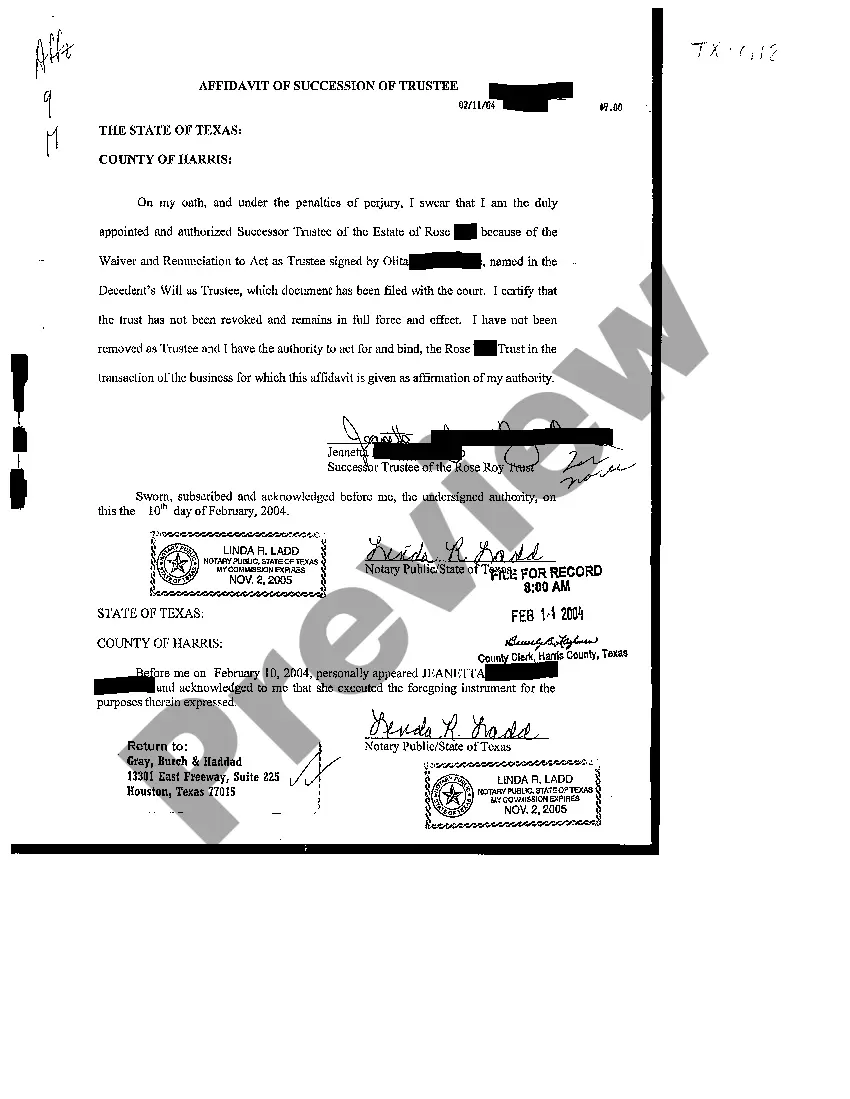

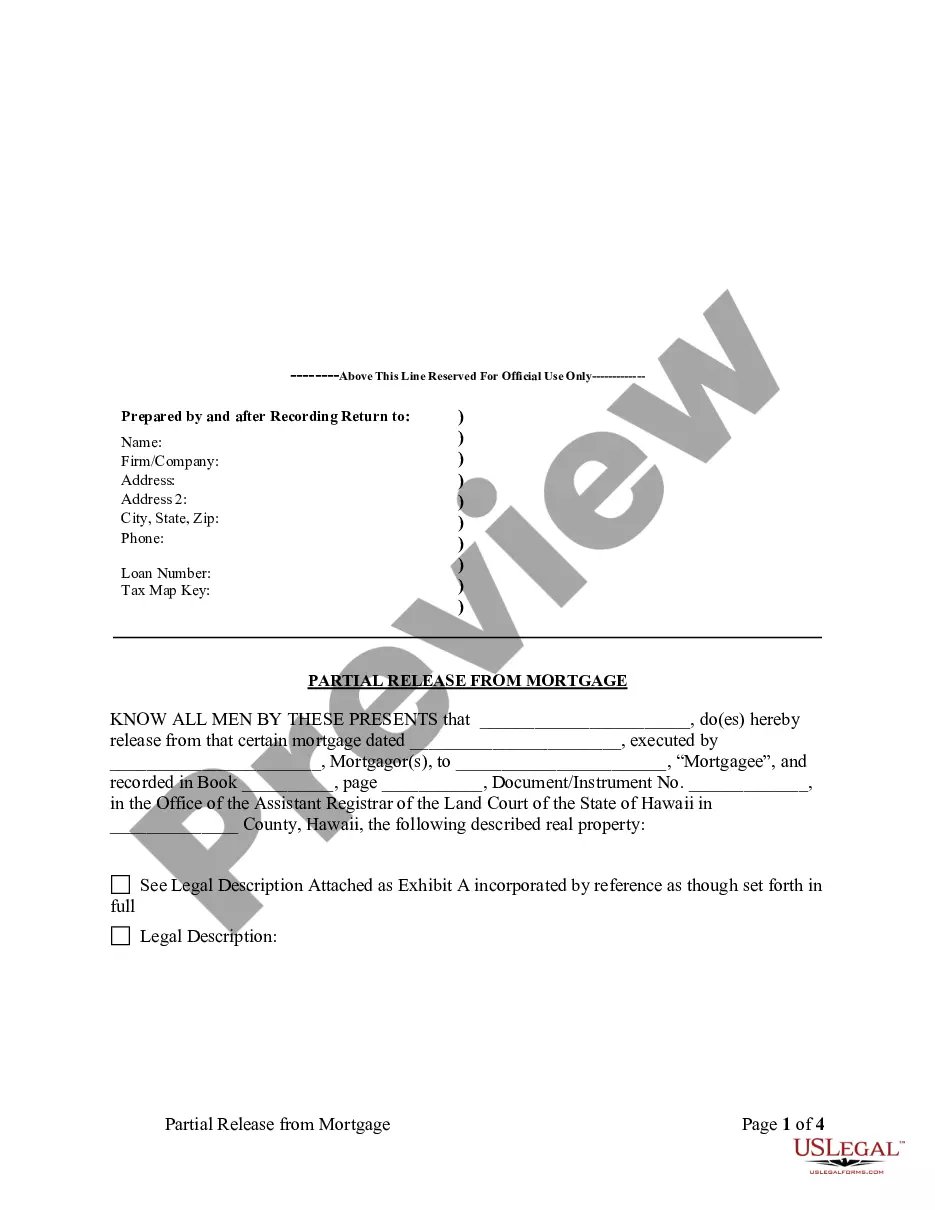

A Fairfax Virginia Charitable Remainder Inter Vivos Unit rust Agreement is a legal document that outlines the terms and conditions of a trust arrangement in which the granter transfers assets to a trustee, who then manages these assets for the benefit of one or more charitable organizations. This arrangement allows the granter to receive an income from the trust for a specified period or for life, with the remaining assets passing to the designated charities upon the granter's death or the end of the specified term. In regard to different types of Fairfax Virginia Charitable Remainder Inter Vivos Unit rust Agreements, there are a few variations to consider. One type is the Charitable Remainder Unit rust (CUT), which provides a fixed percentage of the fair market value of the trust assets to the granter or their designated beneficiaries each year. The percentage is typically determined when the trust is established and remains constant throughout its existence. Another type is the Net Income with Makeup Charitable Remainder Unit rust (TIMEOUT), which allows for fluctuations in the trust income payments. The granter or beneficiaries receive either the net income earned by the trust assets or a fixed percentage of the trust's fair market value, whichever is lower. If the trust income is lower than the fixed percentage, the shortfall can be made up in future years when the trust income exceeds the fixed percentage. There is also the Net Income Charitable Remainder Unit rust (NICEST), which is similar to the TIMEOUT, except that it does not allow for makeup distributions. This means that if the trust income is lower than the fixed percentage, the beneficiaries receive only the actual income earned by the trust and do not have the potential for a future makeup payment. Lastly, there is the Flip Charitable Remainder Unit rust (Flip CUT), which starts as a Charitable Remainder Unit rust and then "flips" into a different type of trust, such as a Charitable Remainder Annuity Trust (CAT) or a Charitable