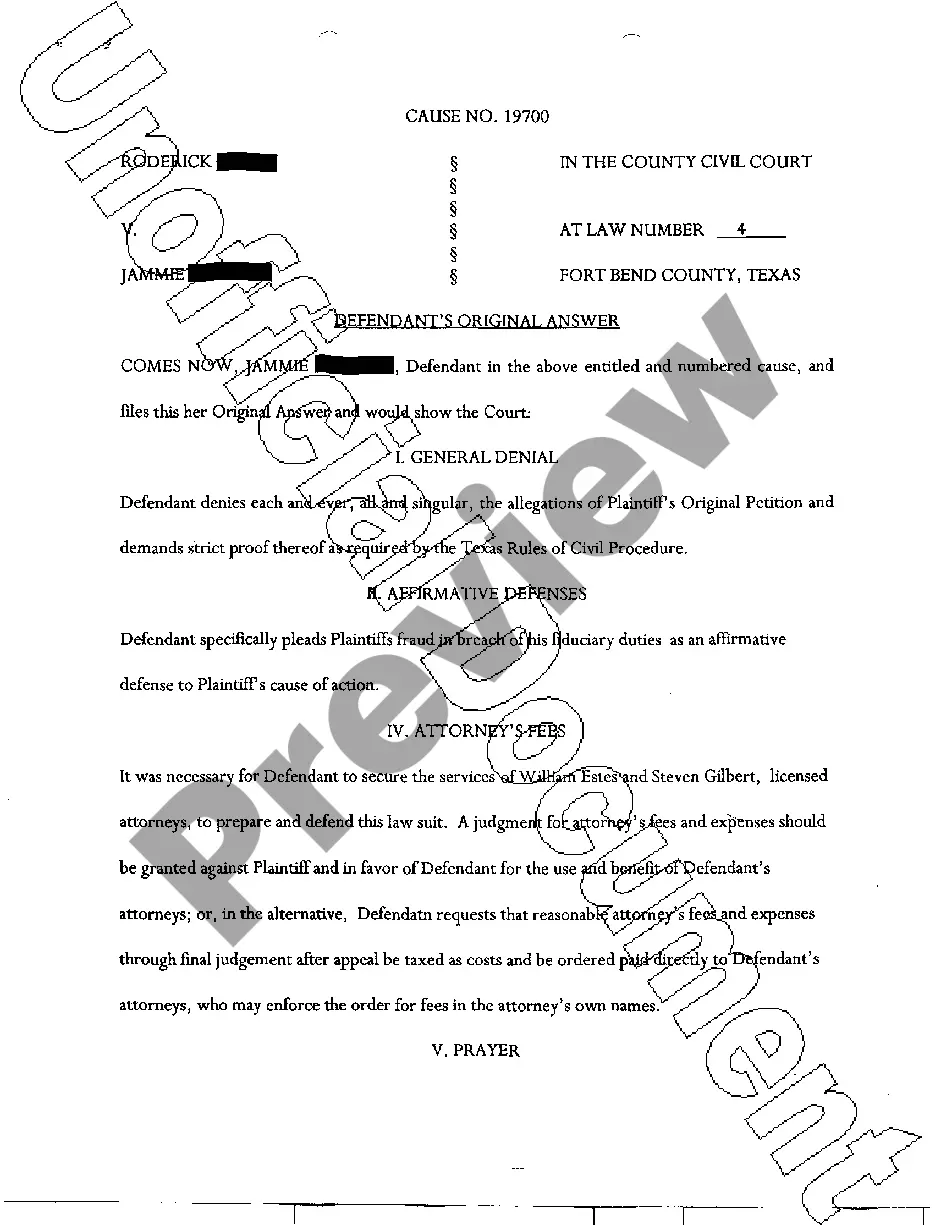

Whether you plan to start your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any personal or business case. All files are collected by state and area of use, so picking a copy like Travis Charitable Remainder Inter Vivos Annuity Trust is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to obtain the Travis Charitable Remainder Inter Vivos Annuity Trust. Adhere to the guidelines below:

- Make sure the sample fulfills your individual needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample when you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Travis Charitable Remainder Inter Vivos Annuity Trust in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!