The Chicago Illinois Charitable Remainder Inter Vivos Unit rust Agreement is a legal arrangement that allows individuals to make charitable contributions while still maintaining an income from their assets. This agreement is commonly used by individuals who wish to support charitable causes in Chicago, Illinois, while also maximizing tax benefits and ensuring their financial security. A Charitable Remainder Inter Vivos Unit rust Agreement is a type of irrevocable trust that is created during the lifetime of the donor, also known as the granter. The granter transfers assets, such as cash, securities, or real estate, into the trust, and designates one or more charitable organizations in Chicago, Illinois, as the beneficiaries. There are different types of Charitable Remainder Inter Vivos Unit rust Agreements available in Chicago, Illinois, each with its own set of features and benefits. Some common types include: 1. Charitable Remainder Annuity Trust (CAT): In this type of trust, the granter receives a fixed annual income from the trust, which is determined at the time of creation. The income remains the same regardless of the trust's investment performance. 2. Charitable Remainder Unit rust (CUT): Unlike a CAT, a CUT provides a variable annual income to the granter, which is a fixed percentage of the trust's value recalculated annually. If the trust performs well, the income may increase over time, but if the trust underperforms, the income will decrease. 3. Flip Unit rust: This type of unit rust starts off as a CAT and converts into a CUT at a specified triggering event, such as the sale of a property. The conversion allows the granter to initially receive a fixed income, which can then become variable to provide potential growth in income later. 4. Net Income with Makeup Charitable Remainder Unit rust (TIMEOUT): Timeouts allow the trustee to make up any shortfall in income from prior years when the trust underperformed. This feature can help the granter receive a more stable income stream regardless of the trust's investment performance. Chicago, Illinois, Charitable Remainder Inter Vivos Unit rust Agreements offer individuals a flexible and tax-efficient way to support charitable causes. By creating such an agreement, individuals can ensure both their own financial well-being and philanthropic desires. It is important to consult with legal and financial professionals to determine which type of unit rust agreement best suits individual preferences and objectives.

Chicago Illinois Charitable Remainder Inter Vivos Unitrust Agreement

Description

How to fill out Chicago Illinois Charitable Remainder Inter Vivos Unitrust Agreement?

Preparing documents for the business or personal needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to draft Chicago Charitable Remainder Inter Vivos Unitrust Agreement without professional help.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Chicago Charitable Remainder Inter Vivos Unitrust Agreement by yourself, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the required form.

If you still don't have a subscription, follow the step-by-step guideline below to obtain the Chicago Charitable Remainder Inter Vivos Unitrust Agreement:

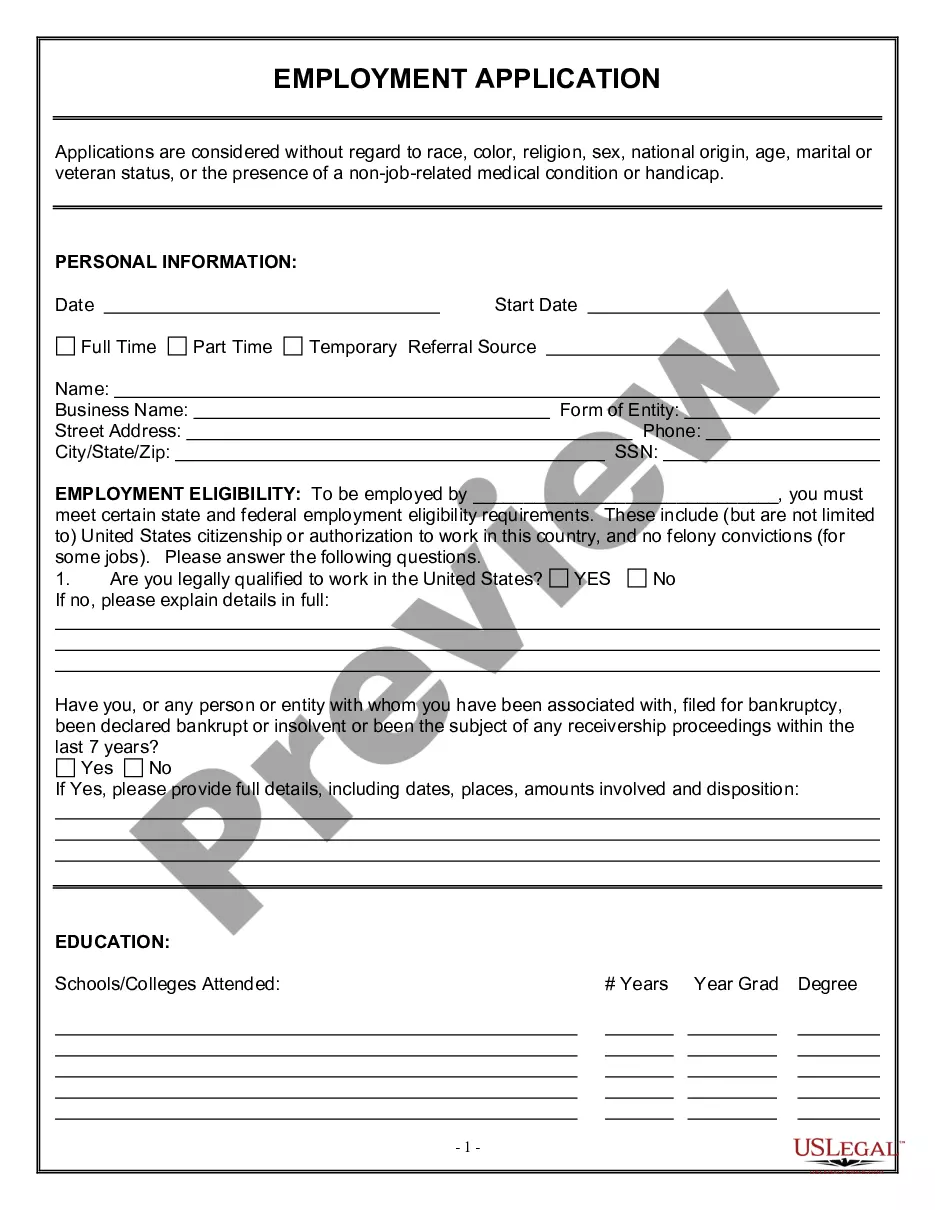

- Look through the page you've opened and check if it has the document you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that meets your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any situation with just a couple of clicks!