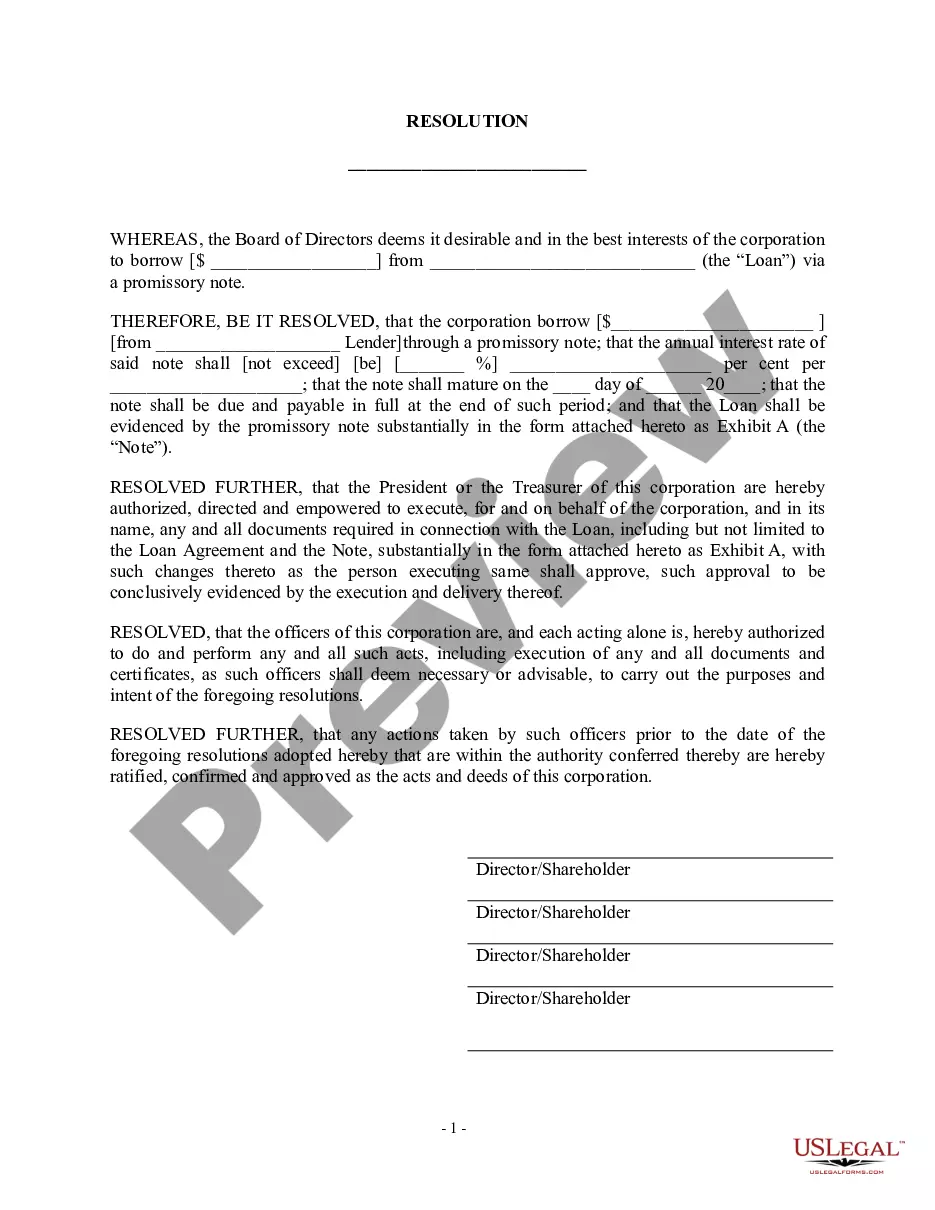

Contra Costa California Borrow Money on Promissory Note — Resolution For— - Corporate Resolutions A Promissory Note Resolution Form is a legally binding document used by corporations in Contra Costa, California, to borrow money through promissory notes. This form allows corporations to establish an official agreement between the borrower and lender, outlining the terms and conditions of the loan. The Contra Costa California Borrow Money on Promissory Note — Resolution For— - Corporate Resolutions includes various sections that encompass essential information to safeguard both parties involved. These sections generally cover: 1. Borrower Details: This section contains the corporation's name, address, contact information, and any other pertinent information required to identify the borrower. 2. Lender Details: All necessary information about the lender, including their name, address, and contact information, is specified in this section. 3. Loan Purpose and Amount: The purpose for which the loan is being borrowed, such as expanding business operations or acquiring assets, and the specific loan amount are outlined in this section. 4. Interest Rate and Repayment Terms: The interest rate and the repayment terms, including the duration, frequency of installments, and any other relevant conditions, are clearly stated in this section. 5. Collateral: If the loan is secured by collateral, details regarding the assets being pledged as security will be mentioned here. This ensures that the lender has a means of recourse if the borrower defaults on the loan. 6. Corporate Resolutions: This section outlines the corporate resolutions passed by the corporation's board of directors or any other relevant authority. These resolutions authorize the borrowing and subsequent execution of the promissory note. Extra Types of Contra Costa California Borrow Money on Promissory Note — Resolution Form— - Corporate Resolutions: 1. Short-term Promissory Note Resolution Form: This form is used for loans with a relatively shorter repayment period, typically lasting no more than a year. 2. Long-term Promissory Note Resolution Form: This form caters to loans with extended repayment periods, often spanning several years. 3. Convertible Promissory Note Resolution Form: When a loan has the potential to convert into equity or stock in the future, this form is used to establish the terms and conditions for conversion. 4. Cross-Collateralization Promissory Note Resolution Form: In cases where multiple assets are used as collateral, this form is employed to define how these assets are cross-collateralized. By using a Contra Costa California Borrow Money on Promissory Note — Resolution For— - Corporate Resolutions, corporations can ensure a legally sound agreement when borrowing money through promissory notes. It helps protect both borrower and lender, outlining the responsibilities, obligations, and rights of each party and minimizing the potential for disputes or misunderstandings.

Contra Costa California Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions

Description

How to fill out Contra Costa California Borrow Money On Promissory Note - Resolution Form - Corporate Resolutions?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Contra Costa Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used many times: once you pick a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Contra Costa Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Contra Costa Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions:

- Analyze the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template once you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!