Remainder Unit rust (CUT), after a specific triggering event, such as the sale of a particular asset or reaching a certain age. In summary, a Fairfax Virginia Charitable Remainder Inter Vivos Unit rust Agreement is a legal instrument that allows individuals to donate assets to a trust for charitable purposes while receiving an income and potential tax benefits during their lifetime. The different types of inter vivos unit rusts available allow for flexibility in selecting the most suitable option based on the granter's financial goals and charitable intentions.

Fairfax Virginia Charitable Remainder Inter Vivos Unitrust Agreement

Description

How to fill out Fairfax Virginia Charitable Remainder Inter Vivos Unitrust Agreement?

If you need to get a trustworthy legal document provider to get the Fairfax Charitable Remainder Inter Vivos Unitrust Agreement, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed template.

- You can select from more than 85,000 forms categorized by state/county and case.

- The self-explanatory interface, number of learning materials, and dedicated support make it simple to locate and complete different papers.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply type to look for or browse Fairfax Charitable Remainder Inter Vivos Unitrust Agreement, either by a keyword or by the state/county the form is created for. After finding the required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the Fairfax Charitable Remainder Inter Vivos Unitrust Agreement template and check the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Create an account and select a subscription option. The template will be instantly available for download as soon as the payment is completed. Now you can complete the form.

Taking care of your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes these tasks less pricey and more affordable. Create your first business, arrange your advance care planning, draft a real estate agreement, or complete the Fairfax Charitable Remainder Inter Vivos Unitrust Agreement - all from the convenience of your home.

Join US Legal Forms now!